Wv it 141 2018

What is the WV IT 141?

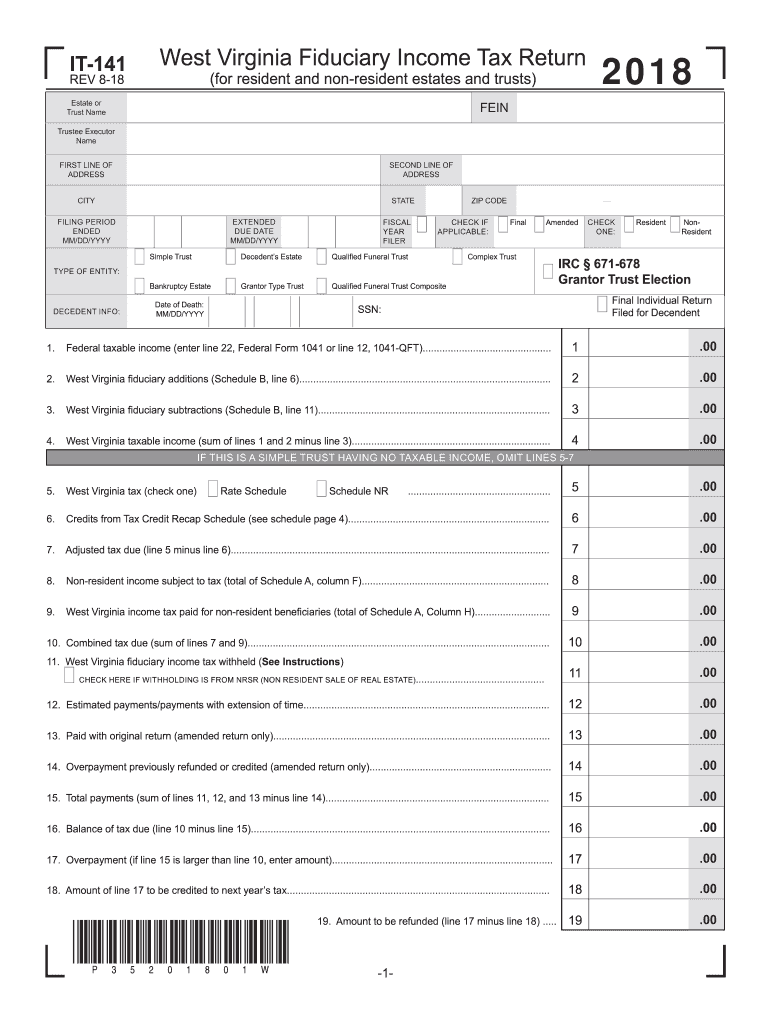

The WV IT 141 is a tax form used by residents of West Virginia to report their fiduciary income tax. This form is essential for estates and trusts that generate income during the tax year. It allows fiduciaries to accurately report income, deductions, and credits, ensuring compliance with state tax laws. Understanding the purpose and requirements of the WV IT 141 is crucial for proper tax filing and to avoid penalties.

How to Obtain the WV IT 141

To obtain the WV IT 141 form, individuals can visit the official West Virginia State Tax Department website, where the form is available for download. Additionally, physical copies can be requested from local tax offices. It is advisable to ensure that you have the most current version of the form to meet filing requirements.

Steps to Complete the WV IT 141

Completing the WV IT 141 involves several important steps:

- Gather all necessary financial documents, including income statements for the estate or trust.

- Fill in the identifying information, including the name and address of the fiduciary.

- Report all sources of income, deductions, and credits as required.

- Review the completed form for accuracy before submission.

Following these steps ensures that the form is filled out correctly, minimizing the risk of errors that could lead to delays or penalties.

Legal Use of the WV IT 141

The WV IT 141 is legally recognized as a valid document for reporting fiduciary income tax in West Virginia. To ensure compliance, it must be completed accurately and submitted by the designated deadlines. The form's legal standing is supported by state tax laws, which outline the obligations of fiduciaries in reporting income generated by estates and trusts.

Filing Deadlines / Important Dates

Filing deadlines for the WV IT 141 typically align with federal tax deadlines. For most taxpayers, the form must be submitted by April fifteenth of the following year. However, if the fiduciary is unable to meet this deadline, an extension may be requested. It is crucial to stay informed about any changes to filing dates to avoid late penalties.

Form Submission Methods

The WV IT 141 can be submitted through various methods, including:

- Online submission through the West Virginia State Tax Department's e-filing system.

- Mailing a physical copy to the appropriate tax office.

- In-person submission at local tax offices.

Choosing the right submission method can enhance convenience and ensure timely processing of the form.

Penalties for Non-Compliance

Failure to file the WV IT 141 on time or inaccuracies in the form can result in penalties. These may include fines and interest on unpaid taxes. It is essential for fiduciaries to adhere to all requirements and deadlines to avoid these consequences and maintain compliance with state tax regulations.

Quick guide on how to complete wv it 141 2018 2019 form

Your assistance manual on preparing your Wv It 141

If you're curious about how to generate and dispatch your Wv It 141, here are several straightforward instructions to simplify the tax submission process.

First, you need to create an airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document platform that enables you to edit, generate, and complete your tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures and revert to modify details as necessary. Optimize your tax handling with enhanced PDF editing, electronic signing, and seamless sharing.

Follow the instructions below to finalize your Wv It 141 in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Wv It 141 within our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if required).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to the intended recipient, and download it to your device.

Refer to this guide for filing your taxes electronically with airSlate SignNow. Keep in mind that submitting paper forms may lead to returning errors and postponed reimbursements. As a reminder, before e-filing your taxes, check the IRS website for filing regulations in your area.

Create this form in 5 minutes or less

Find and fill out the correct wv it 141 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Is it advantageous to fill out the JEE Mains 2018 form as soon as possible?

Yes. It is advantageous to fill out the JEE Mains 2018 form as soon as possible? Click here to know more about what are the advantage of filling JEE Main Application Form Earlier.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the wv it 141 2018 2019 form

How to create an eSignature for the Wv It 141 2018 2019 Form in the online mode

How to generate an electronic signature for the Wv It 141 2018 2019 Form in Chrome

How to generate an electronic signature for putting it on the Wv It 141 2018 2019 Form in Gmail

How to generate an eSignature for the Wv It 141 2018 2019 Form right from your smart phone

How to generate an electronic signature for the Wv It 141 2018 2019 Form on iOS devices

How to generate an electronic signature for the Wv It 141 2018 2019 Form on Android

People also ask

-

What is formit 141 and how does it relate to airSlate SignNow?

Formit 141 is a specific type of document that can easily be signed using airSlate SignNow. With our platform, you can quickly fill out, send, and eSign Formit 141 documents, ensuring a smooth and efficient workflow.

-

How much does it cost to use airSlate SignNow for formit 141?

airSlate SignNow offers competitive pricing for businesses looking to manage Formit 141 documents efficiently. Our plans start at an affordable monthly rate, allowing you to choose based on your eSigning needs and the volume of Formit 141 documents you handle.

-

What features are available for managing formit 141 in airSlate SignNow?

airSlate SignNow comes equipped with numerous features for handling Formit 141, including customizable templates, automated workflows, and real-time document tracking. These features streamline the eSigning process and enhance productivity.

-

What benefits does airSlate SignNow offer for businesses using formit 141?

By utilizing airSlate SignNow for Formit 141, businesses can experience increased efficiency, reduced turnaround times, and improved document security. Our platform allows for seamless collaboration while ensuring compliance with industry regulations.

-

Can airSlate SignNow integrate with other tools to handle formit 141?

Yes, airSlate SignNow provides integrations with various tools and applications that can enhance your experience with Formit 141. Whether you need to sync data with CRMs, cloud storage services, or other document management systems, our integrations ensure a smooth transition.

-

Is airSlate SignNow suitable for small businesses dealing with formit 141?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing Formit 141. Our user-friendly interface and cost-effective pricing make it an excellent choice for streamlining document workflows.

-

How does airSlate SignNow ensure the security of formit 141 documents?

airSlate SignNow employs industry-standard security measures to protect Formit 141 documents, including encryption and secure access controls. With our platform, you can be confident that your sensitive information is safeguarded throughout the signing process.

Get more for Wv It 141

- Louisiana title application 27282667 form

- San francisco ca form

- Swachh bharat mission format i for data on toilet form no no download needed needed

- Charlotte county setback requirements form

- Form 565 1 montgomery county public schools mcps k12 md

- Jb pest control llc form

- Wellstar plan b letter quality improvement form

- Self declaration for income fill and sign printable form

Find out other Wv It 141

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy