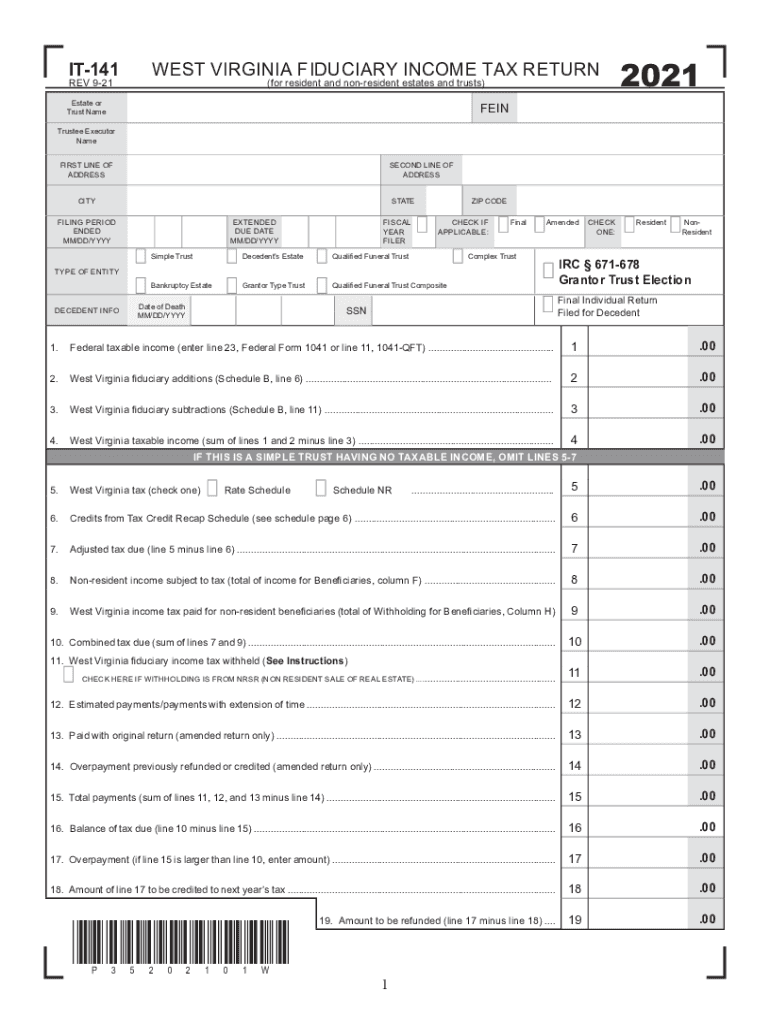

Form it 141qft West Virginia Fiduciary Income Tax Return 2021

What is the West Virginia Form IT-141?

The West Virginia Form IT-141, also known as the Fiduciary Income Tax Return, is a tax document used by fiduciaries to report income received on behalf of estates or trusts. This form is essential for ensuring compliance with state tax laws and helps in calculating the tax owed by the estate or trust. It is specifically designed for entities that manage assets and income for beneficiaries, allowing them to report earnings accurately to the West Virginia State Tax Department.

Steps to Complete the West Virginia Form IT-141

Completing the West Virginia Form IT-141 involves several key steps:

- Gather all necessary financial documents related to the estate or trust, including income statements, deductions, and credits.

- Fill out the identification section of the form, providing details about the fiduciary and the estate or trust.

- Report the total income received during the tax year, including interest, dividends, and capital gains.

- Calculate allowable deductions, which may include administrative expenses and distributions to beneficiaries.

- Determine the tax liability based on the net income reported on the form.

- Review the completed form for accuracy and ensure all required signatures are included.

Legal Use of the West Virginia Form IT-141

The West Virginia Form IT-141 is legally binding when completed and submitted according to state regulations. To ensure its validity, fiduciaries must adhere to the guidelines set forth by the West Virginia State Tax Department. This includes providing accurate information, meeting filing deadlines, and ensuring compliance with eSignature laws if submitting electronically. The form must be signed by the fiduciary to affirm its accuracy and completeness.

Filing Deadlines for the West Virginia Form IT-141

Filing deadlines for the West Virginia Form IT-141 are crucial for maintaining compliance. Typically, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the form must be filed by April 15. It is important for fiduciaries to be aware of any extensions or changes to deadlines that may occur due to state regulations or specific circumstances.

Required Documents for the West Virginia Form IT-141

To accurately complete the West Virginia Form IT-141, fiduciaries must gather several key documents:

- Financial statements for the estate or trust, including income and expense reports.

- Documentation of any distributions made to beneficiaries during the tax year.

- Records of deductions that can be claimed, such as administrative costs and legal fees.

- Previous year’s tax returns, if applicable, to ensure consistency in reporting.

Form Submission Methods for the West Virginia Form IT-141

The West Virginia Form IT-141 can be submitted through various methods to accommodate different preferences:

- Online Submission: Fiduciaries can file electronically through approved e-filing services, which may streamline the process and reduce processing times.

- Mail: The completed form can be printed and mailed to the West Virginia State Tax Department at the designated address.

- In-Person: Fiduciaries may also choose to submit the form in person at local tax offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete form it 141qft west virginia fiduciary income tax return

Complete Form It 141qft West Virginia Fiduciary Income Tax Return effortlessly on any device

Online document management has grown increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Form It 141qft West Virginia Fiduciary Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Form It 141qft West Virginia Fiduciary Income Tax Return seamlessly

- Obtain Form It 141qft West Virginia Fiduciary Income Tax Return and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Simplify document management with airSlate SignNow, eliminating worries about lost or misfiled documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form It 141qft West Virginia Fiduciary Income Tax Return to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 141qft west virginia fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the form it 141qft west virginia fiduciary income tax return

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is wv it 141 and how does airSlate SignNow utilize it?

The term wv it 141 refers to a specific compliance and integration standard that airSlate SignNow adheres to. By utilizing wv it 141, airSlate SignNow ensures secure and efficient document signing processes that meet industry regulations. This not only enhances user trust but also streamlines the compliance efforts of businesses.

-

How much does it cost to use airSlate SignNow with wv it 141 features?

airSlate SignNow offers a variety of pricing plans that accommodate different business needs, including those that require compliance with wv it 141. Pricing starts at an affordable rate for basic features, and advanced features designed for wv it 141 compliance are available at a competitive price. It’s best to check the website or contact sales for specific pricing details.

-

What features are included in airSlate SignNow that support wv it 141 compliance?

airSlate SignNow includes a range of features to support wv it 141 compliance, such as secure document storage, detailed audit trails, and customizable workflows. These features ensure that all signatories adhere to necessary standards and regulations. Additionally, the user-friendly interface makes it easy for businesses to navigate and implement these compliance measures.

-

How can airSlate SignNow benefit my business when implementing wv it 141?

By using airSlate SignNow with wv it 141 compliance, your business can benefit from increased efficiency and reduced risk of non-compliance. Automating document signing speeds up workflows, allowing teams to focus on core tasks. Furthermore, enhanced security measures provided by airSlate SignNow protect your sensitive data and improve client trust.

-

Does airSlate SignNow integrate with other tools while maintaining wv it 141 compliance?

Yes, airSlate SignNow supports integrations with various third-party applications while ensuring compliance with wv it 141. This allows businesses to seamlessly connect their existing systems and improve overall productivity. Popular integrations include CRM tools, project management software, and storage solutions.

-

What types of documents can I sign electronically with airSlate SignNow under wv it 141?

With airSlate SignNow, you can electronically sign a wide array of documents such as contracts, agreements, and forms while ensuring compliance with wv it 141. This versatility makes it ideal for different industries, including legal, finance, and real estate. The platform supports various file types, ensuring compatibility with your document needs.

-

Is airSlate SignNow easy to use, especially for those concerned about wv it 141?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for those who need to comply with wv it 141. The intuitive interface allows users to create, send, and sign documents without extensive training. Comprehensive support is also available to assist users at any stage of their journey.

Get more for Form It 141qft West Virginia Fiduciary Income Tax Return

- Mo contract deed form

- Statutory equivalent of living will or declaration missouri form

- Missouri attorney form

- Revised uniform anatomical gift act donation missouri

- Employment hiring process package missouri form

- Anatomical gift act donation by a person under 18 years old missouri form

- Revocation of anatomical gift donation missouri form

- Employment or job termination package missouri form

Find out other Form It 141qft West Virginia Fiduciary Income Tax Return

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template