Form 100s 2019

What is the Form 100s

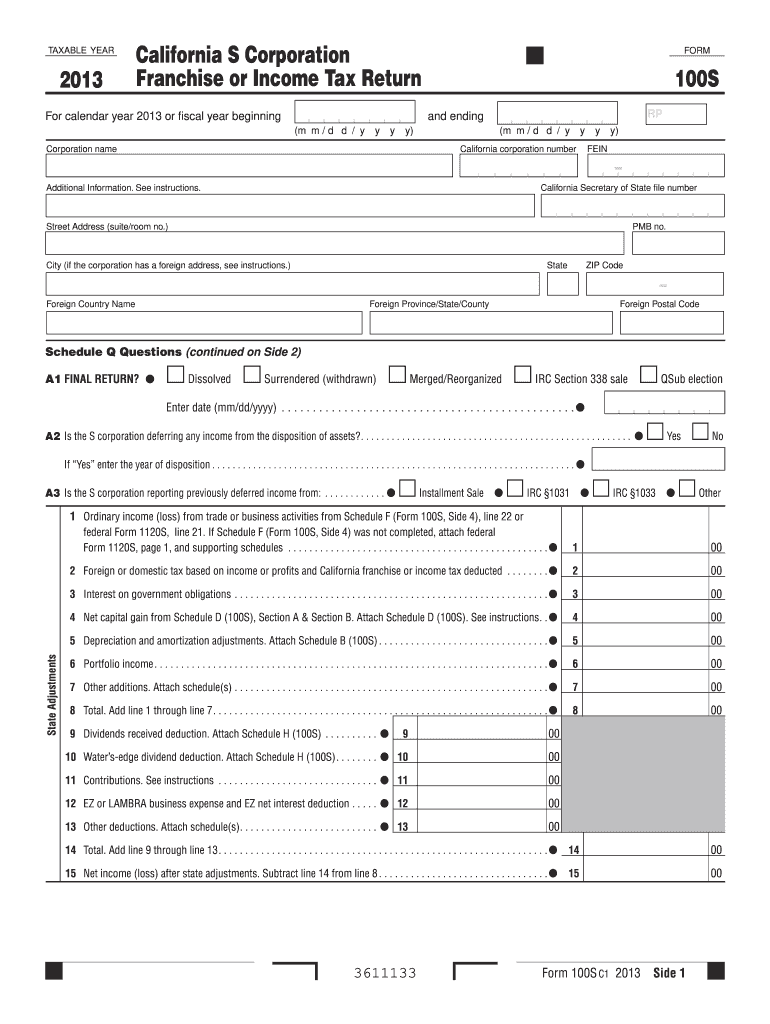

The Form 100s is a tax form used by corporations in the United States to report their income, deductions, and tax liability. This form is essential for corporations to comply with federal tax regulations and is part of the annual tax filing process. It provides a comprehensive overview of a corporation's financial activities over the tax year, ensuring transparency and accountability in corporate taxation.

How to use the Form 100s

Using the Form 100s involves a systematic approach to accurately report financial data. Corporations must gather all relevant financial documents, including income statements and balance sheets. Once the information is compiled, it should be entered into the form according to the specific guidelines provided by the IRS. It is crucial to ensure that all figures are accurate and reflect the corporation's financial status to avoid penalties.

Steps to complete the Form 100s

Completing the Form 100s requires careful attention to detail. Here are the steps involved:

- Gather necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Fill out the identification section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income, deductions, and credits in the appropriate sections of the form.

- Calculate the total tax liability based on the reported income and deductions.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 100s

The Form 100s is legally binding when completed and submitted according to IRS regulations. It must be filed by the designated deadline to avoid penalties. The information provided on the form is subject to verification by the IRS, and inaccuracies can lead to audits or legal repercussions. Therefore, it is essential for corporations to ensure compliance with all legal requirements when using this form.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Form 100s to maintain compliance. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. Extensions may be available, but they must be requested in advance, and any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the Form 100s, several documents are necessary. These include:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Prior year tax returns for reference.

- Documentation for any deductions or credits being claimed.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 100s can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for fraudulent reporting. It is crucial for corporations to adhere to all filing guidelines and deadlines to mitigate these risks and maintain good standing with the IRS.

Quick guide on how to complete 2013 form 100s

Easily complete Form 100s on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a superb eco-friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 100s on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Form 100s effortlessly

- Locate Form 100s and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method to send the form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 100s and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 100s

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 100s

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What are Form 100s and how can airSlate SignNow help?

Form 100s are standardized documents used for various purposes across different industries. airSlate SignNow simplifies the process by allowing users to easily create, send, and eSign their Form 100s, ensuring a smooth transaction experience and compliance with necessary regulations.

-

Is there a cost associated with using airSlate SignNow for Form 100s?

Yes, airSlate SignNow offers a range of pricing plans tailored to different business needs. These plans provide access to features that will help you efficiently manage and eSign Form 100s at a cost-effective rate, making it an ideal solution for companies of all sizes.

-

What features does airSlate SignNow offer for managing Form 100s?

airSlate SignNow provides robust features for managing Form 100s, including document templates, team collaboration tools, and advanced reporting. These tools help streamline the eSigning process while ensuring security and compliance, making it easier to manage your Form 100s.

-

Can I integrate airSlate SignNow with other applications for Form 100s?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your Form 100s effectively. These integrations help build a unified workflow, enhancing your productivity and speeding up the signing process.

-

What benefits can businesses expect from using airSlate SignNow for Form 100s?

By using airSlate SignNow for Form 100s, businesses can expect improved efficiency, cost savings, and enhanced document security. The platform enables faster turnaround times and reduces the risk of errors, ensuring that your Form 100s are processed smoothly.

-

How does airSlate SignNow ensure the security of Form 100s?

airSlate SignNow prioritizes the security of your Form 100s by implementing industry-standard encryption and secure access controls. These measures not only protect sensitive information but also ensure compliance with regulations like GDPR and HIPAA.

-

Is there a mobile app for airSlate SignNow for managing Form 100s?

Yes, airSlate SignNow offers a mobile app that allows users to send, receive, and eSign Form 100s on the go. This mobile solution provides flexibility and convenience, ensuring you can manage your documents anytime and anywhere.

Get more for Form 100s

Find out other Form 100s

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA