Tax Form Sales 2020

What is the Tax Form Sales

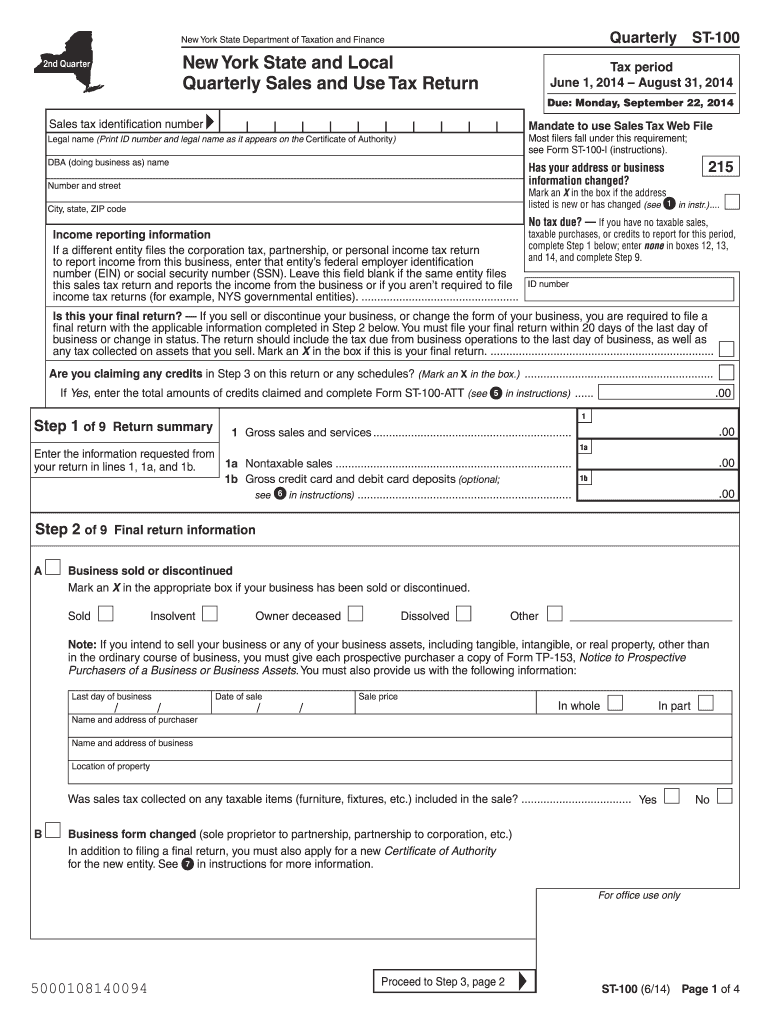

The Tax Form Sales refers to the documentation required for reporting sales-related income and expenses to the Internal Revenue Service (IRS). This form is essential for businesses and individuals who engage in sales activities, ensuring compliance with federal tax regulations. It captures various details, including revenue, deductions, and any applicable credits, which ultimately determine the tax liability for the reporting period.

How to use the Tax Form Sales

Using the Tax Form Sales involves accurately filling out the required fields with relevant financial information. Begin by gathering all necessary documentation, such as sales records, receipts, and expense reports. Once you have the information, enter it into the designated sections of the form. It is important to double-check all entries for accuracy to avoid discrepancies that could lead to penalties. After completing the form, you can submit it electronically or via mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the Tax Form Sales

Completing the Tax Form Sales involves a series of straightforward steps:

- Gather all relevant financial documents, including sales records and receipts.

- Fill in the required information, including total sales, deductions, and credits.

- Review all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the completed form either electronically or by mail, following IRS guidelines.

Legal use of the Tax Form Sales

The legal use of the Tax Form Sales is governed by IRS regulations. To ensure that the form is considered valid, it must be completed accurately and submitted within the designated deadlines. Using electronic signatures is permissible under the Electronic Signatures in Global and National Commerce (ESIGN) Act, provided that the eSignature meets all legal requirements. It is crucial to maintain records of the submitted form and any supporting documents for future reference and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form Sales vary based on the type of entity and the specific tax year. Typically, businesses must file their sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume. It is essential to be aware of these deadlines to avoid late fees and penalties. Mark your calendar with important dates, such as the end of the tax year and the due date for submitting the form to ensure timely compliance.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Tax Form Sales. These guidelines outline the necessary information required, the acceptable methods for submission, and the penalties for non-compliance. It is advisable to consult the IRS website or seek assistance from a tax professional to ensure that you are following the most current regulations and procedures. Staying informed about any changes in tax laws can help you avoid mistakes and ensure accurate reporting.

Quick guide on how to complete 2014 tax form sales

Effortlessly Prepare Tax Form Sales on Any Device

The management of online documents has gained immense popularity among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Manage Tax Form Sales on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

Seamlessly Edit and eSign Tax Form Sales with Ease

- Find Tax Form Sales and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or obscure private data using the specific tools airSlate SignNow provides for this purpose.

- Create your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to finalize your changes.

- Select your preferred method for sharing your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form hunts, and errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Modify and eSign Tax Form Sales and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 tax form sales

Create this form in 5 minutes!

How to create an eSignature for the 2014 tax form sales

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What are Tax Form Sales and how does airSlate SignNow support them?

Tax Form Sales refer to the process of selling tax-related documents and services. airSlate SignNow simplifies this process by allowing businesses to create, send, and eSign tax forms efficiently, ensuring compliance and security.

-

How does airSlate SignNow pricing work for Tax Form Sales?

Our pricing model for Tax Form Sales is designed to be affordable and flexible. You can choose from various plans that cater to your business's needs, ensuring you only pay for what you use.

-

What features does airSlate SignNow offer for Tax Form Sales?

airSlate SignNow provides robust features such as customizable templates, automated workflows, and secure eSignature capabilities specifically tailored for Tax Form Sales. These features enhance efficiency and reduce turnaround time.

-

What are the benefits of using airSlate SignNow for Tax Form Sales?

Using airSlate SignNow for Tax Form Sales streamlines document management, enhances collaboration, and ensures documents are signed and returned quickly. This leads to improved customer satisfaction and increased sales conversion rates.

-

Can I integrate airSlate SignNow with other applications for Tax Form Sales?

Yes, airSlate SignNow offers seamless integrations with popular business applications that facilitate Tax Form Sales. This integration enables you to maintain a consistent workflow and improve overall productivity.

-

How secure is airSlate SignNow for handling Tax Form Sales?

Security is a top priority at airSlate SignNow. All documents related to Tax Form Sales are encrypted and stored securely, ensuring that sensitive information remains protected throughout the signing process.

-

Is airSlate SignNow user-friendly for managing Tax Form Sales?

Absolutely! airSlate SignNow is designed with a user-friendly interface that makes it easy for businesses of all sizes to manage Tax Form Sales efficiently. The intuitive platform requires minimal training, allowing you to start right away.

Get more for Tax Form Sales

Find out other Tax Form Sales

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word