Ct 3 Instructions Form 2020

What is the Ct 3 Instructions Form

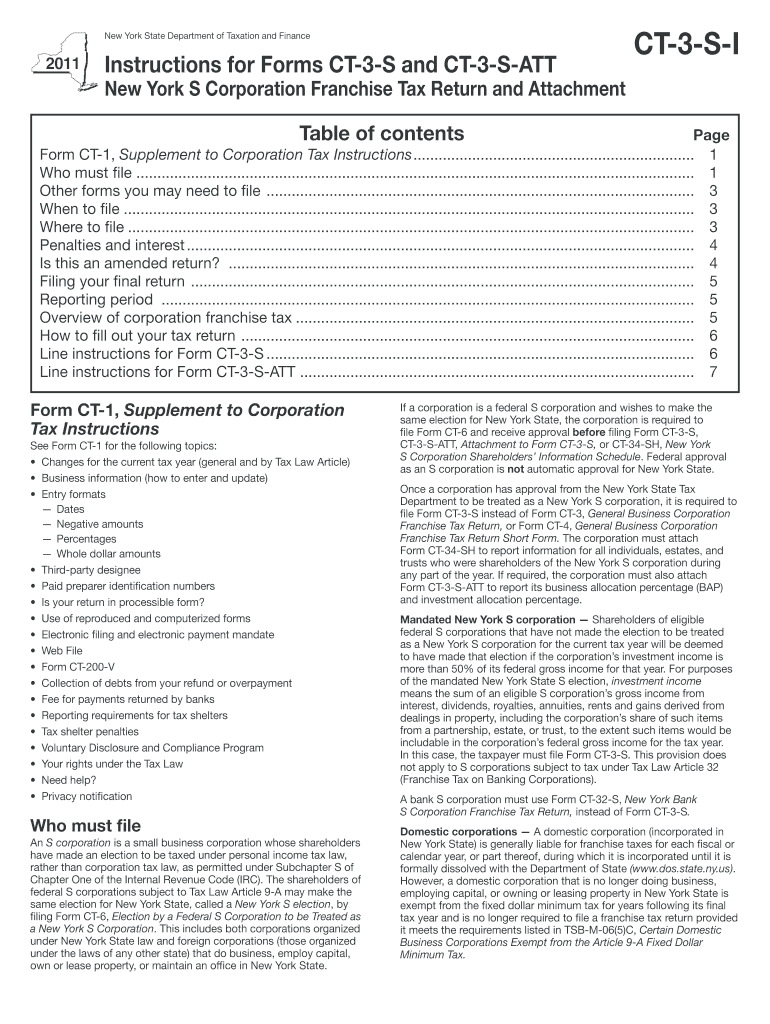

The Ct 3 Instructions Form is a crucial document used primarily for tax reporting purposes in the United States. It provides detailed guidelines for businesses on how to complete their corporate tax returns. This form is essential for ensuring compliance with state tax regulations and accurately reporting income, deductions, and credits. Understanding the specifics of the Ct 3 Instructions Form can help businesses avoid errors that may lead to penalties or audits.

How to use the Ct 3 Instructions Form

To effectively use the Ct 3 Instructions Form, businesses should first familiarize themselves with the structure and requirements outlined in the document. The form includes sections that guide users through the necessary calculations and information needed for tax reporting. It is advisable to gather all relevant financial records, such as income statements and expense reports, before starting. Each section should be completed carefully, ensuring that all information is accurate and up-to-date to facilitate a smooth filing process.

Steps to complete the Ct 3 Instructions Form

Completing the Ct 3 Instructions Form involves several key steps:

- Gather all necessary financial documents, including income and expense records.

- Review the instructions carefully to understand the requirements for each section.

- Fill out the form, ensuring that all entries are accurate and reflect the business's financial situation.

- Double-check all calculations and information for any errors.

- Submit the completed form by the designated deadline, either electronically or by mail.

Legal use of the Ct 3 Instructions Form

The legal use of the Ct 3 Instructions Form is governed by state tax laws and regulations. It is imperative that businesses adhere to these guidelines to ensure that their tax filings are compliant. Failure to use the form correctly can result in legal repercussions, including fines or audits. Businesses should keep records of their submissions and any correspondence related to the form to maintain compliance and provide evidence of their filings if required.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 Instructions Form can vary based on the business's fiscal year and state regulations. Typically, businesses must file their corporate tax returns by a specific date each year, often falling on the fifteenth day of the fourth month following the end of the fiscal year. It is crucial for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely submissions.

Required Documents

When completing the Ct 3 Instructions Form, several documents are typically required to support the information provided. These may include:

- Financial statements, such as profit and loss statements.

- Records of income and expenses.

- Previous tax returns for reference.

- Documentation of any deductions or credits claimed.

Having these documents on hand can streamline the completion process and enhance accuracy.

Quick guide on how to complete ct 3 instructions 2011 form

Complete Ct 3 Instructions Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without interruptions. Handle Ct 3 Instructions Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Ct 3 Instructions Form effortlessly

- Locate Ct 3 Instructions Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Ct 3 Instructions Form while ensuring effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 instructions 2011 form

Create this form in 5 minutes!

How to create an eSignature for the ct 3 instructions 2011 form

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Ct 3 Instructions Form used for?

The Ct 3 Instructions Form is essential for New York City businesses to correctly report their business income to the Department of Finance. By utilizing airSlate SignNow, you can efficiently complete and eSign this form, ensuring compliance with local tax regulations. Our platform streamlines the process, making it user-friendly and cost-effective.

-

How can I complete the Ct 3 Instructions Form using airSlate SignNow?

To complete the Ct 3 Instructions Form with airSlate SignNow, simply upload your document, fill in the required fields, and utilize our eSignature features. The platform allows for easy editing and collaboration, ensuring that all necessary information is accurately captured. This streamlined process saves you time and reduces the likelihood of errors.

-

Is there a cost associated with using the Ct 3 Instructions Form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Whether you're a small business or a larger enterprise, our plans are designed to be cost-effective while providing full access to the Ct 3 Instructions Form and other essential features. You can view our pricing options on the website to find a plan that suits your budget.

-

Are there integrations available for the Ct 3 Instructions Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, making it easy to incorporate the Ct 3 Instructions Form into your existing workflow. Whether you use CRM systems, project management tools, or cloud storage services, our integrations enhance your document processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Ct 3 Instructions Form?

Using airSlate SignNow for the Ct 3 Instructions Form offers numerous benefits, including increased efficiency and time savings. Our user-friendly interface allows for quick completion and eSigning, while robust security features ensure your data remains safe. Furthermore, you'll appreciate the convenience of managing all your documents in one place.

-

Can I track the status of my Ct 3 Instructions Form submissions?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Ct 3 Instructions Form submissions. You’ll receive notifications as your document is viewed and signed, giving you peace of mind and ensuring you never miss an important step in the submission process. Managing your documents has never been easier.

-

Is customer support available for assistance with the Ct 3 Instructions Form?

Certainly! airSlate SignNow offers comprehensive customer support to assist you with the Ct 3 Instructions Form and any related queries. Our dedicated team is available through various channels, ensuring that you receive prompt and helpful responses. We aim to make your experience smooth and satisfying, providing help whenever you need it.

Get more for Ct 3 Instructions Form

Find out other Ct 3 Instructions Form

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now