California Nonresident or Part Year Resident Income Tax Return Long Form 540NR 2018

What is the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR

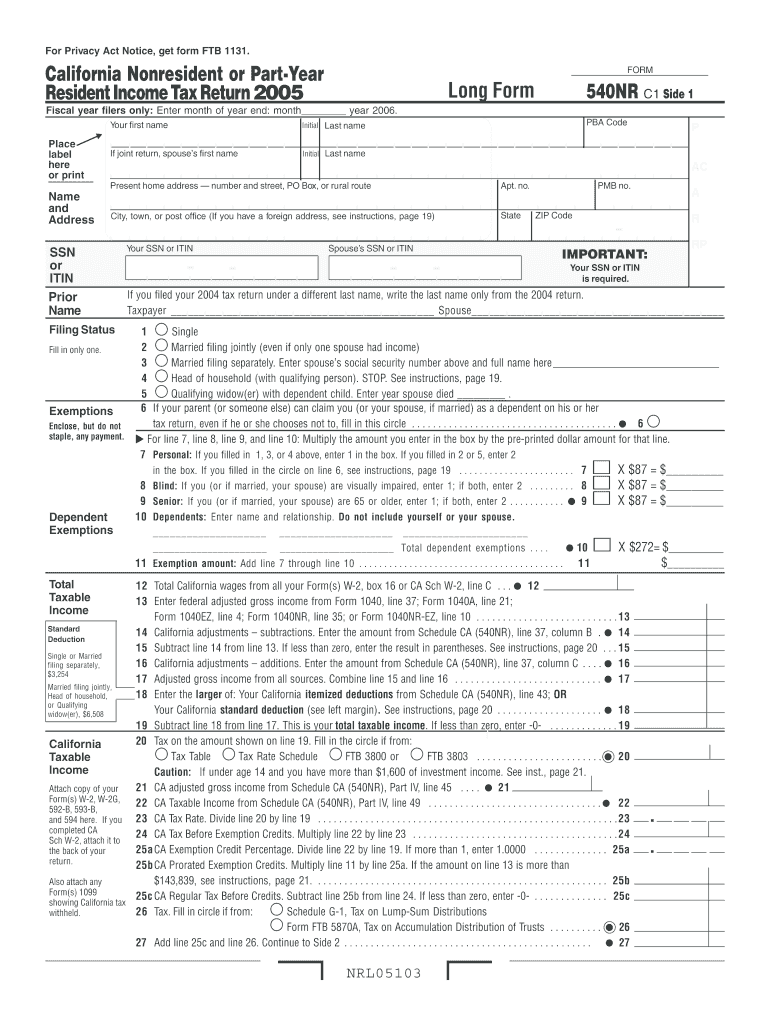

The California Nonresident or Part Year Resident Income Tax Return Long Form 540NR is a tax form specifically designed for individuals who earn income in California but do not reside in the state for the entire year. This form allows these taxpayers to report their California-source income and calculate their tax liability accordingly. Nonresidents are typically those who live in another state or country, while part-year residents are individuals who moved into or out of California during the tax year. Understanding this form is crucial for compliance with California tax laws and ensuring that the correct amount of tax is paid.

Steps to complete the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR

Completing the California Nonresident or Part Year Resident Income Tax Return Long Form 540NR involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the period for which you are filing.

- Fill out the form by providing personal information, income details, and any applicable deductions or credits.

- Calculate your total tax liability based on the income earned in California.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form by the designated deadline, either electronically or via mail.

How to obtain the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR

The California Nonresident or Part Year Resident Income Tax Return Long Form 540NR can be obtained through several methods. Taxpayers can download the form directly from the California Franchise Tax Board's website. Alternatively, physical copies of the form are available at various state offices, libraries, and post offices. Many tax preparation software programs also include the 540NR form, allowing for easy electronic completion and submission.

Legal use of the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR

The California Nonresident or Part Year Resident Income Tax Return Long Form 540NR is legally binding when filled out and signed correctly. To ensure its legal validity, taxpayers must adhere to the requirements set forth by the California Franchise Tax Board. This includes providing accurate information, signing the form, and submitting it by the deadline. Utilizing digital tools for e-signatures can also enhance the legal standing of the document, provided they comply with relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the California Nonresident or Part Year Resident Income Tax Return Long Form 540NR typically align with federal tax deadlines. For most taxpayers, the deadline is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes or extensions that may affect filing dates to avoid penalties.

Required Documents

To complete the California Nonresident or Part Year Resident Income Tax Return Long Form 540NR, taxpayers should gather several key documents:

- W-2 forms from employers for income earned.

- 1099 forms for any freelance or contract work.

- Documentation of any other California-source income.

- Records of deductions or credits claimed.

- Proof of residency status, if applicable.

Quick guide on how to complete 2005 california nonresident or part year resident income tax return long form 540nr

Effortlessly Manage California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without hassle. Handle California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR on any platform with airSlate SignNow’s Android or iOS applications and simplify your document processes today.

The Easiest Way to Modify and Electronically Sign California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR with Ease

- Find California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2005 california nonresident or part year resident income tax return long form 540nr

Create this form in 5 minutes!

How to create an eSignature for the 2005 california nonresident or part year resident income tax return long form 540nr

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR?

The California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR is a tax form used by individuals who earn income in California but do not reside in the state. This form helps determine your tax obligation based on the income earned during the period you were in California. It is essential for ensuring compliance with California tax laws.

-

How can I file my California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR?

You can file your California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR electronically using various online tax preparation services. Many of these services simplify the filing process and help ensure accuracy. Alternatively, you can download the form and submit it by mail if you prefer traditional filing methods.

-

What documents do I need to complete the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR?

To complete the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR, you will need your W-2s, 1099s, and any other relevant income statements. Additionally, gather any records of deductions and credits you plan to claim. Having all the necessary documents at hand will help expedite the filing process.

-

What are the deadlines for submitting the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR?

The deadline for submitting the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR is typically April 15th following the end of the tax year. However, if this date falls on a weekend or holiday, you may have until the next business day to file. It’s essential to check for any updates from the California Franchise Tax Board regarding extensions or changes.

-

Are there any penalties for not filing the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR on time?

Yes, failing to file the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR by the deadline may result in penalties and interest on any unpaid taxes. To avoid these penalties, it is crucial to file your return on time, even if you cannot pay the full amount owed. Consider applying for an extension if necessary.

-

Can I eSign my California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR?

Yes, you can eSign your California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR using platforms like airSlate SignNow. This feature streamlines the signing process, making it easier to submit your tax return securely and quickly. Ensure your eSignature complies with IRS regulations to avoid any issues.

-

What features does airSlate SignNow offer for tax document management, including the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR?

airSlate SignNow offers a user-friendly interface for managing tax documents, including the California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR. Key features include customizable templates, secure eSigning, and document tracking. These tools simplify the management of your tax-related paperwork and enhance collaboration with tax professionals.

Get more for California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR

Find out other California Nonresident Or Part Year Resident Income Tax Return Long Form 540NR

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document