100 S Form 2019

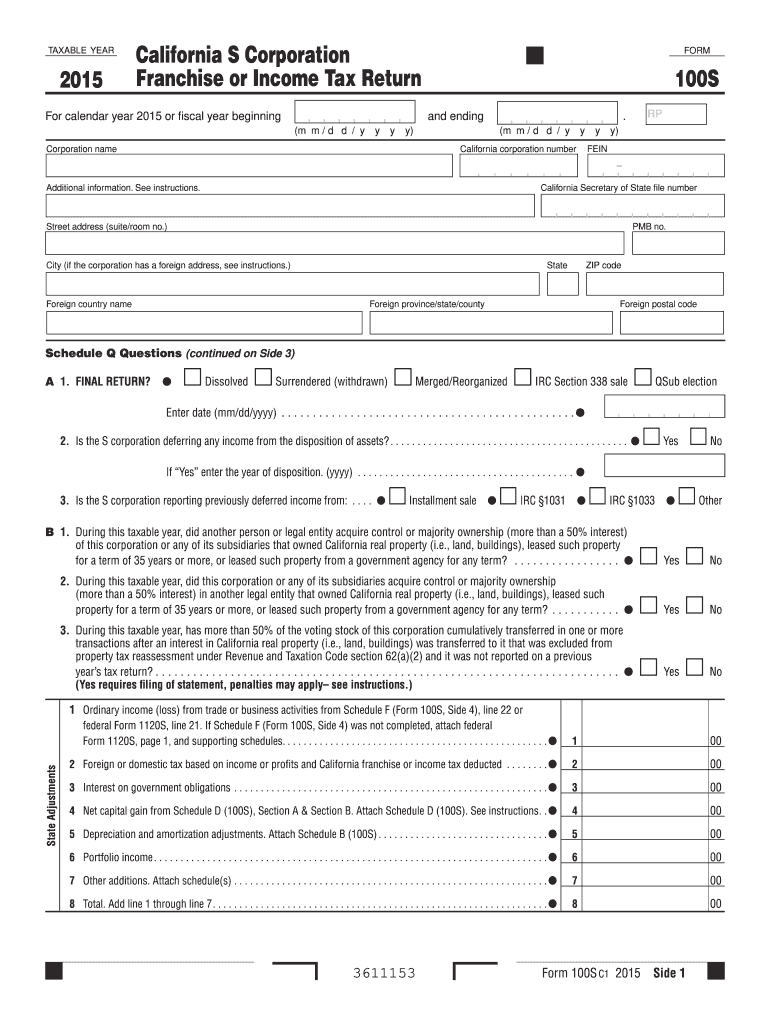

What is the 100 S Form

The 100 S Form is a tax document used by S corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for S corporations as it allows them to pass corporate income, losses, deductions, and credits through to their shareholders for tax purposes. The form is crucial for ensuring compliance with federal tax regulations and helps shareholders accurately report their share of the corporation's income on their individual tax returns.

How to use the 100 S Form

Using the 100 S Form involves several steps to ensure accurate reporting of financial information. First, gather all necessary financial records, including income statements, expense reports, and any relevant documentation related to deductions and credits. Next, complete the form by entering the required information, such as total income, deductions, and credits. After filling out the form, review it carefully for accuracy before submitting it to the IRS. It is advisable to keep copies of the form and all supporting documentation for your records.

Steps to complete the 100 S Form

Completing the 100 S Form requires attention to detail. Follow these steps:

- Gather financial records, including profit and loss statements and balance sheets.

- Fill in the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including gross receipts and other income sources.

- List all deductions, such as salaries, rent, and other business expenses.

- Calculate the total tax credits applicable to the corporation.

- Review all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 100 S Form

The 100 S Form must be filed in compliance with IRS regulations to ensure it is legally valid. S corporations are required to file this form annually to report their income and expenses. Failure to file the form can result in penalties and may affect the corporation's tax status. It is important to adhere to the filing deadlines and ensure that all information reported is accurate to avoid legal complications.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 100 S Form. These guidelines include instructions on what information must be reported, how to calculate income and deductions, and the deadlines for submission. It is essential for S corporations to familiarize themselves with these guidelines to ensure compliance and avoid potential issues with the IRS. Regular updates to tax laws may also affect how the form is completed, so staying informed is crucial.

Form Submission Methods

The 100 S Form can be submitted to the IRS through various methods. Corporations may choose to file electronically using approved tax software or submit a paper form by mail. Electronic filing is often faster and provides immediate confirmation of receipt, while paper filing may take longer to process. It is important to choose a submission method that aligns with the corporation's needs and ensures timely compliance with IRS requirements.

Quick guide on how to complete 2015 100 s form

Complete 100 S Form seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage 100 S Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign 100 S Form effortlessly

- Locate 100 S Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or conceal sensitive details using tools that airSlate SignNow designed specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Edit and eSign 100 S Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 100 s form

Create this form in 5 minutes!

How to create an eSignature for the 2015 100 s form

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is a 100 S Form and how can airSlate SignNow help with it?

A 100 S Form is a document often used for specific tax and compliance purposes. With airSlate SignNow, you can easily create, send, and eSign your 100 S Form, ensuring it meets all regulatory requirements while streamlining your workflow.

-

How much does it cost to use airSlate SignNow for 100 S Form processing?

AirSlate SignNow offers competitive pricing plans tailored to fit various business needs. You can select from a range of options, focusing on value that enhances your ability to manage 100 S Form documents efficiently and effectively.

-

What features make airSlate SignNow ideal for managing 100 S Forms?

AirSlate SignNow provides essential features such as document templates, seamless eSigning, and real-time tracking for 100 S Forms. These capabilities ensure that you can quickly prepare and execute importance forms while maintaining full compliance.

-

Are there integrations available for airSlate SignNow to manage 100 S Forms?

Yes, airSlate SignNow integrates with multiple platforms, including CRM systems and cloud storage services, allowing you to manage your 100 S Forms more effectively. This integration enhances collaboration and eases the document management process.

-

What are the benefits of using airSlate SignNow for 100 S Form eSigning?

Using airSlate SignNow for 100 S Form eSigning offers numerous benefits, including improved turnaround time and reduced paperwork. The platform is designed to facilitate quick and secure signing, which helps speed up your business processes.

-

Can airSlate SignNow help maintain compliance when using 100 S Forms?

Absolutely! AirSlate SignNow is designed with compliance in mind, ensuring that all eSigned 100 S Forms adhere to necessary regulations. This feature provides peace of mind while managing sensitive information.

-

Is there a trial available for airSlate SignNow to test its 100 S Form features?

Yes, airSlate SignNow offers a free trial that allows users to explore its capabilities for processing 100 S Forms. Taking advantage of the trial can help you understand how the platform meets your specific signing needs.

Get more for 100 S Form

Find out other 100 S Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF