Ct 990 T Fillable Form 2019

What is the Ct 990 T Fillable Form

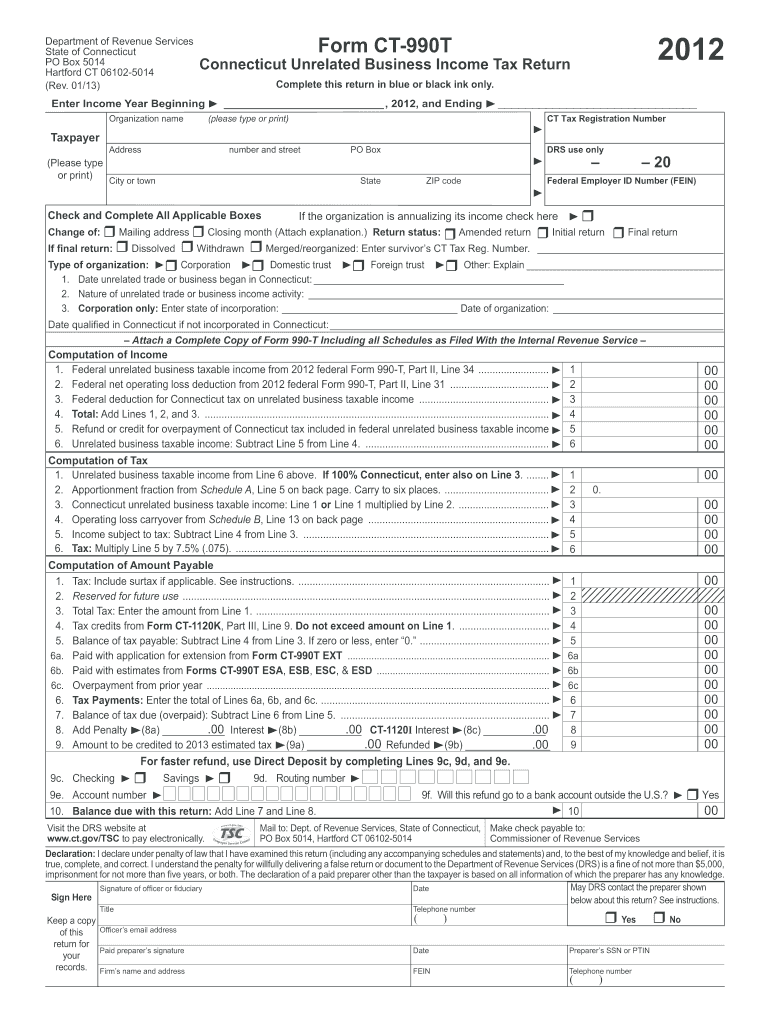

The Ct 990 T Fillable Form is a tax document used by organizations in Connecticut to report unrelated business income. This form is primarily utilized by nonprofit entities that earn income from activities not directly related to their exempt purposes. By filing this form, organizations ensure compliance with state tax regulations and properly report their financial activities to the Connecticut Department of Revenue Services.

How to use the Ct 990 T Fillable Form

Using the Ct 990 T Fillable Form involves several steps to ensure accurate completion and submission. First, organizations must gather all relevant financial information, including income from unrelated business activities and any allowable deductions. Next, the form should be filled out electronically, ensuring that all required fields are completed. Once the form is filled out, it can be reviewed for accuracy before submission.

Steps to complete the Ct 990 T Fillable Form

Completing the Ct 990 T Fillable Form involves a systematic approach:

- Gather necessary financial documents, including income statements and expense reports.

- Access the fillable form online and input the organization’s information.

- Report all unrelated business income and applicable deductions in the designated sections.

- Review the form for accuracy and completeness before finalizing.

- Submit the form electronically or print it for mailing, depending on preference.

Legal use of the Ct 990 T Fillable Form

The legal use of the Ct 990 T Fillable Form is essential for organizations to maintain compliance with Connecticut tax laws. Filing this form accurately ensures that the organization is reporting its unrelated business income correctly, which can affect its tax-exempt status. Noncompliance may result in penalties, making it crucial for organizations to understand the legal implications of this form.

Filing Deadlines / Important Dates

Organizations must be aware of specific deadlines when filing the Ct 990 T Fillable Form. Generally, the form is due on the fifteenth day of the fifth month following the close of the organization’s fiscal year. For organizations operating on a calendar year, this typically means the form is due by May 15. It is important to stay informed about any changes to these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ct 990 T Fillable Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Organizations can file electronically through the Connecticut Department of Revenue Services website.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the state.

- In-Person: Some organizations may choose to deliver the form in person at designated state offices.

Required Documents

To complete the Ct 990 T Fillable Form, organizations must prepare specific documents, including:

- Financial statements detailing unrelated business income.

- Records of expenses related to the income-generating activities.

- Any prior year tax documents that may be relevant for reporting.

Quick guide on how to complete ct 990 t fillable 2012 form

Effortlessly Prepare Ct 990 T Fillable Form on Any Device

The management of online documents has become increasingly prominent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed forms and signatures, allowing you to obtain the correct document and securely store it online. airSlate SignNow provides all the essential tools to create, modify, and electronically sign your documents swiftly without any holdups. Handle Ct 990 T Fillable Form from any device using airSlate SignNow's Android or iOS applications and simplify any document-focused task today.

How to Modify and eSign Ct 990 T Fillable Form with Ease

- Find Ct 990 T Fillable Form and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight key sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Ct 990 T Fillable Form while ensuring seamless communication throughout the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 990 t fillable 2012 form

Create this form in 5 minutes!

How to create an eSignature for the ct 990 t fillable 2012 form

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the Ct 990 T Fillable Form?

The Ct 990 T Fillable Form is a crucial document for businesses in Connecticut that need to report unrelated business income. This form is designed to be completed electronically, making it more accessible and efficient for users. By utilizing the Ct 990 T Fillable Form, organizations can ensure compliance with state tax obligations.

-

How can I easily fill out the Ct 990 T Fillable Form?

You can fill out the Ct 990 T Fillable Form easily using airSlate SignNow's user-friendly platform. Our solution allows you to input data directly into the form, enhancing accuracy and saving time. With built-in guidance, the Ct 990 T Fillable Form becomes more manageable for users of all skill levels.

-

Is there a cost associated with using the Ct 990 T Fillable Form through airSlate SignNow?

Accessing the Ct 990 T Fillable Form through airSlate SignNow comes with various pricing plans tailored to suit different business needs. Our competitive pricing ensures that you get a cost-effective solution without compromising on quality. It’s always best to check our website for the latest pricing information.

-

What features does airSlate SignNow offer for the Ct 990 T Fillable Form?

airSlate SignNow offers multiple features for the Ct 990 T Fillable Form, including eSignature capabilities, document tracking, and cloud storage. These features streamline your workflow, allowing you to manage and sign documents quickly and efficiently. The integration of these functionalities enhances your overall experience with the Ct 990 T Fillable Form.

-

What are the benefits of using the Ct 990 T Fillable Form with airSlate SignNow?

Using the Ct 990 T Fillable Form with airSlate SignNow offers several benefits, such as improved efficiency and reduced paper clutter. Our platform ensures that your documents are securely stored and easily accessible at any time. Additionally, eSigning capability expedites the signing process, allowing for faster submission.

-

Can I integrate the Ct 990 T Fillable Form with other software?

Yes, airSlate SignNow allows for seamless integration of the Ct 990 T Fillable Form with various business applications. This means you can enhance your overall document management process by connecting with CRM systems, accounting software, and more. Our integrations help you tailor your workflow to fit your business needs.

-

Is it safe to use the Ct 990 T Fillable Form through airSlate SignNow?

Absolutely! The Ct 990 T Fillable Form and all documents processed through airSlate SignNow benefit from robust security measures. Our platform utilizes industry-standard encryption and compliance protocols to protect your sensitive information. You can confidently use the Ct 990 T Fillable Form knowing that your data is secured.

Get more for Ct 990 T Fillable Form

Find out other Ct 990 T Fillable Form

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form