Ct Tax Form 0s 114 2020

What is the Ct Tax Form 0s 114

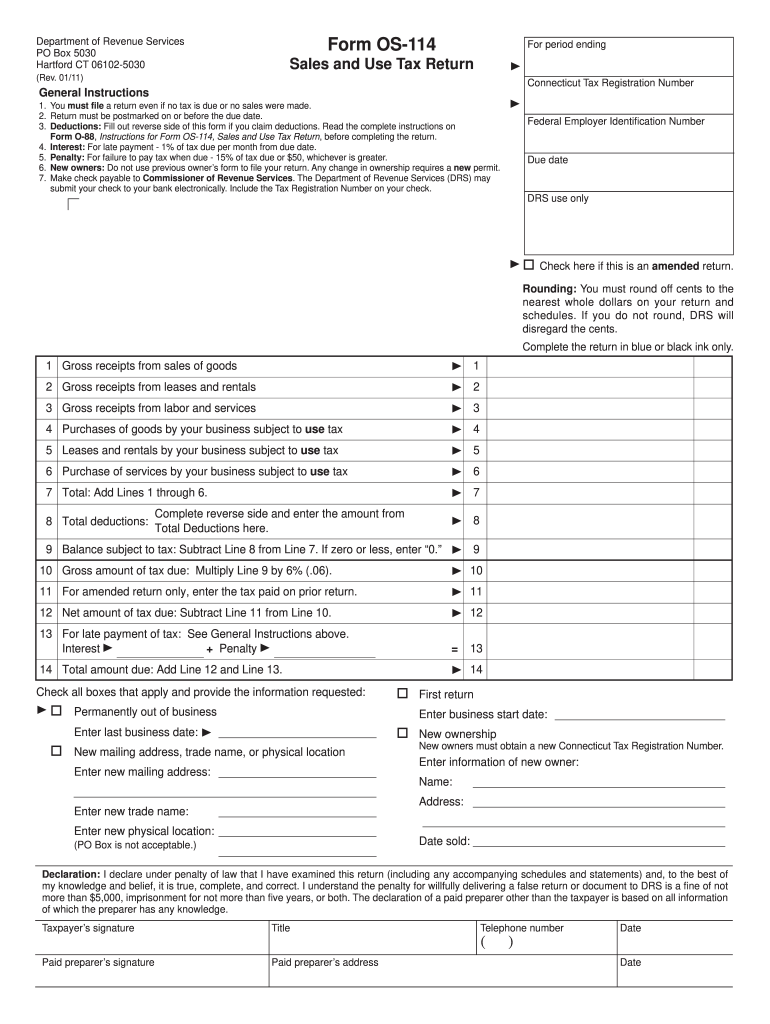

The Ct Tax Form 0s 114 is a specific tax form used by residents of Connecticut for various tax-related purposes. This form is essential for individuals and businesses to report income, calculate tax liabilities, and claim deductions or credits. It is crucial for ensuring compliance with state tax regulations. Understanding the purpose and requirements of this form is vital for accurate tax reporting and avoiding potential penalties.

How to use the Ct Tax Form 0s 114

Using the Ct Tax Form 0s 114 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand each section's requirements. Fill out the form completely and accurately, ensuring that all calculations are correct. Finally, review the form for any errors before submission to avoid delays or issues with your tax filing.

Steps to complete the Ct Tax Form 0s 114

Completing the Ct Tax Form 0s 114 requires a systematic approach. Follow these steps:

- Collect all relevant financial information, such as W-2s, 1099s, and other income documentation.

- Read the instructions carefully to understand the form's layout and requirements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections.

- Calculate your deductions and credits as applicable.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Ct Tax Form 0s 114

The Ct Tax Form 0s 114 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be filled out accurately, signed, and submitted by the appropriate deadlines. Compliance with state tax laws is essential to avoid penalties or legal issues. It is advisable to retain a copy of the submitted form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Ct Tax Form 0s 114 are critical to ensure compliance with state tax laws. Typically, the form must be submitted by April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing situations. It is essential to stay informed about any changes in deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ct Tax Form 0s 114 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using designated state tax websites, which often provide a streamlined process. Alternatively, the form can be mailed to the appropriate tax office, ensuring it is postmarked by the filing deadline. In-person submissions may also be possible at local tax offices, providing assistance for those who prefer face-to-face interactions.

Quick guide on how to complete ct tax form 0s 114 2011

Effortlessly prepare Ct Tax Form 0s 114 on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Ct Tax Form 0s 114 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Ct Tax Form 0s 114 with ease

- Find Ct Tax Form 0s 114 and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ct Tax Form 0s 114 to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct tax form 0s 114 2011

Create this form in 5 minutes!

How to create an eSignature for the ct tax form 0s 114 2011

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Ct Tax Form 0s 114 and why is it important?

The Ct Tax Form 0s 114 is a specific state tax form required for certain tax filings in Connecticut. Understanding this form is crucial for businesses to ensure compliance with state tax regulations, as inaccuracies can lead to penalties. Utilizing airSlate SignNow can simplify the eSigning and submission process, making it easier to stay compliant.

-

How does airSlate SignNow assist with completing the Ct Tax Form 0s 114?

airSlate SignNow offers features that allow users to fill out the Ct Tax Form 0s 114 electronically and securely. You can easily add necessary information, obtain signatures, and send the form directly to relevant parties. This streamlines the process and helps reduce the risk of errors during submission.

-

Is there a cost associated with using airSlate SignNow for Ct Tax Form 0s 114?

Yes, airSlate SignNow offers a range of pricing plans to fit different business needs, including options to handle the Ct Tax Form 0s 114. Users can choose the plan that best suits their volume of document handling. Affordable rates combined with robust features make it a cost-effective solution for businesses.

-

What features does airSlate SignNow provide for managing the Ct Tax Form 0s 114?

airSlate SignNow comes equipped with features such as customizable templates, secure eSignature options, and real-time tracking for the Ct Tax Form 0s 114. These features enhance the user experience, ensuring that submitting the form is efficient and straightforward. Users can also store and manage their documents seamlessly.

-

Can I integrate airSlate SignNow with other software for handling the Ct Tax Form 0s 114?

Absolutely! airSlate SignNow offers numerous integrations with popular business applications, which helps streamline the process for managing the Ct Tax Form 0s 114. You can connect it with tools like CRMs and accounting software, allowing for efficient data sharing and management across platforms.

-

How secure is the submission of the Ct Tax Form 0s 114 using airSlate SignNow?

The submission of the Ct Tax Form 0s 114 using airSlate SignNow is highly secure. The platform employs advanced encryption standards to protect sensitive information, ensuring that your data remains confidential during the signing and submission process. This robust security feature gives users peace of mind.

-

What are the benefits of using airSlate SignNow for the Ct Tax Form 0s 114?

Using airSlate SignNow for the Ct Tax Form 0s 114 brings multiple benefits, including increased efficiency, cost savings, and compliance assurance. The ease of electronic signatures and document management allows businesses to handle tax forms faster and with fewer errors. This streamlined process can lead to signNow time savings and enhanced productivity.

Get more for Ct Tax Form 0s 114

- Doh 389 form

- Mmt chart form

- Coventry viscosupplementation form

- Arithmetic and geometric sequences practice homework form

- Production possibilities curve frontier worksheet answer key form

- Harcama itirazi garanti com tr form

- Application for verification of degree certificate education the nitie nitie form

- Prepayment request letter pmd form

Find out other Ct Tax Form 0s 114

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form