Form Ct 1065ct 1120si 2019

What is the Form Ct 1065ct 1120si

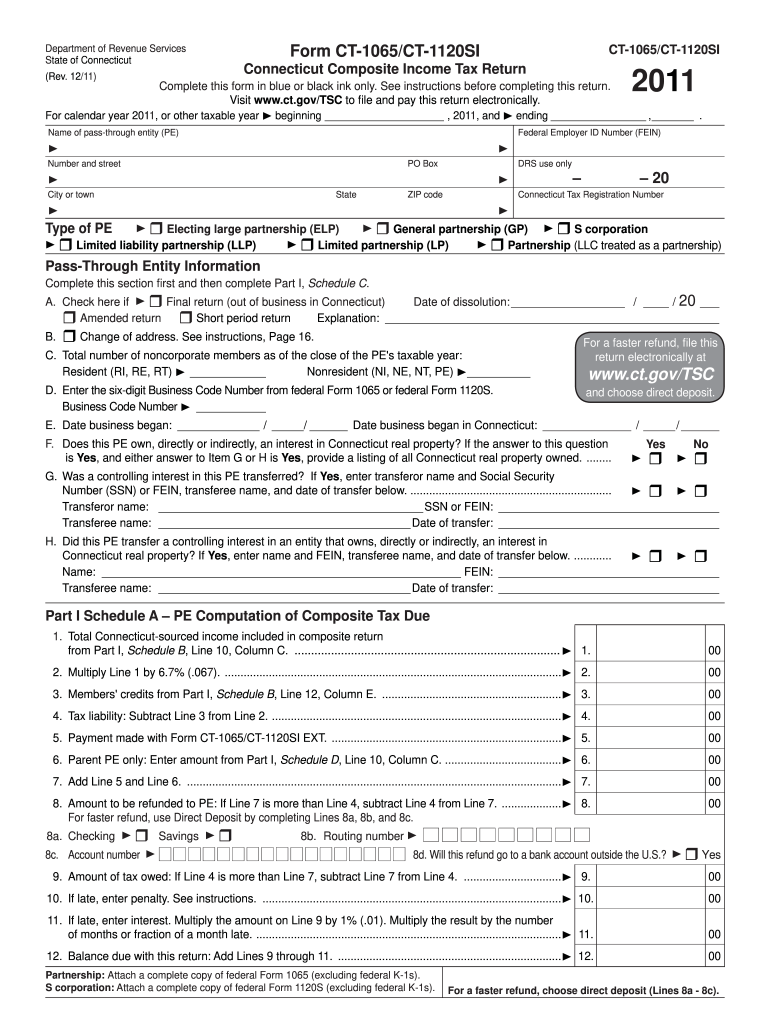

The Form Ct 1065ct 1120si is a tax form used in the United States for specific business entities, including partnerships and S corporations, to report income, deductions, and credits. This form is essential for ensuring compliance with federal tax regulations and provides the necessary information for the Internal Revenue Service (IRS) to assess the tax obligations of the entity. Understanding this form is crucial for accurate tax reporting and to avoid any potential penalties associated with non-compliance.

How to use the Form Ct 1065ct 1120si

Using the Form Ct 1065ct 1120si involves several steps to ensure accurate completion. First, gather all necessary financial documentation, including income statements, expense reports, and any relevant tax documents. Next, carefully fill out the form, ensuring that all sections are completed accurately. It's important to double-check figures and calculations to prevent errors. Once the form is completed, it can be submitted electronically or via mail, depending on the preferences of the filing entity.

Steps to complete the Form Ct 1065ct 1120si

Completing the Form Ct 1065ct 1120si requires a systematic approach:

- Collect all financial records and supporting documents.

- Begin filling out the form, starting with basic information about the business entity.

- Report income, deductions, and credits accurately in the respective sections.

- Review the form for any errors or omissions.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Form Ct 1065ct 1120si

The legal use of the Form Ct 1065ct 1120si is critical for compliance with U.S. tax laws. This form must be filed accurately and on time to avoid penalties. The information provided on the form serves as an official record of the business entity's financial activities for the tax year. Failure to file or inaccuracies in the form can lead to audits, fines, or other legal repercussions. Therefore, it is essential to understand the legal implications associated with this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 1065ct 1120si are crucial for compliance. Typically, partnerships and S corporations must file this form by the fifteenth day of the third month following the end of their tax year. For entities operating on a calendar year, this means the deadline is March 15. It is important to be aware of these deadlines to avoid late filing penalties and ensure timely processing of the form.

Required Documents

To complete the Form Ct 1065ct 1120si, several documents are typically required:

- Income statements detailing revenue generated by the business.

- Expense records to substantiate deductions claimed.

- Previous tax returns for reference and consistency.

- Partnership agreements or corporate bylaws, if applicable.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete form ct 1065ct 1120si 2011

Complete Form Ct 1065ct 1120si seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form Ct 1065ct 1120si on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Form Ct 1065ct 1120si effortlessly

- Obtain Form Ct 1065ct 1120si and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow makes available specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Form Ct 1065ct 1120si and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1065ct 1120si 2011

Create this form in 5 minutes!

How to create an eSignature for the form ct 1065ct 1120si 2011

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is Form Ct 1065ct 1120si and why is it important?

Form Ct 1065ct 1120si is a tax form used by businesses in Connecticut to report income and taxes. It is crucial for ensuring compliance with state tax regulations and helps businesses avoid potential penalties. Understanding this form is essential for accurate tax reporting and smooth business operations.

-

How does airSlate SignNow support the completion of Form Ct 1065ct 1120si?

airSlate SignNow offers user-friendly tools that help businesses complete and eSign Form Ct 1065ct 1120si efficiently. With template options and easy document sharing, the process becomes streamlined. This allows businesses to focus on compliance without the hassle of paper documentation.

-

What features does airSlate SignNow provide for managing Form Ct 1065ct 1120si?

AirSlate SignNow provides features such as electronic signatures, customizable templates, and secure storage for managing Form Ct 1065ct 1120si. These features make it easy to prepare, send, and archive important tax documents, enhancing overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for Form Ct 1065ct 1120si?

Using airSlate SignNow for Form Ct 1065ct 1120si helps businesses save time and reduce errors through its intuitive platform. The integration of eSigning capabilities allows users to quickly finalize documents, streamlining the tax filing process and ensuring timely compliance.

-

Are there any integrations available with airSlate SignNow for Form Ct 1065ct 1120si?

Yes, airSlate SignNow integrates with various accounting and business software, making it easy to manage Form Ct 1065ct 1120si alongside other financial documentation. These integrations facilitate data transfer and enhance productivity by connecting all necessary tools in one ecosystem.

-

What pricing plans does airSlate SignNow offer for handling Form Ct 1065ct 1120si?

airSlate SignNow offers flexible pricing plans tailored for businesses of different sizes, enabling seamless management of Form Ct 1065ct 1120si. Whether you are a small business or a large enterprise, there is a plan that fits your needs without compromising on essential features.

-

Can I store completed Form Ct 1065ct 1120si securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for completed Form Ct 1065ct 1120si and other documents. This ensures that your sensitive tax information is well-protected and easily accessible whenever you need it.

Get more for Form Ct 1065ct 1120si

Find out other Form Ct 1065ct 1120si

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure