Ct Form K1 2019

What is the Ct Form K-1?

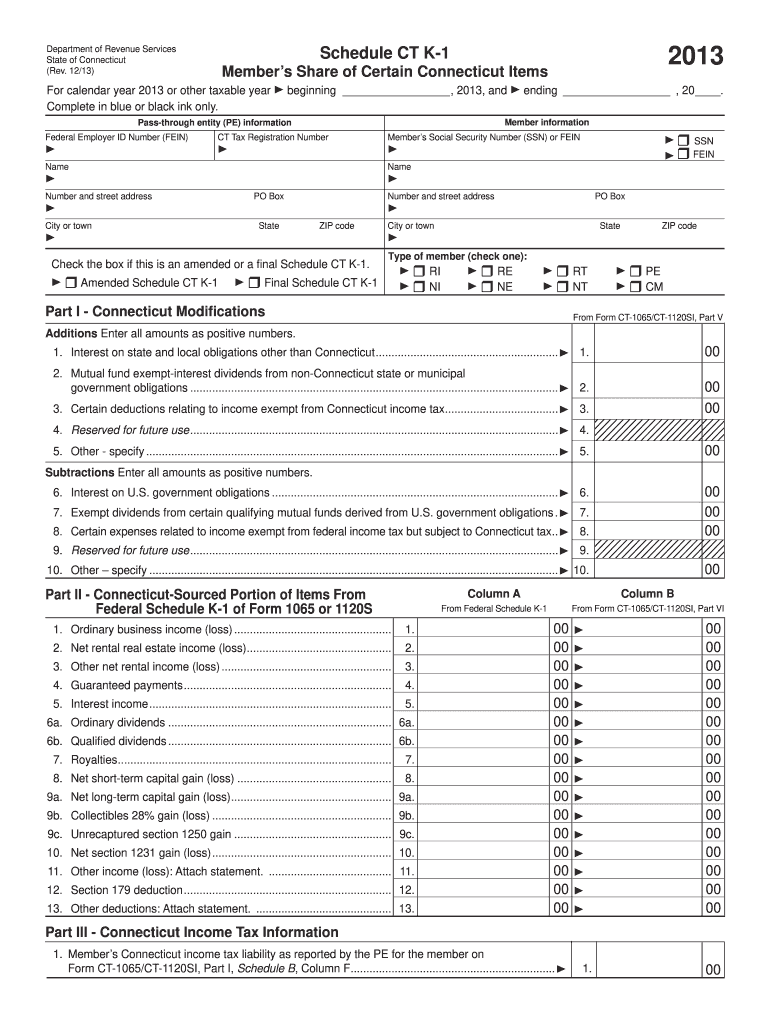

The Ct Form K-1 is a tax document used in the state of Connecticut to report income, deductions, and credits for partners in partnerships, shareholders in S corporations, and beneficiaries of estates or trusts. This form is essential for individuals who receive income from these entities, as it provides the necessary information to accurately report their share of the income on their personal tax returns. The form includes details about the entity's income, losses, and other tax-related items that must be reported by the individual taxpayer.

How to use the Ct Form K-1

To effectively use the Ct Form K-1, individuals must first ensure they receive the form from the partnership, S corporation, or estate/trust that generated the income. Once received, taxpayers should review the information carefully, as it includes various types of income and deductions that must be reported on their personal tax returns. The amounts listed on the form will typically need to be transferred to the appropriate sections of the Connecticut income tax return. It is crucial to maintain accurate records of the form for future reference and potential audits.

Steps to complete the Ct Form K-1

Completing the Ct Form K-1 involves several key steps:

- Gather necessary information from the partnership, S corporation, or estate/trust.

- Fill in the taxpayer's identifying information, including name, address, and Social Security number.

- Report the income, deductions, and credits as detailed on the form.

- Ensure all calculations are accurate and reflect the taxpayer's share of the entity's financial activity.

- Review the completed form for errors before submission.

Legal use of the Ct Form K-1

The Ct Form K-1 is legally recognized as a valid document for reporting income and deductions to the Connecticut Department of Revenue Services. To ensure its legal validity, the form must be completed accurately and submitted in accordance with state tax laws. Taxpayers should retain a copy of the form for their records, as it may be required for future reference or in the event of an audit. Compliance with all relevant tax regulations is essential to avoid penalties or issues with the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Ct Form K-1 typically align with the tax return deadlines for the entities issuing the form. Partnerships and S corporations generally must provide the K-1 to their partners or shareholders by March 15 of each year. Individual taxpayers must then report the income from the K-1 on their personal tax returns, which are due by April 15. It is important to keep track of these dates to ensure timely filing and avoid any potential penalties.

Who Issues the Form

The Ct Form K-1 is issued by partnerships, S corporations, and estates or trusts that generate income. Each entity is responsible for preparing and distributing the form to its partners, shareholders, or beneficiaries. This ensures that all parties receive the necessary information to report their income accurately on their tax returns. Entities must ensure compliance with state regulations when issuing the form to avoid any legal issues.

Quick guide on how to complete ct form k1 2013

Easily Prepare Ct Form K1 on Any Device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Ct Form K1 on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The Simplest Way to Edit and eSign Ct Form K1 Effortlessly

- Find Ct Form K1 and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the specific tools provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes necessitating new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and eSign Ct Form K1 to ensure effective communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct form k1 2013

Create this form in 5 minutes!

How to create an eSignature for the ct form k1 2013

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is a Ct Form K1?

A Ct Form K1 is a tax document used by partnerships, S corporations, and other pass-through entities to report income, deductions, and credits to their partners or shareholders. Understanding how to accurately complete and distribute this form is essential for compliance with Connecticut tax laws.

-

How can airSlate SignNow help with managing Ct Form K1?

airSlate SignNow offers a streamlined solution for sending and eSigning Ct Form K1 documents. With its user-friendly interface, businesses can easily manage the paperwork, track signatures, and ensure timely distribution to partners, signNowly reducing manual errors.

-

Is airSlate SignNow cost-effective for handling Ct Form K1?

Yes, airSlate SignNow provides a cost-effective solution for generating and managing Ct Form K1 documents. Its competitive pricing model allows businesses to efficiently handle all their document signing needs without breaking the bank, making it an ideal choice for various sized entities.

-

What features does airSlate SignNow offer for Ct Form K1 processing?

airSlate SignNow includes features designed specifically for document management, such as customizable templates, automated reminders, and secure cloud storage for Ct Form K1. These tools empower users to work efficiently and maintain compliance in their tax reporting.

-

Can airSlate SignNow integrate with accounting software for Ct Form K1?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, ensuring that your Ct Form K1 data flows effortlessly between platforms. This integration streamlines the process of preparing and filing documents, reducing the risk of errors and saving valuable time.

-

How does eSigning a Ct Form K1 work with airSlate SignNow?

eSigning a Ct Form K1 with airSlate SignNow is simple and secure. Users can upload their forms, add signature fields, and send them to the necessary parties for electronic signature, ensuring a quick turnaround while maintaining the integrity and legality of the document.

-

What benefits does airSlate SignNow provide for businesses dealing with Ct Form K1?

Using airSlate SignNow for your Ct Form K1 processing enhances efficiency and accuracy. The platform reduces the likelihood of printing and mailing delays, allows for real-time updates, and provides audit trails for compliance, all of which save businesses time and money.

Get more for Ct Form K1

Find out other Ct Form K1

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors