Form Ct 1096 Drs 2020

What is the Form Ct 1096 Drs

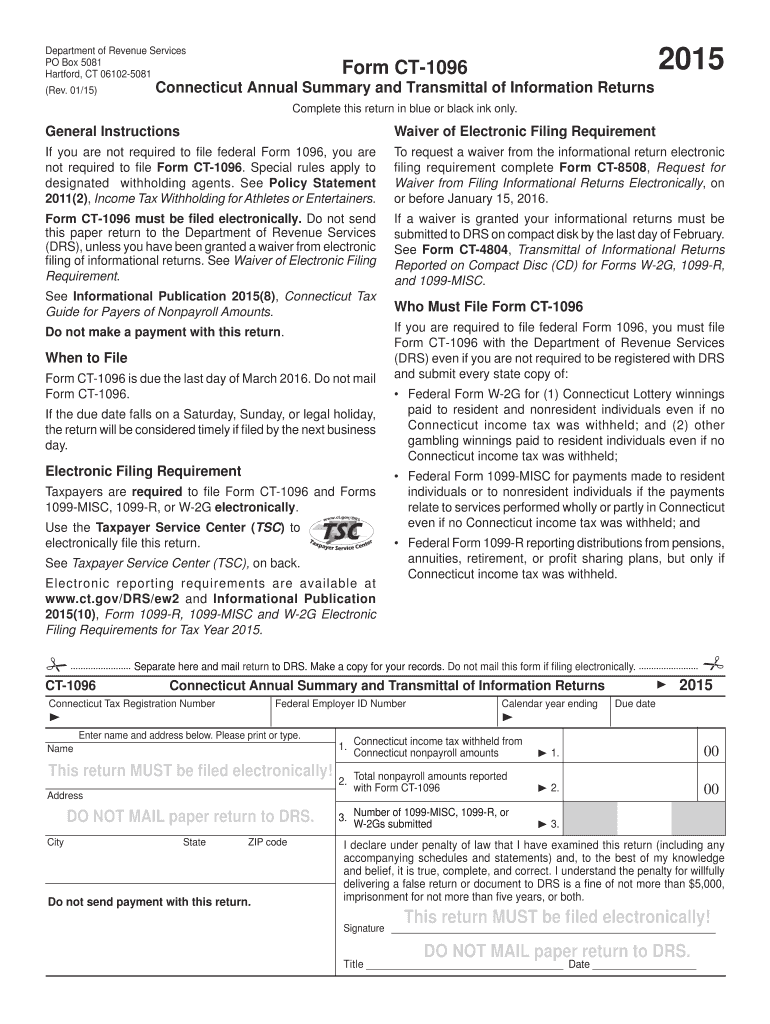

The Form Ct 1096 Drs is a crucial document used in the state of Connecticut for reporting and summarizing certain types of payments made to non-employees, such as independent contractors. This form is typically utilized by businesses and organizations to comply with state tax regulations. It serves as a summary of all 1099 forms issued by a business during the tax year, ensuring that the state has accurate records of income reported by recipients.

How to use the Form Ct 1096 Drs

Using the Form Ct 1096 Drs involves several steps to ensure compliance with state tax laws. First, businesses must gather all relevant 1099 forms they have issued throughout the year. Next, they should complete the Ct 1096 Drs by entering the total amounts paid to each recipient as reported on the 1099 forms. After filling out the form, it must be submitted to the appropriate state tax authority, either electronically or by mail, depending on the filing requirements for the year.

Steps to complete the Form Ct 1096 Drs

Completing the Form Ct 1096 Drs involves a straightforward process:

- Collect all 1099 forms issued to non-employees during the tax year.

- Enter the total amount paid to each recipient on the Ct 1096 Drs.

- Include your business information, such as name, address, and tax identification number.

- Review the form for accuracy to avoid penalties.

- Submit the completed form to the state tax authority by the designated deadline.

Legal use of the Form Ct 1096 Drs

The legal use of the Form Ct 1096 Drs is essential for businesses to maintain compliance with state tax regulations. Failure to accurately report payments can result in penalties and interest charges. Additionally, the form must be completed in accordance with the guidelines set forth by the Connecticut Department of Revenue Services to ensure that it is legally binding and recognized by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 1096 Drs typically coincide with federal tax deadlines. Businesses must ensure that the form is filed by the last day of January following the tax year. It is important to stay updated on any changes to deadlines or requirements by checking with the Connecticut Department of Revenue Services to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form Ct 1096 Drs can be submitted through various methods, depending on the preferences of the business and the requirements of the state. Options include:

- Online submission through the Connecticut Department of Revenue Services e-filing portal.

- Mailing a hard copy of the form to the designated state tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form ct 1096 drs 2015

Effortlessly prepare Form Ct 1096 Drs on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Form Ct 1096 Drs on any device with airSlate SignNow apps for Android or iOS and enhance your document-driven processes today.

The easiest way to modify and eSign Form Ct 1096 Drs with ease

- Locate Form Ct 1096 Drs and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using features that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you prefer. Modify and eSign Form Ct 1096 Drs to ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1096 drs 2015

Create this form in 5 minutes!

How to create an eSignature for the form ct 1096 drs 2015

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form Ct 1096 Drs and how can it be used with airSlate SignNow?

Form Ct 1096 Drs is a tax reporting form used by businesses to summarize annual information returns submitted to the Connecticut Department of Revenue Services. airSlate SignNow simplifies the process of filling out and electronically signing this form, enabling users to manage their tax documents efficiently.

-

How much does it cost to use airSlate SignNow for Form Ct 1096 Drs?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. Whether you're a small business or a large enterprise, our solutions are cost-effective, providing value while ensuring ease of use when handling Form Ct 1096 Drs and other important documents.

-

What features does airSlate SignNow offer for handling Form Ct 1096 Drs?

airSlate SignNow includes features such as customizable templates, easy electronic signatures, and secure document storage, all of which enhance the process of completing Form Ct 1096 Drs. Our platform also allows for real-time collaboration, ensuring that all stakeholders can participate effortlessly.

-

How can I integrate airSlate SignNow with my existing tools for Form Ct 1096 Drs?

airSlate SignNow offers seamless integrations with various software and tools, including document management systems and CRMs. These integrations facilitate the smooth processing of Form Ct 1096 Drs by allowing users to connect their existing workflows and streamline document handling.

-

What are the benefits of using airSlate SignNow for Form Ct 1096 Drs?

Using airSlate SignNow for Form Ct 1096 Drs provides numerous benefits, including enhanced productivity, accuracy in completing tax forms, and compliance with state requirements. The platform's user-friendly interface allows for quick access and efficient management of your tax documents.

-

Can airSlate SignNow help my team collaborate on Form Ct 1096 Drs?

Absolutely! airSlate SignNow is designed for team collaboration, allowing multiple users to work on Form Ct 1096 Drs simultaneously. You can share documents securely, track changes, and communicate within the platform to ensure everyone is on the same page.

-

Is airSlate SignNow secure for handling Form Ct 1096 Drs?

Yes, airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures. This ensures that your sensitive information, including Form Ct 1096 Drs, is protected from unauthorized access and meets industry standards.

Get more for Form Ct 1096 Drs

Find out other Form Ct 1096 Drs

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself