Ct Tax Return Form 2019

What is the Ct Tax Return Form

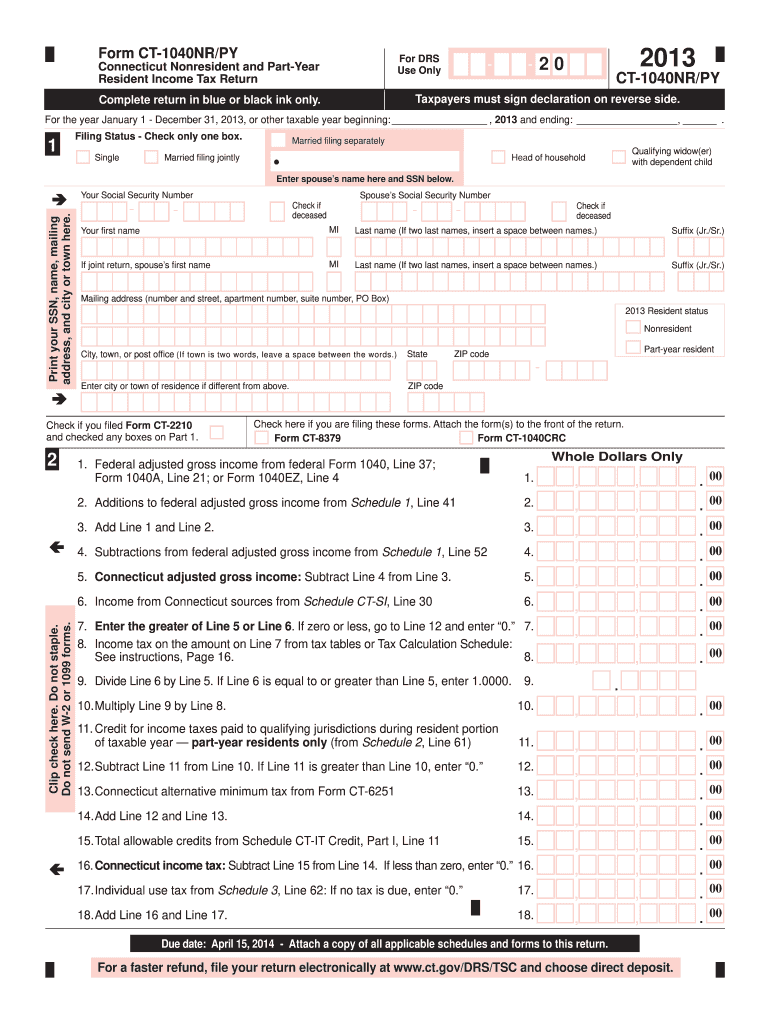

The Ct Tax Return Form is a crucial document used by residents of Connecticut to report their income, calculate their tax liability, and determine any refunds or payments owed to the state. This form is essential for individuals and businesses alike, ensuring compliance with state tax laws. It includes various sections that require detailed information about income sources, deductions, and credits applicable to the taxpayer's situation. Understanding the purpose of this form is vital for accurate tax reporting and compliance.

How to use the Ct Tax Return Form

Using the Ct Tax Return Form involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, such as W-2s, 1099s, and any records of deductions. Next, they should carefully read the instructions provided with the form to understand the specific requirements for their filing status. After filling out the form, it is important to review all entries for accuracy before submission. This process can be streamlined by utilizing digital tools that facilitate eSignature and secure document handling.

Steps to complete the Ct Tax Return Form

Completing the Ct Tax Return Form requires a systematic approach:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Carefully read the form instructions to understand the required information.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately.

- Claim applicable deductions and credits to reduce taxable income.

- Review the completed form for any errors or omissions.

- Submit the form by the designated filing deadline, either electronically or by mail.

Legal use of the Ct Tax Return Form

The Ct Tax Return Form is legally binding once submitted to the state of Connecticut. It serves as an official record of a taxpayer's income and tax obligations. To ensure its legal validity, the form must be completed accurately and submitted on time. E-filing options provide additional security and compliance, as they often include features like electronic signatures and audit trails, which help validate the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Ct Tax Return Form are critical to avoid penalties. Typically, the deadline for individuals to file their state tax return is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available for filing, which may require additional forms to be submitted. Keeping track of these dates is essential for maintaining compliance and avoiding unnecessary fines.

Required Documents

To complete the Ct Tax Return Form, taxpayers must gather several key documents, including:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Records of any tax credits claimed in previous years.

Having these documents organized will facilitate a smoother filing process and help ensure accuracy on the form.

Quick guide on how to complete 2013 ct tax return form

Easily Prepare Ct Tax Return Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Ct Tax Return Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-driven task today.

Effortlessly Modify and Electronically Sign Ct Tax Return Form

- Locate Ct Tax Return Form and click Obtain Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just moments and has the same legal validity as a standard ink signature.

- Review the information and click on the Complete button to save your modifications.

- Select your preferred method to send your form, whether by email, text (SMS), invitation link, or download to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ct Tax Return Form for seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 ct tax return form

Create this form in 5 minutes!

How to create an eSignature for the 2013 ct tax return form

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the Ct Tax Return Form and why do I need it?

The Ct Tax Return Form is a document required by the state of Connecticut for reporting income and calculating tax liabilities. It's essential for individuals and businesses to comply with state tax laws and avoid penalties. With airSlate SignNow, you can easily eSign and send your Ct Tax Return Form, streamlining the filing process.

-

How can airSlate SignNow help me with my Ct Tax Return Form?

airSlate SignNow simplifies the process of managing your Ct Tax Return Form by allowing you to eSign documents electronically, reducing the time spent on paperwork. Our platform ensures that your forms are secure and easily accessible, facilitating a smooth and efficient filing experience. Plus, you can track your documents in real-time to ensure timely submission.

-

What are the pricing options for using airSlate SignNow for my Ct Tax Return Form?

Our pricing for using airSlate SignNow varies based on the features you need. We offer flexible plans that can accommodate individuals and businesses, ensuring that signing your Ct Tax Return Form remains cost-effective. Join us to take advantage of our competitive pricing and features tailored to your needs.

-

Is it safe to use airSlate SignNow for my Ct Tax Return Form?

Yes, using airSlate SignNow for your Ct Tax Return Form is safe. Our platform employs bank-level encryption and rigorous security protocols to protect your personal and financial information. You can eSign with confidence, knowing your data is secure throughout the process.

-

Can I integrate airSlate SignNow with other applications for my Ct Tax Return Form?

Absolutely! airSlate SignNow offers seamless integration with a variety of applications, enhancing your workflow with your Ct Tax Return Form. Whether you use accounting software or document management systems, our integrations simplify the process and improve efficiency, making it easier to manage your tax-related documents.

-

What benefits does eSigning my Ct Tax Return Form provide?

eSigning your Ct Tax Return Form through airSlate SignNow offers multiple advantages including increased efficiency, reduced paperwork, and faster processing times. You can easily sign your documents from anywhere, saving time and effort compared to traditional methods. Additionally, eSigning adds an extra layer of security to your sensitive tax information.

-

How do I track the status of my Ct Tax Return Form with airSlate SignNow?

With airSlate SignNow, tracking the status of your Ct Tax Return Form is straightforward. Our platform provides real-time updates and notifications, allowing you to see when your document is opened, signed, and completed. This transparency ensures you stay informed throughout the entire process.

Get more for Ct Tax Return Form

Find out other Ct Tax Return Form

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer