Form 85083 2011

What is the Form 85083

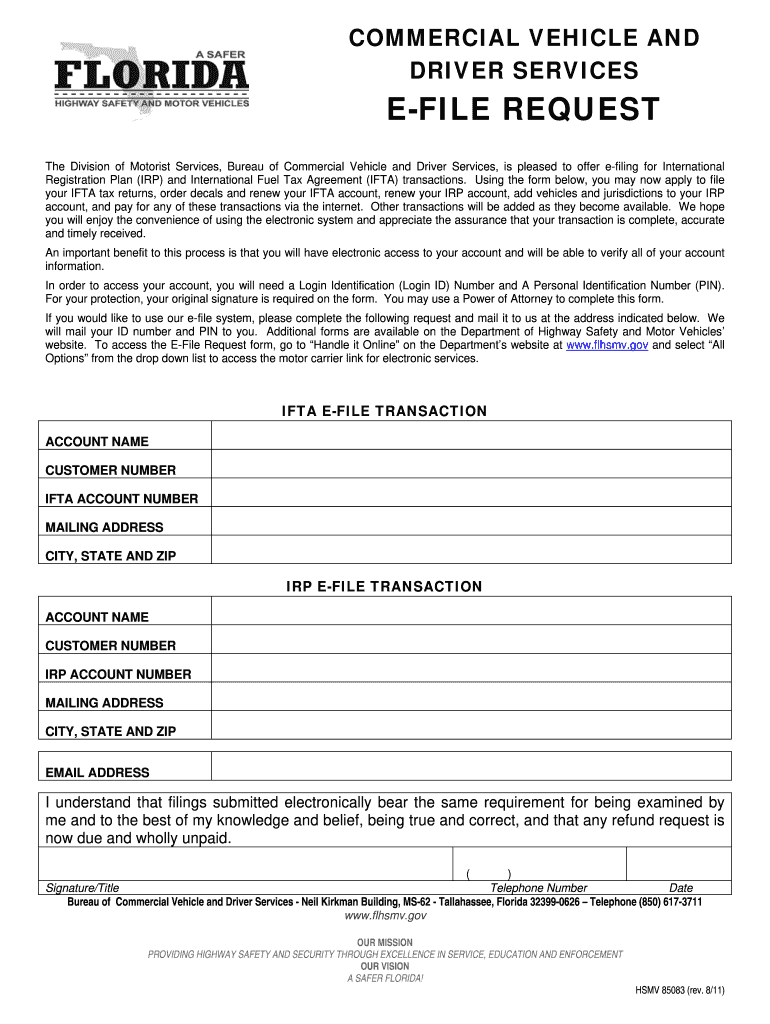

The Form 85083, also known as the Florida International Fuel Tax Agreement (IFTA) e-file, is a crucial document for commercial vehicle operators in the United States. This form is designed to facilitate the reporting and payment of fuel taxes for vehicles that operate in more than one jurisdiction. By using this form, businesses can ensure compliance with state and federal regulations regarding fuel tax reporting.

How to use the Form 85083

Using the Form 85083 involves several steps to ensure accurate reporting. First, gather all necessary information regarding fuel purchases and mileage traveled in each jurisdiction. Next, complete the form by entering the required data, including the total miles driven and fuel consumed. After filling out the form, it can be submitted electronically through the Florida e-filing portal, streamlining the process and ensuring timely compliance.

Steps to complete the Form 85083

To complete the Form 85083 effectively, follow these steps:

- Collect all relevant data, including fuel purchase receipts and mileage logs.

- Access the Florida e-filing portal to begin the submission process.

- Input the total miles traveled in each jurisdiction and the gallons of fuel purchased.

- Double-check all entries for accuracy to avoid potential penalties.

- Submit the completed form electronically and retain a copy for your records.

Legal use of the Form 85083

The Form 85083 is legally binding when completed accurately and submitted in accordance with state and federal regulations. It is essential to ensure that all information provided is truthful and complete, as discrepancies can lead to audits or penalties. Utilizing a reliable e-signature solution, such as signNow, can enhance the legitimacy of the submission, providing an electronic certificate that proves compliance with eSignature laws.

Filing Deadlines / Important Dates

Adhering to filing deadlines is critical for maintaining compliance with IFTA regulations. The Form 85083 must typically be submitted quarterly, with specific deadlines varying by state. It is advisable to check the Florida Department of Revenue's website for the most current deadlines to avoid late fees or penalties.

Required Documents

When preparing to complete the Form 85083, certain documents are necessary to ensure accuracy and compliance. These include:

- Fuel purchase receipts from all jurisdictions.

- Mileage logs detailing distances traveled in each state.

- Previous IFTA returns, if applicable.

- Any correspondence from state tax authorities related to fuel taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 85083 can be submitted through various methods, providing flexibility for users. The most efficient option is electronic submission via the Florida e-filing portal, which simplifies the process and reduces processing time. Alternatively, the form can be mailed to the appropriate state tax authority or submitted in person at designated offices, though these methods may take longer for processing.

Quick guide on how to complete form 85083

Complete Form 85083 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Form 85083 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Form 85083 with ease

- Locate Form 85083 and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 85083 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 85083

Create this form in 5 minutes!

How to create an eSignature for the form 85083

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is FL IFTA eFile and how does it work?

FL IFTA eFile is an electronic filing system that streamlines the process of submitting your International Fuel Tax Agreement reports in Florida. By using airSlate SignNow, you can easily complete and eFile your IFTA reports digitally, saving time and reducing errors. This solution simplifies compliance and ensures that your filings are submitted accurately and on time.

-

What features does airSlate SignNow offer for FL IFTA eFile?

airSlate SignNow provides a range of features for FL IFTA eFile, including document templates, automated reminders, and real-time status tracking. You can also securely sign your documents electronically, making the filing process more efficient. With an intuitive interface, submitting your IFTA reports has never been easier.

-

Is airSlate SignNow a cost-effective solution for FL IFTA eFile?

Yes, airSlate SignNow is designed to provide a cost-effective solution for FL IFTA eFile. Our pricing plans are competitive and offer great value for businesses looking to manage their tax filings more efficiently. By reducing paperwork and associated labor costs, you can save both time and money.

-

How can I integrate airSlate SignNow with my existing systems for FL IFTA eFile?

airSlate SignNow offers various integrations with popular accounting and financial software to enhance your FL IFTA eFile experience. Whether you use QuickBooks, Xero, or other platforms, our API and built-in integrations allow for seamless data transfer. This ensures a smoother filing process without the need for manual entries.

-

What are the benefits of using airSlate SignNow for FL IFTA eFile?

Using airSlate SignNow for FL IFTA eFile provides several benefits, including increased accuracy, reduced filing time, and enhanced security for your documents. The digital process minimizes the chances of errors and helps you stay compliant with state regulations. Additionally, you can easily access your filings and documentation at any time.

-

Can I use airSlate SignNow on mobile devices for FL IFTA eFile?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage your FL IFTA eFile on the go. Whether you are using a smartphone or a tablet, you can complete your eFiling quickly and securely from anywhere, making it convenient for busy professionals.

-

What support options are available for airSlate SignNow users with FL IFTA eFile?

airSlate SignNow provides comprehensive support for users navigating FL IFTA eFile. Our support team is available via chat, email, and phone to assist you with any questions or issues you may encounter. Additionally, our online resources, including guides and FAQs, are designed to help you get the most out of your eFiling experience.

Get more for Form 85083

Find out other Form 85083

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract