Reciprocal Nonresident Indiana Individual Income Tax Return Yours a 2020

What is the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A

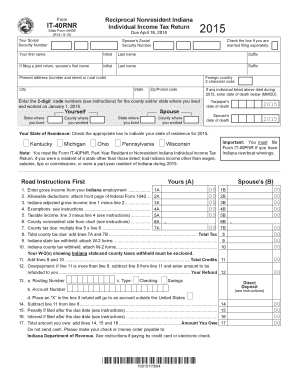

The Reciprocal Nonresident Indiana Individual Income Tax Return Yours A is a specific tax form used by individuals who reside in states that have reciprocal agreements with Indiana. This form allows nonresident taxpayers to report their income earned in Indiana while avoiding double taxation. It is essential for individuals who work in Indiana but live in neighboring states that have such agreements, ensuring they only pay taxes in their home state.

How to use the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A

To utilize the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A effectively, taxpayers should first confirm their eligibility based on their residency and the state they work in. Once eligibility is established, the form must be accurately filled out with relevant income details, deductions, and credits applicable to nonresidents. After completing the form, it can be submitted electronically or via mail, depending on the preferences and requirements of the Indiana Department of Revenue.

Steps to complete the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A

Completing the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A involves several steps:

- Gather all necessary documents, including W-2 forms and any other income statements.

- Ensure you have your personal information, such as Social Security number and address, readily available.

- Fill out the form, ensuring all income earned in Indiana is reported accurately.

- Apply any eligible deductions and credits to minimize taxable income.

- Review the completed form for accuracy before submission.

Legal use of the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A

The legal use of the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A is governed by tax laws and regulations that apply to nonresidents. This form must be used in accordance with Indiana's tax statutes, ensuring that all information provided is truthful and complete. Misuse of the form, such as providing false information, can lead to penalties or legal repercussions.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A. Typically, the form is due on the same date as the federal income tax return, which is usually April fifteenth. However, taxpayers should check for any updates or changes to the deadlines annually, as extensions may be available under specific circumstances.

Required Documents

To complete the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A, several documents are required:

- W-2 forms from employers indicating income earned in Indiana.

- Records of any other income sources, such as 1099 forms.

- Documentation for any deductions or credits claimed.

- Identification details, including Social Security number.

Quick guide on how to complete reciprocal nonresident indiana individual income tax return yours a

Complete Reciprocal Nonresident Indiana Individual Income Tax Return Yours A effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage Reciprocal Nonresident Indiana Individual Income Tax Return Yours A on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Reciprocal Nonresident Indiana Individual Income Tax Return Yours A without difficulty

- Locate Reciprocal Nonresident Indiana Individual Income Tax Return Yours A and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Reciprocal Nonresident Indiana Individual Income Tax Return Yours A to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reciprocal nonresident indiana individual income tax return yours a

Create this form in 5 minutes!

How to create an eSignature for the reciprocal nonresident indiana individual income tax return yours a

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is a Reciprocal Nonresident Indiana Individual Income Tax Return Yours A?

The Reciprocal Nonresident Indiana Individual Income Tax Return Yours A is a specific tax form used by individuals who reside in a different state but earn income in Indiana. This form allows taxpayers to file their income tax returns accurately while ensuring they are compliant with Indiana tax laws. Using airSlate SignNow, you can easily prepare and eSign this document, streamlining the filing process.

-

How can I prepare my Reciprocal Nonresident Indiana Individual Income Tax Return Yours A with airSlate SignNow?

You can prepare your Reciprocal Nonresident Indiana Individual Income Tax Return Yours A using airSlate SignNow's user-friendly interface. Simply upload your tax documents, fill in the required fields, and apply your electronic signature. The platform makes it easy to manage your tax filings efficiently and securely.

-

What are the benefits of using airSlate SignNow for tax documents like the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A?

Using airSlate SignNow for your tax documents, including the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A, ensures a seamless and efficient filing process. The platform offers electronic signing, document tracking, and automated workflows, which can save you time and reduce the complexities associated with traditional paper filing.

-

Is there a cost associated with filing my Reciprocal Nonresident Indiana Individual Income Tax Return Yours A using airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which provides various plans suitable for different needs. The cost often depends on the number of documents you handle and the features you choose to access. However, the affordability of airSlate SignNow makes it a cost-effective solution for managing your Reciprocal Nonresident Indiana Individual Income Tax Return Yours A and other documents.

-

Can I integrate airSlate SignNow with other tax preparation software for my Reciprocal Nonresident Indiana Individual Income Tax Return Yours A?

Absolutely, airSlate SignNow offers integrations with various tax preparation software that can enhance your experience when preparing your Reciprocal Nonresident Indiana Individual Income Tax Return Yours A. This allows for smooth data transfer, reducing the chances of errors and saving time during your tax preparation.

-

How does airSlate SignNow ensure the security of my Reciprocal Nonresident Indiana Individual Income Tax Return Yours A?

airSlate SignNow prioritizes the security of your documents, including the Reciprocal Nonresident Indiana Individual Income Tax Return Yours A. The platform employs advanced encryption protocols, ensuring that your sensitive information remains protected during transmission and storage.

-

What features does airSlate SignNow offer to assist with my Reciprocal Nonresident Indiana Individual Income Tax Return Yours A?

airSlate SignNow provides several features to assist with filing your Reciprocal Nonresident Indiana Individual Income Tax Return Yours A, including customizable templates, cloud storage, and real-time collaboration. These tools facilitate a smoother filing experience, making it easier for you to finalize and eSign your tax forms.

Get more for Reciprocal Nonresident Indiana Individual Income Tax Return Yours A

Find out other Reciprocal Nonresident Indiana Individual Income Tax Return Yours A

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later