From Contractor Form

What is the From Contractor

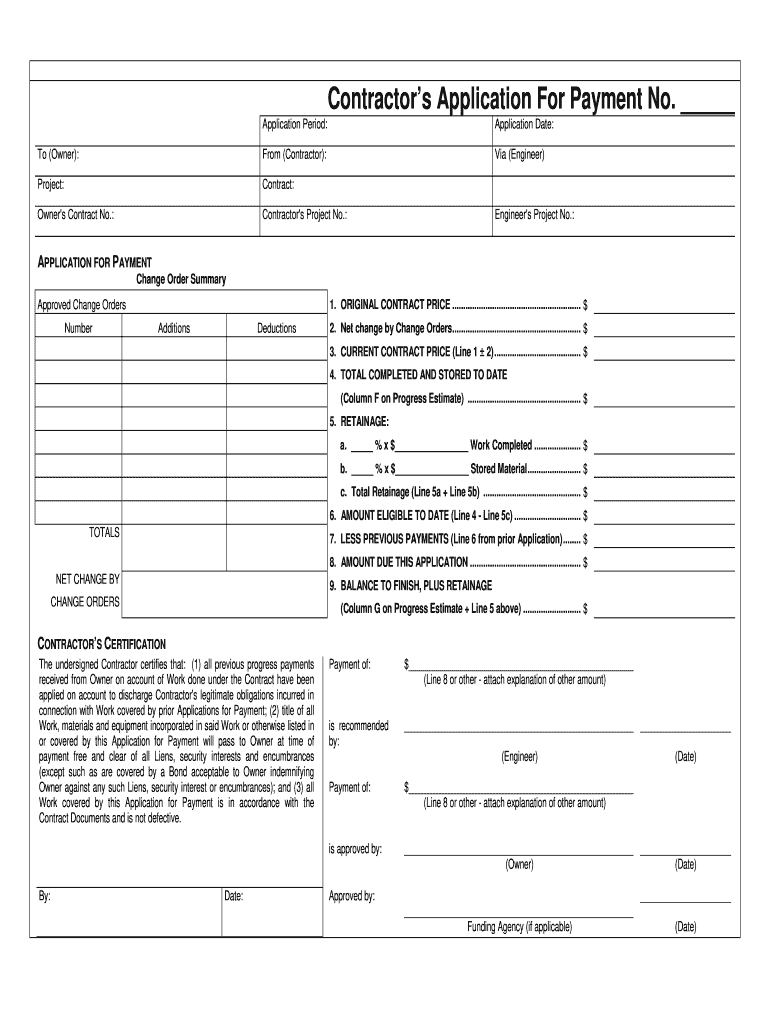

The From Contractor is a crucial document used primarily in the context of tax reporting for independent contractors and freelancers. This form serves to report income received from various sources, ensuring that the contractor complies with tax obligations. It is essential for both the contractor and the entity that hires them, as it helps maintain transparency in financial transactions.

How to use the From Contractor

Using the From Contractor involves several straightforward steps. First, the contractor must fill out the form with relevant personal and business information, including their name, address, and Social Security number or Employer Identification Number (EIN). Next, the hiring entity completes their portion, detailing the payments made to the contractor throughout the tax year. Once both parties have signed the form, it can be submitted to the IRS as part of the contractor's tax filings.

Steps to complete the From Contractor

Completing the From Contractor requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including personal identification and payment records.

- Fill out the contractor's details, ensuring accuracy in names and identification numbers.

- Document all payments received during the tax year, specifying the amounts and dates.

- Review the completed form for any errors or omissions.

- Sign the form and ensure the hiring entity does the same before submission.

Legal use of the From Contractor

The legal use of the From Contractor is governed by IRS regulations, which stipulate that the form must be accurately completed and submitted in a timely manner. Failure to comply with these regulations can result in penalties for both the contractor and the hiring entity. It is crucial to keep copies of the completed form for record-keeping purposes, as this documentation may be required in case of an audit.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the From Contractor. Contractors must adhere to these guidelines to ensure proper tax reporting. This includes understanding which payments need to be reported, the deadlines for submission, and the consequences of failing to file. Familiarizing oneself with these guidelines can help contractors avoid common pitfalls and ensure compliance with federal tax laws.

Required Documents

To complete the From Contractor, several documents are typically required. These include:

- Personal identification, such as a Social Security card or EIN.

- Records of all payments received from clients or employers.

- Any previous tax forms that may provide context for the current year's reporting.

Form Submission Methods

The From Contractor can be submitted through various methods, including online filing, mailing a physical copy, or delivering it in person to the appropriate IRS office. Each method has its own set of guidelines and deadlines, so it is important for contractors to choose the option that best fits their needs while ensuring compliance with IRS regulations.

Quick guide on how to complete from contractor

Complete From Contractor seamlessly on any device

Digital document management has gained signNow traction with companies and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to draft, amend, and eSign your documents quickly without any holdups. Manage From Contractor on any platform with airSlate SignNow Android or iOS applications and streamline any document-related processes right now.

How to edit and eSign From Contractor effortlessly

- Find From Contractor and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign From Contractor to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the from contractor

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What does the term 'From Contractor' mean in relation to airSlate SignNow?

The term 'From Contractor' refers to documents that are sent for eSignature from a contractor to other parties. With airSlate SignNow, you can easily manage, send, and track these important documents with a streamlined and user-friendly interface.

-

How does airSlate SignNow enhance the document signing process 'From Contractor'?

airSlate SignNow allows contractors to send documents for eSigning in just a few clicks. This means you can improve turnaround time, reduce paperwork, and maintain a clear audit trail for all documents sent 'From Contractor', ensuring compliance and security.

-

What are the pricing options for airSlate SignNow for contractors?

airSlate SignNow offers flexible pricing plans designed to fit the needs of contractors and businesses of all sizes. Whether you're sending documents 'From Contractor' on a regular basis or occasionally, our cost-effective solutions help you optimize your budget while gaining access to essential features.

-

What features does airSlate SignNow provide specifically for contractors?

airSlate SignNow includes features tailored for contractors, such as customizable templates, bulk sending, and real-time tracking of documents sent 'From Contractor'. These tools make it convenient for contractors to manage multiple projects while ensuring all signatures are obtained promptly.

-

What integrations are available with airSlate SignNow for contractors?

airSlate SignNow integrates seamlessly with various tools that contractors use daily, such as CRM systems, cloud storage, and project management software. This allows you to send documents directly 'From Contractor' using the tools you're already familiar with, enhancing your workflow.

-

How does airSlate SignNow ensure document security when sending 'From Contractor'?

Document security is a top priority for airSlate SignNow. When sending documents 'From Contractor', all data is encrypted and stored securely, with strict access controls in place, ensuring that sensitive information remains protected throughout the signing process.

-

Can I customize documents sent 'From Contractor' using airSlate SignNow?

Yes, airSlate SignNow allows contractors to customize documents easily before sending them out for signature. You can add your branding, select fields for signatures, and make sure the document meets your specific needs when sending 'From Contractor'.

Get more for From Contractor

Find out other From Contractor

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document