941 X Form 2011

What is the 941 X Form

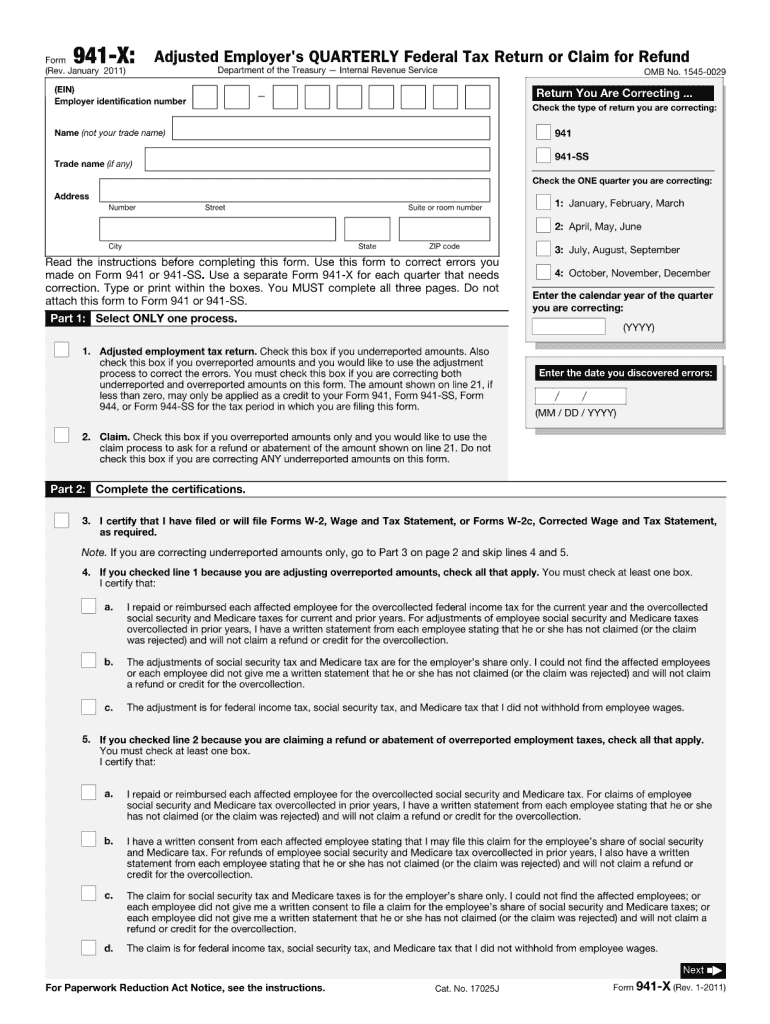

The 941 X Form is a tax document used by employers in the United States to amend previously filed Form 941, which reports payroll taxes. This form allows businesses to correct errors related to income, Social Security, and Medicare taxes. It is essential for ensuring accurate tax reporting and compliance with IRS regulations. The 941 X Form is specifically designed for adjustments to the quarterly payroll tax filings, making it a crucial tool for maintaining proper tax records.

How to use the 941 X Form

Using the 941 X Form involves several steps to ensure that the amendments are processed correctly. First, gather all relevant information regarding the original Form 941 that needs correction. Next, fill out the 941 X Form by providing details about the changes being made, including the specific lines that require adjustment. It is important to clearly explain the reason for the amendments in the designated section. After completing the form, review it for accuracy before submitting it to the IRS.

Steps to complete the 941 X Form

Completing the 941 X Form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the 941 X Form from the IRS website.

- Fill in your business information, including the employer identification number (EIN).

- Indicate the quarter and year of the original Form 941 being amended.

- Provide the corrected amounts for each relevant line item.

- Include a clear explanation for each change made.

- Sign and date the form before submission.

Legal use of the 941 X Form

The legal use of the 941 X Form is governed by IRS guidelines, ensuring that all amendments comply with federal tax laws. Employers must file this form to correct errors in previously submitted payroll tax returns. Failure to use the 941 X Form appropriately can lead to penalties or additional scrutiny from the IRS. It is vital to retain copies of both the original Form 941 and the amended 941 X Form for record-keeping purposes.

Filing Deadlines / Important Dates

Filing deadlines for the 941 X Form are crucial for compliance. Generally, the form must be submitted within three years from the original filing date of Form 941. However, if the correction pertains to a specific tax liability, it is essential to check the IRS guidelines for any specific deadlines that may apply. Timely submission helps avoid penalties and ensures that the employer remains in good standing with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The 941 X Form can be submitted through various methods, depending on the preference of the employer. The most common submission methods include:

- Mail: Employers can send the completed form to the appropriate IRS address based on their location.

- Online: While the 941 X Form itself cannot be filed electronically, employers may use IRS e-file services for related forms.

- In-Person: Employers can also visit a local IRS office to submit the form directly.

Quick guide on how to complete 2011 941 x form

Complete 941 X Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it in the cloud. airSlate SignNow provides you with all the resources required to create, amend, and electronically sign your documents swiftly without delays. Manage 941 X Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign 941 X Form with ease

- Find 941 X Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow manages all your document handling needs within a few clicks from your chosen device. Edit and electronically sign 941 X Form to ensure excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 941 x form

Create this form in 5 minutes!

How to create an eSignature for the 2011 941 x form

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the 941 X Form, and why is it important?

The 941 X Form is a tax form used by employers to correct errors on previously filed Form 941. It allows businesses to adjust their payroll tax liabilities, ensuring they remain compliant with IRS regulations. Understanding how to effectively use the 941 X Form can save your business from penalties and streamline your tax reporting process.

-

How can airSlate SignNow help with filing the 941 X Form?

airSlate SignNow simplifies the process of completing and submitting the 941 X Form by allowing users to electronically sign and send documents securely. Our platform provides templates that streamline the preparation of tax forms, ensuring you can file accurately and on time. This way, you can focus on your business while we handle your document management.

-

What features does airSlate SignNow offer for managing the 941 X Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking for managing the 941 X Form. Users can edit, fill out, and share their tax forms effortlessly, ensuring a smooth filing experience. These features help businesses save time and minimize errors when submitting important tax documents.

-

Is there a cost associated with using airSlate SignNow for the 941 X Form?

Yes, airSlate SignNow operates on a subscription model, offering various plans to cater to different business needs. Pricing is competitive, providing cost-effective solutions for managing the 941 X Form and other essential documents. You can choose a plan that fits your budget and enjoy numerous features that enhance your workflow.

-

Can airSlate SignNow integrate with other software for handling the 941 X Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easy to manage the 941 X Form alongside your existing systems. This integration allows for automatic data synchronization, reducing duplicate entries and errors while improving overall efficiency in your tax management process.

-

What are the benefits of using airSlate SignNow for the 941 X Form?

Using airSlate SignNow to manage the 941 X Form offers multiple benefits including enhanced accuracy, time savings, and improved security. The platform's user-friendly interface allows for quick preparation and submission of your tax documents, reducing the risk of mistakes. Additionally, electronic signing keeps your sensitive information secure while streamlining the approval process.

-

Is airSlate SignNow secure for handling the 941 X Form?

Yes, airSlate SignNow prioritizes security, employing advanced encryption protocols and security features to protect your data when handling the 941 X Form. Compliance with industry standards ensures that sensitive information remains confidential during the eSignature process. You can trust our platform to keep your tax documents safe and secure.

Get more for 941 X Form

- Goal sheet sacramento city unified form

- Recommendation adopt the declaration of need for fully qualified educators for the form

- De 4 form how to fill out

- Contractor lcptracker setup sheet city and county of denvergov form

- Division human resource services form

- 111234 directive waiverindd form

- Commercial water meter sizing form commercial water meter sizing form

- Green roof declaration form green roof declaration form

Find out other 941 X Form

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast