Schedule D Form 2015

What is the Schedule D Form

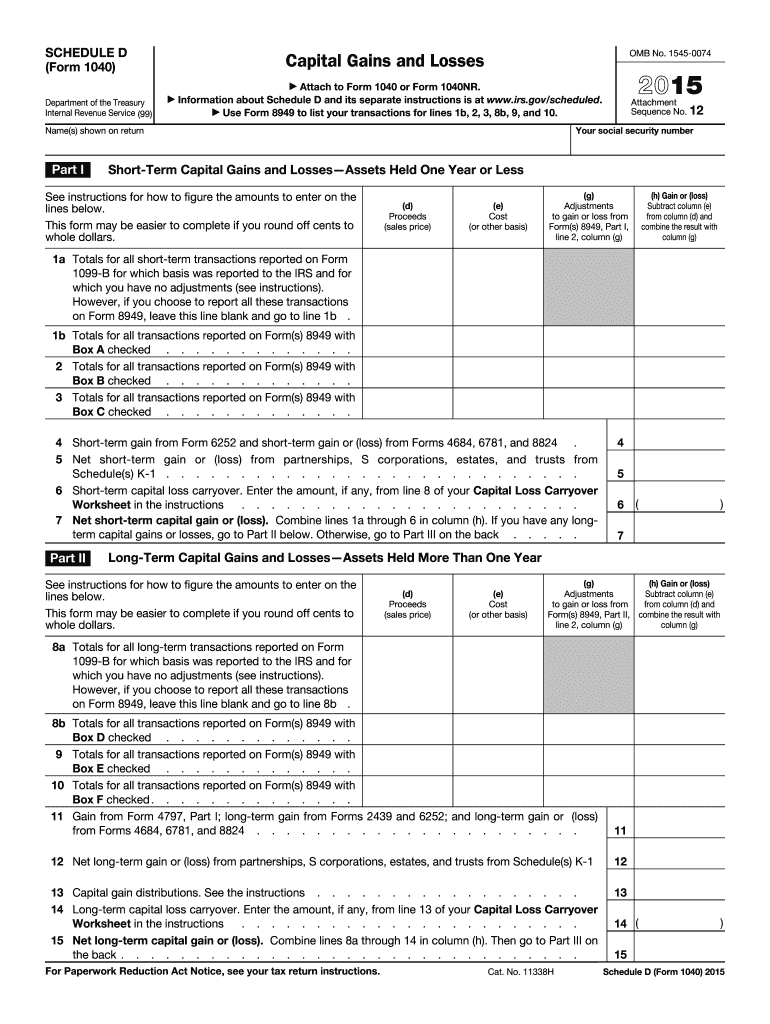

The Schedule D Form is a tax document used by individuals and entities in the United States to report capital gains and losses from the sale of assets. This form is essential for taxpayers who have engaged in transactions involving stocks, bonds, real estate, or other investments during the tax year. By accurately completing the Schedule D Form, taxpayers can determine their overall capital gain or loss, which affects their taxable income and tax liability. This form is typically filed alongside the individual income tax return, Form 1040.

How to use the Schedule D Form

Using the Schedule D Form involves several steps to ensure accurate reporting of capital gains and losses. Taxpayers must first gather all relevant information regarding their asset transactions, including purchase and sale dates, amounts, and any associated costs. The form is divided into sections that require details about short-term and long-term gains and losses. After filling out the required sections, taxpayers must transfer the totals to their Form 1040. It is crucial to review the completed form for accuracy to avoid potential issues with the IRS.

Steps to complete the Schedule D Form

Completing the Schedule D Form involves a systematic approach:

- Gather all necessary documents related to asset transactions, including brokerage statements and purchase receipts.

- Identify and categorize each transaction as either short-term or long-term based on the holding period of the asset.

- Calculate the gain or loss for each transaction by subtracting the cost basis from the sale price.

- Fill in the appropriate sections of the Schedule D Form, ensuring that totals for short-term and long-term gains and losses are accurately reported.

- Transfer the totals to your Form 1040 and ensure that all forms are submitted by the tax deadline.

Filing Deadlines / Important Dates

The Schedule D Form must be filed along with the individual income tax return, which is typically due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who need additional time to prepare their returns can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to keep track of these dates to ensure timely filing and compliance with IRS regulations.

Legal use of the Schedule D Form

The Schedule D Form is legally recognized as a valid method for reporting capital gains and losses to the IRS. To ensure compliance, taxpayers must adhere to IRS guidelines when completing the form. This includes accurately reporting all transactions and maintaining proper documentation to support the figures reported. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional if there are uncertainties regarding the legal aspects of using the Schedule D Form.

Key elements of the Schedule D Form

Several key elements must be included when completing the Schedule D Form:

- Transaction Details: Each asset transaction must include the date acquired, date sold, sale price, and cost basis.

- Short-term vs. Long-term Gains: Taxpayers must differentiate between short-term gains (assets held for one year or less) and long-term gains (assets held for more than one year).

- Total Gains and Losses: Accurate calculations of total short-term and long-term gains and losses are essential for determining overall tax liability.

- Carryover Losses: Any capital losses that exceed gains can be carried over to future tax years, which must be documented on the form.

Quick guide on how to complete 2015 schedule d form

Complete Schedule D Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without interruptions. Manage Schedule D Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Schedule D Form with ease

- Obtain Schedule D Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your document, via email, SMS, or shared link, or download it to your computer.

Eliminate the issues of lost or disorganized documents, tedious form searching, and errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule D Form and ensure seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 schedule d form

Create this form in 5 minutes!

How to create an eSignature for the 2015 schedule d form

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is a Schedule D Form and why is it important?

The Schedule D Form is used to report capital gains and losses from the sale of securities and other assets. Understanding this form is crucial for accurate tax reporting, as it helps taxpayers calculate their gains or losses and understand the implications on their financial situation.

-

How can airSlate SignNow simplify the process of filling out a Schedule D Form?

airSlate SignNow offers an intuitive platform to securely eSign and fill out documents, including the Schedule D Form. With our user-friendly interface, you can easily upload your documents, fill them in, and get them signed electronically, enhancing efficiency and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the Schedule D Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, all while providing a cost-effective solution for managing documents like the Schedule D Form. Check our pricing page to find a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for handling the Schedule D Form?

Our platform includes features such as customizable templates, real-time collaboration, and secure document storage, specifically designed to facilitate the completion of the Schedule D Form. These features ensure you can manage your documents efficiently while maintaining compliance.

-

Can I integrate airSlate SignNow with other tools when working on my Schedule D Form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of business tools and software, making it easier to incorporate the Schedule D Form into your existing workflow. This connectivity enhances productivity and helps streamline document management.

-

Is the Schedule D Form easily accessible within airSlate SignNow?

Yes, within airSlate SignNow, you can access the Schedule D Form and a range of other tax-related documents through our library of templates. This accessibility makes it simple and quick to find the form you need and get started with your eSigning process.

-

What benefits does airSlate SignNow provide for businesses dealing with the Schedule D Form?

Using airSlate SignNow allows businesses to save time and reduce errors when handling the Schedule D Form. Our electronic signature feature ensures that you can sign documents securely from anywhere, increasing flexibility while ensuring compliance with legal standards.

Get more for Schedule D Form

- Individual marketplace book of business transfer form here

- Fuhsd administrative regulation 1312 form

- Checks attach adding machine tape of itemized checks form

- Oral health notification form poway unified school district

- Health assessment form

- 445 ingenuity ave sparks nv form

- District information handbook gilroy unified school district

- Heap program stockton ca form

Find out other Schedule D Form

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure