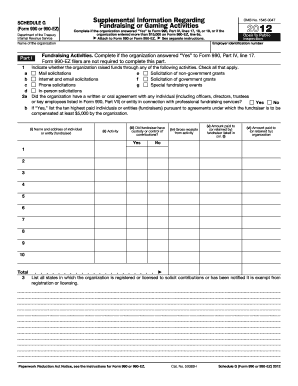

990 Form 2012

What is the 990 Form

The 990 Form is an essential tax document used by tax-exempt organizations, including charities and non-profits, to report their financial information to the Internal Revenue Service (IRS). This form provides transparency regarding an organization’s income, expenses, and activities, ensuring accountability to the public and the government. It is crucial for maintaining tax-exempt status and offers insights into the financial health and operations of the organization.

How to use the 990 Form

Using the 990 Form involves several steps to ensure accurate reporting. Organizations must first gather all necessary financial data, including revenue, expenses, and assets. Once the data is compiled, it should be entered into the appropriate sections of the form. It is important to follow IRS guidelines closely to avoid errors. After completing the form, organizations must review it for accuracy before submitting it to the IRS.

Steps to complete the 990 Form

Completing the 990 Form requires careful attention to detail. Here are the key steps:

- Gather financial statements, including income statements and balance sheets.

- Fill out the organization’s basic information, including name, address, and EIN.

- Report revenue sources, detailing contributions, grants, and program service revenue.

- List expenses, categorizing them into functional areas such as program services, management, and fundraising.

- Complete the governance section, providing information about board members and policies.

- Review the form for completeness and accuracy before submission.

Legal use of the 990 Form

The 990 Form must be filed according to IRS regulations to maintain legal compliance. It serves as a public document, meaning it can be accessed by anyone interested in the organization’s financial practices. Accurate and timely filing is essential to avoid penalties and maintain tax-exempt status. Organizations should ensure they understand the legal implications of the information they report on the form.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the 990 Form to remain compliant. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. If the organization operates on a calendar year, the deadline is May fifteenth. Extensions may be requested, but it is crucial to file the form on time to avoid penalties.

Form Submission Methods

The 990 Form can be submitted to the IRS through various methods. Organizations have the option to file electronically using the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on the organization’s location and type. It is important to ensure that the form is sent to the correct address to avoid processing delays.

Quick guide on how to complete 2012 990 form

Complete 990 Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, as you can easily find the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage 990 Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related activity today.

The easiest way to edit and electronically sign 990 Form effortlessly

- Find 990 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the particulars and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and electronically sign 990 Form and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 990 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 990 form

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a 990 Form and why is it important?

The 990 Form is a key document that tax-exempt organizations in the U.S. must file annually with the IRS. It provides detailed information about the organization's financial performance, governance, and activities. Understanding the 990 Form is crucial for maintaining compliance and ensuring transparency with stakeholders.

-

How can airSlate SignNow help with completing the 990 Form?

airSlate SignNow streamlines the process of completing the 990 Form by allowing users to eSign and send documents securely. Its user-friendly features help organizations efficiently collect necessary signatures and reduce the paperwork burden. By leveraging SignNow, users can enhance the accuracy and efficiency of their 990 Form submissions.

-

What features does airSlate SignNow offer for managing the 990 Form?

airSlate SignNow includes robust features such as document templates, collaborative editing, and audit trails that can simplify the management of the 990 Form. Customizable templates help save time, while audit trails provide a clear record of changes and approvals. These features cater specifically to the needs of organizations dealing with complex compliance forms.

-

Is there a cost associated with using airSlate SignNow for the 990 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different organizational needs, making it a cost-effective solution for managing the 990 Form. Each plan includes essential features to help organizations streamline their document workflows. Organizations can choose the plan that best aligns with their usage and budget.

-

Can I integrate airSlate SignNow with other software for managing my 990 Form?

Absolutely! airSlate SignNow provides seamless integration with various accounting and document management software. By integrating these tools, organizations can enhance their workflow efficiency and ensure that data related to the 990 Form is easily accessible and organized, simplifying the filing process.

-

What benefits does airSlate SignNow offer for nonprofits preparing a 990 Form?

For nonprofits preparing the 990 Form, airSlate SignNow offers signNow time savings and improved accuracy. Users can easily gather signatures and collaborate in real-time, reducing the chances of errors. These benefits ultimately lead to faster and smoother compliance with IRS requirements.

-

How is data security ensured when using airSlate SignNow for the 990 Form?

Data security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 990 Form. The platform employs advanced encryption protocols and complies with industry standards to protect user information. This ensures that organizations can manage their 990 Form submissions with confidence in data integrity and confidentiality.

Get more for 990 Form

- Minimum wage ordinance form

- Union bank deposit slip form

- Prescriptive residential additions that do not require hers field form

- 20182019 individual membership form

- Amador county fair form

- Returning volunteer driver sjusd form

- Medication form for school

- Broker of record renewals sample letter for renewals on form

Find out other 990 Form

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter