Form 1042 S 2010

What is the Form 1042-S

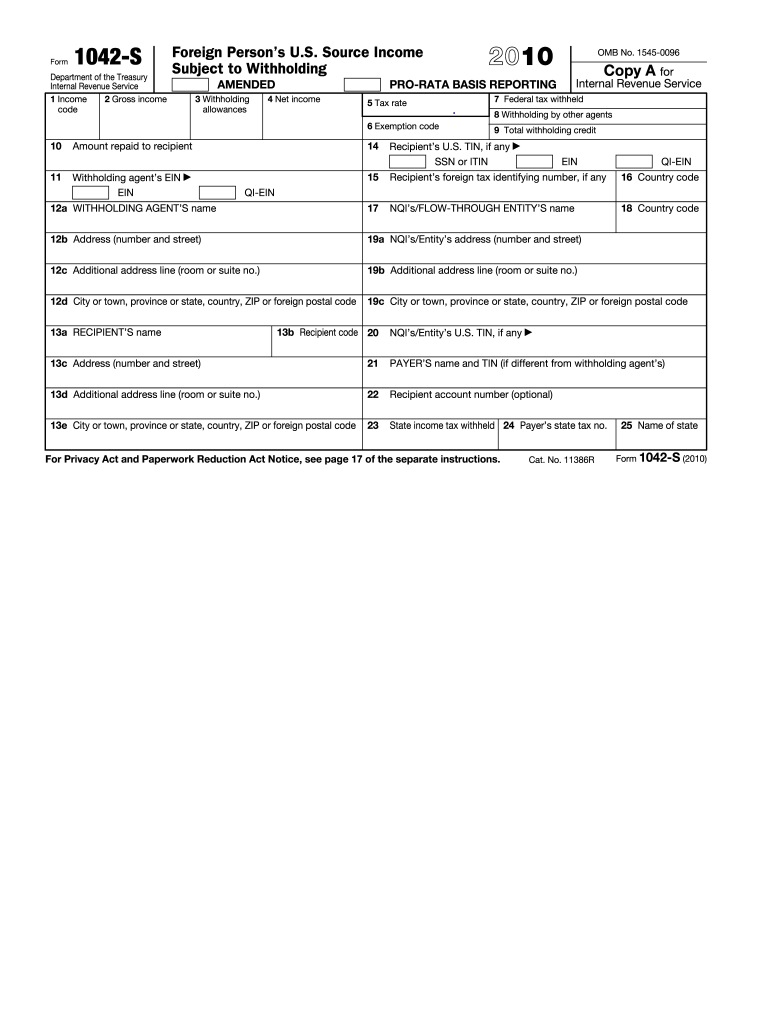

The Form 1042-S is a tax document used by U.S. withholding agents to report income paid to foreign persons, including non-resident aliens and foreign entities. This form details the income types, amounts, and any taxes withheld on behalf of these foreign recipients. It is essential for ensuring compliance with U.S. tax laws and for the recipients to report their income accurately when filing their tax returns in their respective countries. The form includes specific sections that identify the recipient, the type of income, and the amount withheld, making it a critical document for both the payer and the payee.

How to use the Form 1042-S

To effectively use the Form 1042-S, withholding agents must first determine if they are required to file the form based on the payments made to foreign individuals or entities. Once it is established that the form is necessary, the agent should accurately fill out all relevant sections, including the recipient's information and the income type. After completing the form, it must be distributed to the foreign recipients by March 15 of the following year. Additionally, the withholding agent must submit the form to the IRS by the same deadline, ensuring that all information is correct to avoid penalties.

Steps to complete the Form 1042-S

Completing the Form 1042-S involves several key steps:

- Gather necessary information about the foreign recipient, including their name, address, and taxpayer identification number.

- Identify the type of income being reported, such as interest, dividends, or royalties.

- Determine the amount of income paid and any taxes withheld.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Distribute copies of the completed form to the recipient and submit it to the IRS by the deadline.

Legal use of the Form 1042-S

The legal use of the Form 1042-S is governed by U.S. tax regulations. Withholding agents are required to file this form to comply with the Internal Revenue Code, which mandates reporting payments made to foreign persons. Failure to file the form or inaccuracies can result in penalties. The form serves as a record for both the payer and the recipient, ensuring that the correct amount of tax is withheld and reported. It is crucial for withholding agents to understand their responsibilities under U.S. law to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042-S are critical for compliance. The form must be provided to recipients by March 15 of the year following the payment. Additionally, the withholding agent must submit the form to the IRS by the same date. If March 15 falls on a weekend or holiday, the deadline is extended to the next business day. It is important for agents to keep track of these dates to avoid penalties for late filing.

Penalties for Non-Compliance

Non-compliance with the requirements for filing the Form 1042-S can lead to significant penalties. The IRS imposes fines for late filings, inaccuracies, and failure to provide the form to recipients. The penalties can vary based on the severity of the violation, with fines increasing for repeated offenses. It is essential for withholding agents to ensure that they understand their obligations and file the form correctly and on time to avoid these financial repercussions.

Quick guide on how to complete 2010 form 1042 s

Complete Form 1042 S seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides all the resources you require to generate, modify, and eSign your documents swiftly without delays. Manage Form 1042 S on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 1042 S without hassle

- Obtain Form 1042 S and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1042 S and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 1042 s

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1042 s

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is Form 1042 S?

Form 1042 S is an IRS form used to report income paid to non-resident aliens. It outlines amounts withheld and helps recipients understand their tax liabilities related to such income. Understanding how to correctly fill out a Form 1042 S is crucial for compliance and accurate tax reporting.

-

How does airSlate SignNow simplify the process of managing Form 1042 S?

airSlate SignNow offers an intuitive platform for electronically signing and sending Form 1042 S documents seamlessly. With user-friendly features, businesses can save time and reduce errors associated with manual processes. This efficiency is especially beneficial when dealing with multiple international clients and compliance requirements.

-

Can I customize my Form 1042 S using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Form 1042 S to meet your unique requirements. You can add logos, branding, and specific fields needed for your documentation. This flexibility ensures that your form remains professional and tailored to your business needs.

-

What are the pricing options for airSlate SignNow when handling Form 1042 S?

airSlate SignNow offers competitive pricing plans to suit businesses of all sizes. Whether you need a plan for small teams or large enterprises, you can find a pricing option that fits your budget while ensuring you can manage Form 1042 S efficiently. Plus, there are no hidden fees, providing transparency in your cost structure.

-

Does airSlate SignNow support integrations for preparing Form 1042 S?

Absolutely! airSlate SignNow integrates with various applications such as accounting software and CRMs, making it easier to prepare Form 1042 S. These integrations enable you to streamline your workflow, making data entry and management simple and efficient, ensuring you never miss a detail.

-

What benefits can I expect by using airSlate SignNow for Form 1042 S?

By using airSlate SignNow for Form 1042 S, you'll benefit from increased efficiency, reduced turnaround times, and enhanced document security. The platform ensures that your sensitive tax information is protected while providing an easy platform for eSignatures. This leads to a smoother operational flow and better compliance management.

-

Is there customer support available for Form 1042 S issues on airSlate SignNow?

Yes, airSlate SignNow provides comprehensive customer support for all users, including assistance with Form 1042 S queries. Whether you need help with document setup or troubleshooting, the support team is readily available to assist you through chat, email, or phone. This helps ensure you can manage your documents with confidence.

Get more for Form 1042 S

- Book of discipline 2582 staff or pastor parish relations form

- Partisan nomination petition azld28goporg form

- Arizona aloha festival form

- Speaker appointments official website speaker anthony rendon form

- Diesel record keeping form airquality

- Nrcc mch 02 e form

- Sud residential treatment authorization ampampamp reauthorization form

- Oral health assessment request form modesto city schools

Find out other Form 1042 S

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now