Irs Form 14039 Printable 2017

What is the IRS Form 14039 Printable

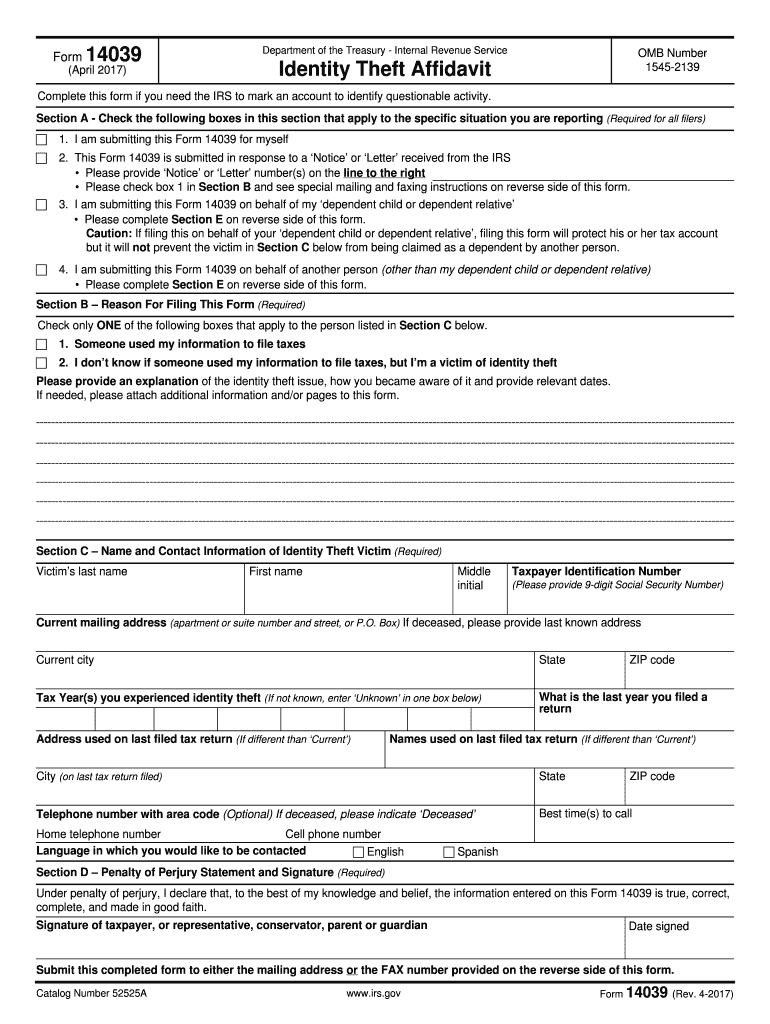

The IRS Form 14039, also known as the Identity Theft Affidavit, is a crucial document for taxpayers who suspect that their personal information has been compromised. This form allows individuals to report instances of identity theft related to their tax returns. It serves as an official declaration to the Internal Revenue Service (IRS) that the taxpayer is a victim of identity theft and seeks to resolve any issues arising from fraudulent activities associated with their Social Security number.

How to Obtain the IRS Form 14039 Printable

To obtain the IRS Form 14039, individuals can visit the official IRS website. The form is available for download in PDF format, which can be printed directly from the website. Additionally, taxpayers may request a physical copy of the form by contacting the IRS directly. It is advisable to ensure that the latest version of the form is being used to comply with current IRS regulations.

Steps to Complete the IRS Form 14039 Printable

Completing the IRS Form 14039 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the nature of the identity theft, providing any relevant details that can help the IRS understand your situation.

- Attach copies of any supporting documents that verify your identity and the fraudulent activity, such as police reports or letters from the IRS.

- Review the completed form for accuracy and completeness before submitting it.

Legal Use of the IRS Form 14039 Printable

The IRS Form 14039 is legally recognized as a formal declaration of identity theft. By submitting this form, taxpayers assert their rights as victims of fraud and initiate the process of protecting their tax records. It is essential to use this form appropriately, as providing false information can lead to legal consequences. The form helps the IRS take necessary actions to secure the taxpayer's account and prevent further fraudulent activities.

Required Documents for IRS Form 14039 Submission

When submitting the IRS Form 14039, taxpayers should include several key documents to support their claim:

- Photocopies of government-issued identification, such as a driver's license or passport.

- Any correspondence from the IRS regarding suspicious activity or identity theft.

- Police reports or affidavits detailing the identity theft incident, if available.

Form Submission Methods for IRS Form 14039

The IRS Form 14039 can be submitted through various methods:

- By Mail: Taxpayers can print the completed form and send it to the appropriate IRS address specified in the form instructions.

- Online Submission: While the form itself cannot be submitted online, taxpayers can report identity theft through the IRS Identity Theft Central page.

- In-Person: Individuals may also visit a local IRS office to submit the form directly, although appointments may be required.

Quick guide on how to complete irs tax form 14039 2017 2018

Uncover the easiest method to complete and endorse your Irs Form 14039 Printable

Are you still spending time preparing your official documents on paper instead of utilizing online options? airSlate SignNow provides a superior approach to complete and endorse your Irs Form 14039 Printable and associated forms for public services. Our advanced electronic signature solution equips you with all the necessary tools to handle documents swiftly and in compliance with formal standards - robust PDF editing, management, protection, signing, and sharing functionalities are readily available in an intuitive interface.

Only a few steps are needed to complete and endorse your Irs Form 14039 Printable successfully:

- Upload the fillable template to the editor using the Get Form button.

- Identify what details you need to include in your Irs Form 14039 Printable.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to populate the fields with your data.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure sections that are no longer relevant.

- Select Sign to create a legally binding electronic signature using whichever option you prefer.

- Include the Date next to your signature and complete your task with the Done button.

Store your finalized Irs Form 14039 Printable in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our service also provides adaptable form sharing. There’s no need to print your templates when you are required to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct irs tax form 14039 2017 2018

FAQs

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How many tax forms does a small startup usually have to fill for the IRS?

It depends. Have you set up a separate legal entity, such as a C corporation or an LLC? Are you operating as a sole proprietor? Are you referring specifically to income tax returns? Depending on what kind of business you have, you may include additional schedules, election statements, informational forms to supplement your income tax returns.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the irs tax form 14039 2017 2018

How to generate an eSignature for your Irs Tax Form 14039 2017 2018 online

How to create an eSignature for the Irs Tax Form 14039 2017 2018 in Chrome

How to make an electronic signature for signing the Irs Tax Form 14039 2017 2018 in Gmail

How to create an eSignature for the Irs Tax Form 14039 2017 2018 from your smart phone

How to generate an eSignature for the Irs Tax Form 14039 2017 2018 on iOS devices

How to make an eSignature for the Irs Tax Form 14039 2017 2018 on Android OS

People also ask

-

What is IRS Form 10439 and how is it used?

IRS Form 10439 is a tax form used to request a tax refund for overpaid amounts. It's crucial for taxpayers who are looking to reclaim excess payments. Understanding how to complete and submit IRS Form 10439 can streamline the refund process.

-

How can airSlate SignNow help with IRS Form 10439?

airSlate SignNow simplifies the process of preparing and eSigning IRS Form 10439. With its user-friendly interface, you can fill out, edit, and electronically sign the document, ensuring a hassle-free experience in submitting your tax form.

-

Is there a cost associated with using airSlate SignNow for IRS Form 10439?

airSlate SignNow offers affordable pricing plans that cater to various business needs. You can access features for managing IRS Form 10439 without breaking the bank, making it a cost-effective solution for document management.

-

What features does airSlate SignNow provide for IRS Form 10439?

AirSlate SignNow offers features such as document templates, cloud storage, and secure digital signatures specifically for IRS Form 10439. These functionalities enhance usability and security, allowing for efficient form management and submission.

-

Can I integrate airSlate SignNow with other software for IRS Form 10439?

Yes, airSlate SignNow seamlessly integrates with various software tools to enhance your workflow for IRS Form 10439. This integration allows users to sync data and streamline processes, improving overall efficiency in managing forms.

-

What are the benefits of using airSlate SignNow for IRS Form 10439?

Using airSlate SignNow for IRS Form 10439 offers benefits such as enhanced security, time savings, and ease of use. The platform ensures your document is secure and easily accessible while allowing you to manage multiple forms efficiently.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 10439?

Absolutely, airSlate SignNow is designed to be fully compliant with IRS regulations regarding document eSigning and submission, including IRS Form 10439. This compliance is essential for ensuring that your documents meet legal standards.

Get more for Irs Form 14039 Printable

- Signed ga divorce pdf 2009 form

- Online divorce paper with blank sign form

- Separate maintenance forms dekalb county ga

- Complaint for divorce for hawaii form

- Dekalb county superior court divorce fillable forms

- Superior court of new jersey chancery division family part complaint for divorce form

- Douglas county ga divorce form

- What do divorce papers look like in pa form

Find out other Irs Form 14039 Printable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors