Form 1040 2017

What is the Form 1040

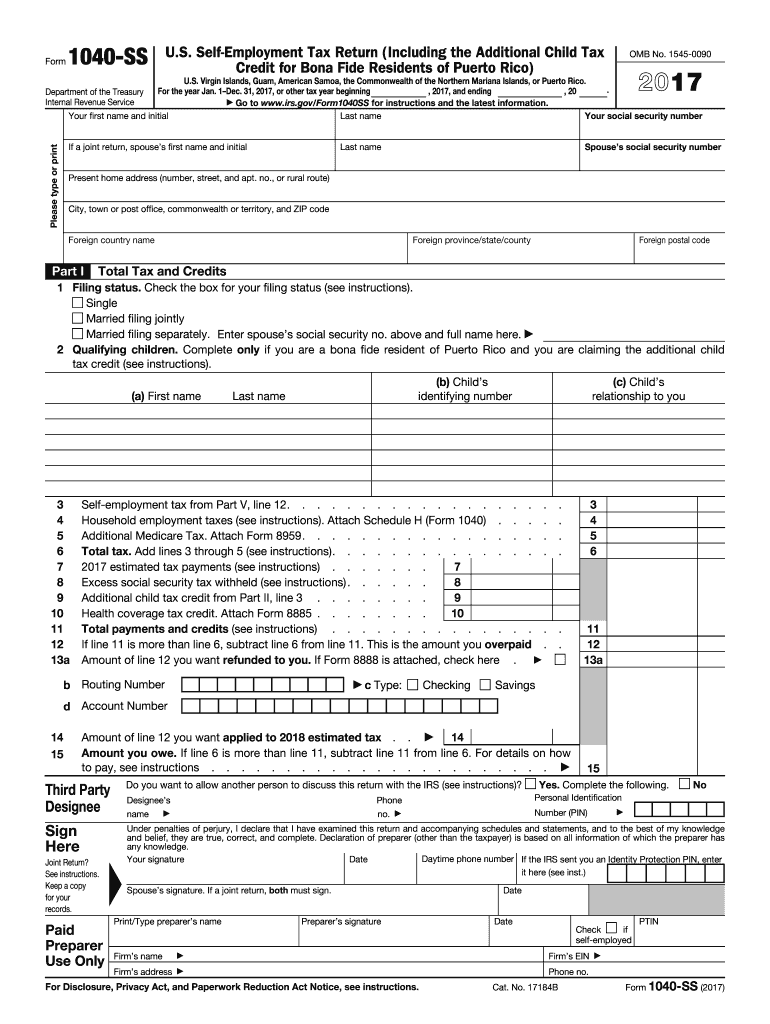

The Form 1040 is the standard individual income tax return form used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form is essential for individuals to calculate their tax liability, claim tax deductions and credits, and determine whether they owe additional taxes or are entitled to a refund. The Form 1040 includes sections for various types of income, such as wages, dividends, and capital gains, as well as deductions for expenses like mortgage interest and charitable contributions.

Steps to complete the Form 1040

Completing the Form 1040 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary documents, including W-2s, 1099s, and records of any other income. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your income from various sources in the appropriate sections.

- Claim any eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on your income and deductions.

- Determine if you owe taxes or if you will receive a refund.

- Sign and date the form before submission.

How to obtain the Form 1040

Taxpayers can obtain the Form 1040 through several convenient methods. The form is available for download on the IRS website, where individuals can access the most current version. Additionally, physical copies can be requested by calling the IRS or visiting a local IRS office. Many tax preparation services and software programs also provide the Form 1040 as part of their offerings, allowing users to complete and file their taxes electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 are crucial for taxpayers to avoid penalties. Typically, the deadline for submitting the Form 1040 is April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can request an automatic six-month extension to file, but any taxes owed must be paid by the original deadline to avoid interest and penalties.

Key elements of the Form 1040

The Form 1040 consists of several key elements that taxpayers must complete. These include:

- Personal Information: Name, address, and Social Security number.

- Income Section: Reporting various income sources, such as wages and dividends.

- Deductions and Credits: Claiming eligible deductions to lower taxable income.

- Tax Calculation: Determining total tax liability based on income and deductions.

- Signature: Signing and dating the form to validate the submission.

Digital vs. Paper Version

Taxpayers have the option to file the Form 1040 either digitally or via paper submission. The digital version allows for faster processing and immediate confirmation of receipt by the IRS. Electronic filing often includes built-in error checks and can simplify the process of claiming deductions and credits. Conversely, filing a paper version may take longer for processing and requires mailing the completed form to the IRS. Each method has its advantages, and taxpayers should choose based on their preferences and needs.

Quick guide on how to complete 2017 form 1040

Discover the simplest method to complete and endorse your Form 1040

Are you still spending time preparing your official documentation on physical copies instead of doing it digitally? airSlate SignNow presents a superior approach to finish and endorse your Form 1040 and similar forms for public services. Our intelligent electronic signature solution provides you with everything necessary to handle paperwork swiftly and in compliance with official requirements - robust PDF editing, management, protection, signing, and sharing tools all available within an intuitive interface.

Only a few steps are required to complete and endorse your Form 1040:

- Upload the fillable template to the editor using the Get Form button.

- Verify what information you need to include in your Form 1040.

- Move through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Obscure fields that are no longer relevant.

- Click Sign to create a legally enforceable electronic signature using any method you prefer.

- Add the Date beside your signature and conclude your work with the Done button.

Store your completed Form 1040 in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our solution also supports adaptable file sharing. There’s no need to print your forms when you need to submit them to the relevant public office - do so via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 1040

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 1040

How to generate an eSignature for your 2017 Form 1040 online

How to create an eSignature for the 2017 Form 1040 in Google Chrome

How to make an eSignature for signing the 2017 Form 1040 in Gmail

How to make an electronic signature for the 2017 Form 1040 right from your smart phone

How to make an eSignature for the 2017 Form 1040 on iOS devices

How to create an electronic signature for the 2017 Form 1040 on Android OS

People also ask

-

What is Form 1040 and how can it be signed electronically?

Form 1040 is the standard federal income tax form used by individuals to report their income, calculate taxes owed, and request refunds. With airSlate SignNow, you can easily eSign Form 1040, making the process more efficient and streamlined. Our platform allows you to securely sign and send your tax forms without the need for printing or mailing.

-

What features does airSlate SignNow offer for handling Form 1040?

airSlate SignNow provides a range of features specifically designed to facilitate the management of Form 1040, including customizable templates, automated workflows, and secure storage. Users can quickly create, send, and track their Form 1040 documents, ensuring a hassle-free tax filing experience. These features save time and minimize the risk of errors.

-

Is airSlate SignNow cost-effective for eSigning Form 1040?

Yes, airSlate SignNow is a cost-effective solution for eSigning Form 1040 and other documents. Our pricing plans are designed to fit various business needs, offering both monthly and annual subscriptions with no hidden fees. By using our platform, businesses can reduce printing and postage costs associated with traditional Form 1040 processing.

-

How does airSlate SignNow ensure the security of my Form 1040?

At airSlate SignNow, the security of your Form 1040 is our top priority. We use advanced encryption and authentication measures to protect your data throughout the signing process. Additionally, our platform complies with industry standards and regulations, ensuring that your sensitive tax information is handled with the utmost care.

-

Can I integrate airSlate SignNow with other software for Form 1040?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easy to manage your Form 1040 alongside your favorite tools. Whether you are using accounting software or document management systems, our integrations streamline your workflow, allowing for a more cohesive experience when dealing with tax forms.

-

What are the benefits of using airSlate SignNow for Form 1040?

Using airSlate SignNow for Form 1040 offers numerous benefits, including quicker turnaround times, increased efficiency, and enhanced collaboration features. Our user-friendly interface makes it simple to navigate the eSigning process, ensuring that you can complete your taxes faster. Moreover, our platform helps eliminate the clutter of paper documents, contributing to a more sustainable environment.

-

Is it easy to create a Form 1040 template on airSlate SignNow?

Creating a Form 1040 template on airSlate SignNow is straightforward and user-friendly. Our intuitive template builder allows you to customize your Form 1040 with necessary fields, ensuring it meets your specific requirements. Once set up, you can reuse this template for future tax seasons, saving you time and effort every year.

Get more for Form 1040

Find out other Form 1040

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online