Www Irs Govpubirs UtlHealth Reimbursement Arrangements FAQs Internal Revenue Service 2021

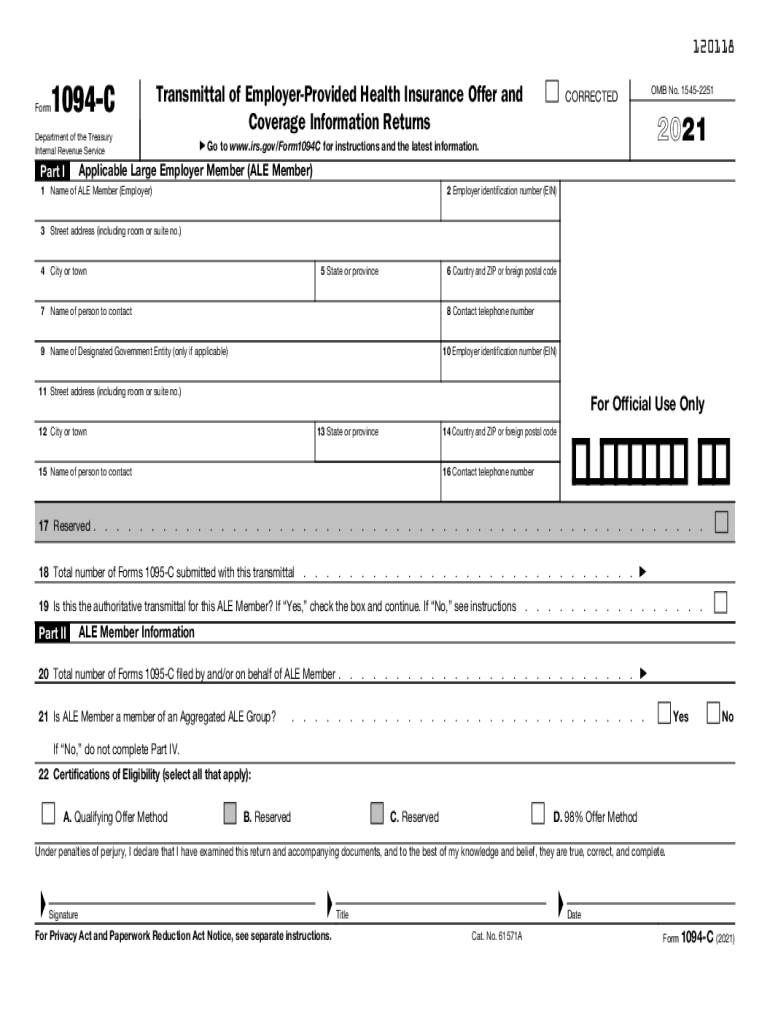

IRS Guidelines for Form 1094-C

The 2-C is a crucial form for employers that provides information about health coverage offered to employees. This form is part of the Affordable Care Act (ACA) reporting requirements and must be filed with the IRS. It is essential to adhere to the guidelines set forth by the IRS to ensure compliance. The form includes details such as the number of full-time employees, the months coverage was available, and the type of coverage offered. Understanding these guidelines helps employers accurately report their health coverage offerings.

Filing Deadlines and Important Dates

For the 2-C, employers must be aware of the key filing deadlines. The form is typically due on the last day of February if filed on paper or March 31 if filed electronically. It is vital to submit the form on time to avoid penalties. Employers should also keep in mind that they must provide copies of the 1095-C forms to their employees by January 31 of the following year. Staying informed about these dates can help ensure timely compliance with IRS requirements.

Required Documents for Submission

When preparing to file the 2-C, employers should gather several key documents. These include employee enrollment records, information about health insurance plans offered, and records of any health coverage provided during the year. Accurate and complete documentation is necessary to ensure that the form is filled out correctly and to support the information reported to the IRS. Having these documents organized in advance can streamline the filing process.

Form Submission Methods

The 2-C can be submitted to the IRS through various methods. Employers have the option to file the form electronically or by mail. Electronic filing is recommended for those submitting a large number of forms, as it is more efficient and reduces the risk of errors. For those choosing to file by mail, it is important to send the form to the correct IRS address and to use certified mail for tracking purposes. Understanding the submission methods can help employers choose the best option for their needs.

Penalties for Non-Compliance

Failure to file the 2-C on time or providing inaccurate information can result in penalties from the IRS. The penalties can vary based on the number of forms not filed or the duration of the delay. Employers may face fines for each form that is filed late or incorrectly. It is crucial for employers to understand these potential penalties and to take proactive measures to ensure compliance with filing requirements.

Eligibility Criteria for Reporting

Not all employers are required to file the 2-C. Generally, applicable large employers (ALEs) with fifty or more full-time employees must file this form. Employers should assess their status based on the number of full-time employees and full-time equivalent employees. Understanding eligibility criteria helps employers determine their reporting obligations under the ACA and ensures that they comply with the necessary regulations.

Quick guide on how to complete wwwirsgovpubirs utlhealth reimbursement arrangements faqs internal revenue service

Complete Www irs govpubirs utlHealth Reimbursement Arrangements FAQs Internal Revenue Service effortlessly on any device

Managing documents online has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Www irs govpubirs utlHealth Reimbursement Arrangements FAQs Internal Revenue Service on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

The simplest way to modify and eSign Www irs govpubirs utlHealth Reimbursement Arrangements FAQs Internal Revenue Service with ease

- Locate Www irs govpubirs utlHealth Reimbursement Arrangements FAQs Internal Revenue Service and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Www irs govpubirs utlHealth Reimbursement Arrangements FAQs Internal Revenue Service to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs utlhealth reimbursement arrangements faqs internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs utlhealth reimbursement arrangements faqs internal revenue service

How to create an e-signature for a PDF document online

How to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2020 1094 C form, and why is it important?

The 2020 1094 C form is a crucial document for employers under the Affordable Care Act. It provides the IRS with information about health coverage offered to employees and is essential for compliance reporting. Completing the 2020 1094 C accurately helps avoid penalties and ensures proper healthcare coverage for your workforce.

-

How can airSlate SignNow help with filling out the 2020 1094 C?

airSlate SignNow streamlines the process of completing and eSigning the 2020 1094 C form. Our platform allows for easy document uploads, form filling, and secure electronic signatures, making it efficient to manage your compliance paperwork. With airSlate SignNow, you can ensure that your forms are filled out correctly and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the 2020 1094 C?

Yes, airSlate SignNow offers various pricing plans tailored to businesses of all sizes. Our cost-effective solutions can help you efficiently manage important documents like the 2020 1094 C without breaking the bank. You can choose a plan that fits your needs and budget while enjoying the full benefits of our services.

-

What features does airSlate SignNow offer for managing the 2020 1094 C?

airSlate SignNow provides features such as customizable templates, bulk sending, and secure storage tailored for documents like the 2020 1094 C. You can track your document status, automate reminders for submissions, and ensure all your eSignatures are legally compliant. These features enhance your productivity and simplify the entire process.

-

Can airSlate SignNow integrate with other software tools for handling the 2020 1094 C?

Absolutely! airSlate SignNow seamlessly integrates with various business tools and CRM systems to help you manage the 2020 1094 C and other documents effectively. These integrations allow for enhanced data sharing and workflow automation, ensuring that your compliance processes are streamlined and efficient.

-

What are the benefits of using airSlate SignNow for the 2020 1094 C?

Using airSlate SignNow for the 2020 1094 C provides numerous benefits, including time savings, reduced paperwork, and improved accuracy. With our user-friendly interface, you can speed up workflows and ensure compliance with regulations. Additionally, the secure environment helps protect sensitive employee information during the signing process.

-

How does airSlate SignNow ensure the security of the 2020 1094 C information?

airSlate SignNow prioritizes the security of your documents, including the 2020 1094 C. We use industry-leading encryption protocols to protect your data and maintain compliance with regulations. Our platform also features secure access controls, ensuring that only authorized personnel can view or edit sensitive information.

Get more for Www irs govpubirs utlHealth Reimbursement Arrangements FAQs Internal Revenue Service

- Excavator contract for contractor florida form

- Renovation contract for contractor florida form

- Concrete mason contract for contractor florida form

- Demolition contract for contractor florida form

- Framing contract 497302610 form

- Security contract contractor form

- Insulation contract 497302612 form

- Paving contract for contractor florida form

Find out other Www irs govpubirs utlHealth Reimbursement Arrangements FAQs Internal Revenue Service

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now