1094 C Form 2015

What is the 1094 C Form

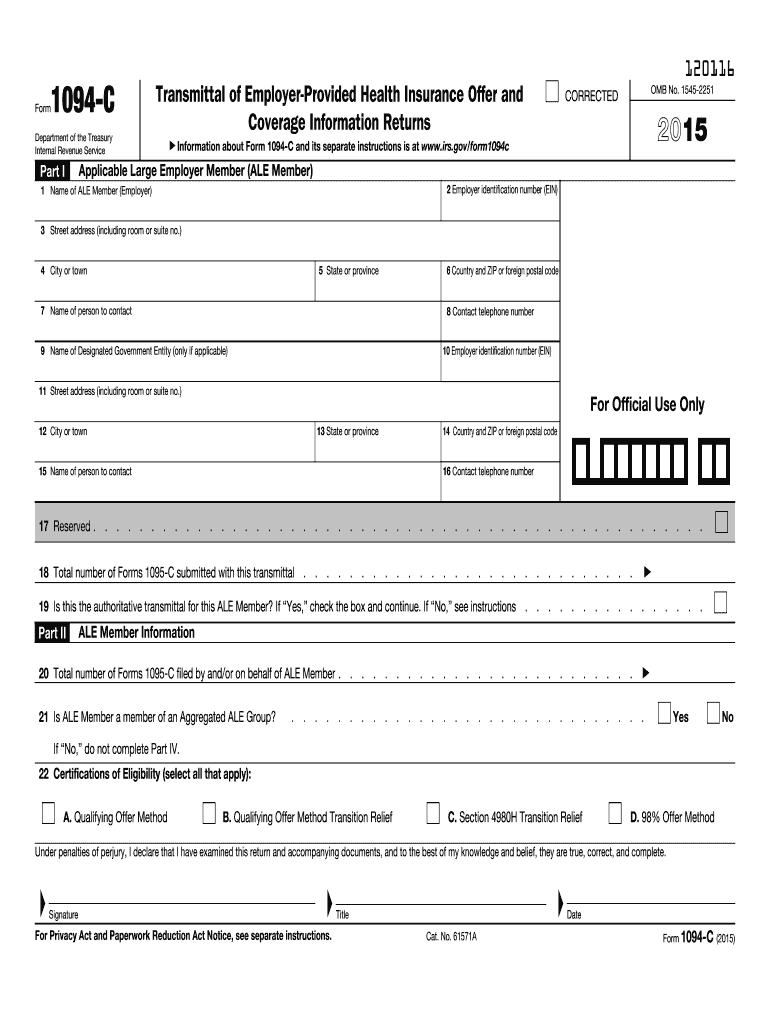

The 1094 C Form is a crucial document used by applicable large employers (ALEs) to report information about their health insurance coverage to the Internal Revenue Service (IRS). This form is part of the Affordable Care Act (ACA) requirements and serves as a transmittal form for the 1095 C Forms, which provide detailed information about each employee's health coverage. The 1094 C Form helps the IRS determine compliance with the ACA's employer mandate, ensuring that ALEs offer affordable health insurance to their full-time employees.

How to use the 1094 C Form

Using the 1094 C Form involves several key steps. First, employers must gather necessary data about their health insurance offerings and employee coverage. This includes information such as the number of full-time employees, the months during which coverage was available, and the type of health insurance plans offered. Once the data is collected, employers can complete the form, ensuring that all information is accurate and complete. After filling out the form, it must be submitted to the IRS along with the corresponding 1095 C Forms for each employee.

Steps to complete the 1094 C Form

Completing the 1094 C Form requires careful attention to detail. Here are the steps to follow:

- Gather Information: Collect data on your employees, including their health coverage details and the months they were covered.

- Fill Out the Form: Enter the required information in the appropriate fields, including your employer identification number (EIN) and the total number of 1095 C Forms being submitted.

- Review for Accuracy: Double-check all entries to ensure compliance with IRS guidelines and accuracy in reporting.

- Submit the Form: File the 1094 C Form electronically or by mail, along with the 1095 C Forms, by the designated deadline.

Legal use of the 1094 C Form

The legal use of the 1094 C Form is governed by IRS regulations under the Affordable Care Act. Employers must accurately report their health coverage to avoid penalties. Failure to file the form or providing incorrect information can result in fines. The form must be submitted annually, and it is essential for employers to maintain compliance with all applicable laws to ensure that their health insurance offerings meet the required standards.

Filing Deadlines / Important Dates

Filing deadlines for the 1094 C Form are critical for compliance. Typically, the forms must be submitted to the IRS by February twenty-eighth if filing by mail, or by March thirty-first if filing electronically. Employers should also be aware of the deadlines for distributing the 1095 C Forms to employees, which usually coincide with the IRS deadlines. Keeping track of these dates helps avoid potential penalties and ensures timely reporting.

Examples of using the 1094 C Form

Employers may encounter various scenarios where the 1094 C Form is necessary. For instance, a company with fifty or more full-time employees must file this form to report on the health coverage provided to its workforce. Another example includes an employer who offers multiple health plans; they must accurately represent each plan's coverage in the 1094 C Form and ensure that all employees receive their respective 1095 C Forms. These examples illustrate the form's importance in maintaining compliance with health insurance reporting requirements.

Quick guide on how to complete 2015 1094 c form

Complete 1094 C Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage 1094 C Form on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

The simplest way to modify and eSign 1094 C Form with ease

- Obtain 1094 C Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1094 C Form and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1094 c form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1094 c form

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is a 1094 C Form and why is it important?

The 1094 C Form is a crucial document used by Applicable Large Employers (ALEs) to report health insurance coverage to the IRS. This form summarizes the information provided on the 1095 C Forms, detailing the health coverage provided to employees. It is essential for compliance with the Affordable Care Act (ACA) and helps avoid potential penalties.

-

How can airSlate SignNow help with the 1094 C Form process?

airSlate SignNow streamlines the process of completing and submitting the 1094 C Form by allowing users to eSign documents quickly and securely. Our easy-to-use platform ensures that you can gather necessary signatures and approvals efficiently, reducing the time spent on paperwork. Plus, our solution is cost-effective, making it accessible for businesses of all sizes.

-

Is airSlate SignNow compliant with IRS regulations for the 1094 C Form?

Yes, airSlate SignNow is designed to comply with all IRS regulations regarding the 1094 C Form. Our platform utilizes secure encryption and follows best practices to ensure that your sensitive data remains protected. You can trust that your submissions will meet the necessary compliance requirements for IRS reporting.

-

What features does airSlate SignNow offer for managing 1094 C Forms?

airSlate SignNow offers several features tailored to managing the 1094 C Form, including customizable templates, robust eSignature capabilities, and real-time tracking of document status. Users can easily collaborate with team members and ensure that all necessary information is included before submission. Additionally, our platform integrates seamlessly with various software solutions to enhance productivity.

-

Can I integrate airSlate SignNow with my existing HR software for 1094 C Form submissions?

Absolutely! airSlate SignNow integrates with a variety of HR and payroll systems, making it easy to manage the 1094 C Form alongside your existing workflows. This integration reduces the manual entry of data and ensures that information is consistent across platforms. Enhance your document management process with our flexible integration options.

-

What is the pricing structure for using airSlate SignNow for the 1094 C Form?

airSlate SignNow offers competitive pricing plans tailored to suit businesses of all sizes, making it affordable for managing the 1094 C Form. Our plans include various features such as unlimited eSignatures, document templates, and integrations, ensuring you get the best value. Visit our website to compare pricing options and find the plan that fits your needs.

-

How secure is the information submitted via airSlate SignNow for the 1094 C Form?

Security is a top priority for airSlate SignNow. We employ advanced encryption protocols to protect all data submitted through our platform, including the 1094 C Form. Our compliance with industry standards ensures that sensitive information remains confidential and secure throughout the entire signing process.

Get more for 1094 C Form

- Electronic filing guide for the quarterly wage and edd form

- Form dof 1 change of business information printable pdf

- Pdf 30811991 nycgov form

- Form ukm application for registration as a british govuk

- Bereavement benefits claim bformb govuk

- Ap 201 texas application for texas sales and use tax permit form ap 201

- Trs forms teacher retirement system

- Home plymouthgovuk form

Find out other 1094 C Form

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy