1094 C 2023

What is the 1094 C?

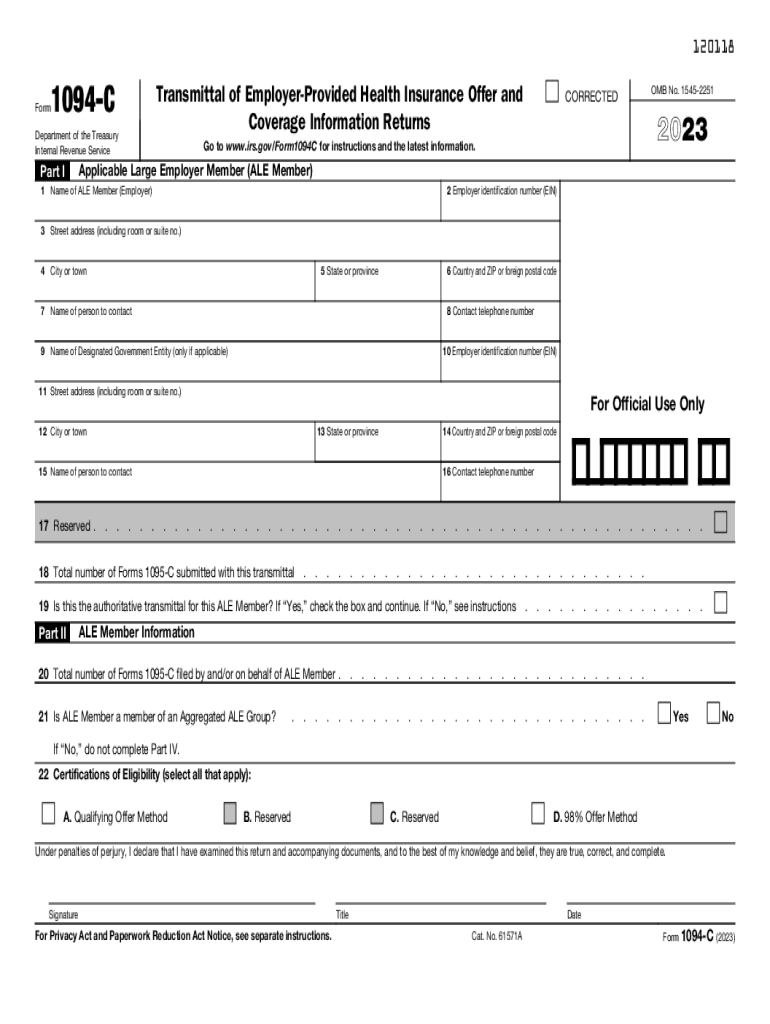

The 1094 C is a crucial form used for reporting employer-provided health insurance coverage under the Affordable Care Act (ACA). It serves as a transmittal form that summarizes information reported on the 1095 C forms, which detail the health coverage offered to employees. Employers with fifty or more full-time employees or equivalents must file this form with the IRS to demonstrate compliance with the ACA's employer mandate. Understanding the 1094 C is essential for businesses to ensure they meet federal requirements and avoid potential penalties.

Key elements of the 1094 C

The 1094 C contains several key elements that employers must accurately complete. These include:

- Employer Information: This section requires the employer's name, address, and Employer Identification Number (EIN).

- Applicable Large Employer (ALE) Status: Employers must indicate whether they qualify as an ALE based on their workforce size.

- Summary of Health Coverage: This part summarizes the total number of 1095 C forms being submitted and the number of full-time employees.

- Contact Information: Employers must provide contact details for someone who can answer questions about the form.

Accurate completion of these elements is vital for compliance and to avoid IRS penalties.

Steps to complete the 1094 C

Completing the 1094 C involves several important steps:

- Gather Required Information: Collect all necessary data, including employee health coverage details and employer identification numbers.

- Fill Out the Form: Carefully enter the required information in each section of the 1094 C, ensuring accuracy.

- Review for Errors: Double-check the form for any mistakes or omissions that could lead to complications.

- Submit the Form: File the completed 1094 C with the IRS by the designated deadline, either electronically or by mail.

Following these steps will help ensure a smooth filing process and compliance with ACA regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 1094 C are crucial for compliance. Generally, employers must submit the form by:

- February 28: If filing by paper.

- March 31: If filing electronically.

Employers should also be aware of any extensions that may apply, as well as the importance of timely filing to avoid penalties. Keeping track of these dates is essential for maintaining compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1094 C. These guidelines include:

- Instructions on how to fill out each section of the form.

- Details on the filing process, including electronic filing requirements.

- Information on penalties for non-compliance and how to avoid them.

Employers should familiarize themselves with these guidelines to ensure accurate and timely submissions, helping to mitigate any risks associated with non-compliance.

Penalties for Non-Compliance

Failure to file the 1094 C accurately or on time can result in significant penalties. The IRS may impose fines for each form that is late or incorrect. The penalties can vary based on the size of the employer and the length of the delay. Understanding these penalties is essential for employers to prioritize compliance and avoid unnecessary costs.

Quick guide on how to complete 1094 c

Complete 1094 C easily on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle 1094 C across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign 1094 C with ease

- Find 1094 C and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign 1094 C and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1094 c

Create this form in 5 minutes!

How to create an eSignature for the 1094 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1095 C codes and why are they important?

1095 C codes are essential for reporting health coverage under the Affordable Care Act. They help employers, and the IRS track compliance and coverage provided to employees. Understanding 1095 C codes is vital for ensuring accurate reporting and avoiding potential penalties.

-

How does airSlate SignNow assist with 1095 C forms?

airSlate SignNow streamlines the process of filling out and eSigning 1095 C forms. Our platform allows for efficient document management, which helps eliminate errors and ensure timely submission. This makes understanding and utilizing 1095 C codes easier for employers.

-

Are there any costs associated with using airSlate SignNow for 1095 C forms?

Yes, airSlate SignNow offers various pricing plans based on your business needs, making it a flexible solution for managing 1095 C forms. Each plan provides valuable features, ensuring that you can match your requirements while efficiently handling your 1095 C codes. Detailed pricing information can be found on our website.

-

What features does airSlate SignNow offer to simplify the 1095 C process?

airSlate SignNow provides features such as templates for 1095 C forms, automated reminders, and secure eSigning capabilities. These features not only simplify the preparation of 1095 C codes but also enhance compliance and improve accuracy. Our platform is designed for ease of use, catering to all types of businesses.

-

Can airSlate SignNow integrate with other software to manage 1095 C codes?

Absolutely, airSlate SignNow offers integrations with popular HR software and other applications. This allows for seamless data transfer when dealing with 1095 C forms and codes, enhancing efficiency in your document management process. Integration simplifies understanding how to apply 1095 C codes within your existing systems.

-

How secure is airSlate SignNow when handling 1095 C forms?

Security is a top priority at airSlate SignNow, especially when processing sensitive documents like 1095 C forms. Our platform uses encryption and secure access controls to protect your data. Understanding 1095 C codes is important, but maintaining confidentiality while doing so is crucial.

-

What are the benefits of using airSlate SignNow for 1095 C codes?

Using airSlate SignNow for 1095 C codes offers several benefits, including time savings, reduced paperwork, and improved compliance accuracy. Our platform’s intuitive interface makes understanding and managing 1095 C codes straightforward for users. This ultimately helps streamline your workflow and lessen the administrative burden.

Get more for 1094 C

- Dubois area high s community service time sheet dasd k12 pa form

- Shift availability form

- Ob10colgate form

- Nys barber apprentice application form

- Vehicular property damage claim form 100339033

- Right to remove contingency addendum louisiana form

- California fire protection district 610032805 form

- Transportation contract template form

Find out other 1094 C

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template