Form 1094 C 2016

What is the Form 1094 C

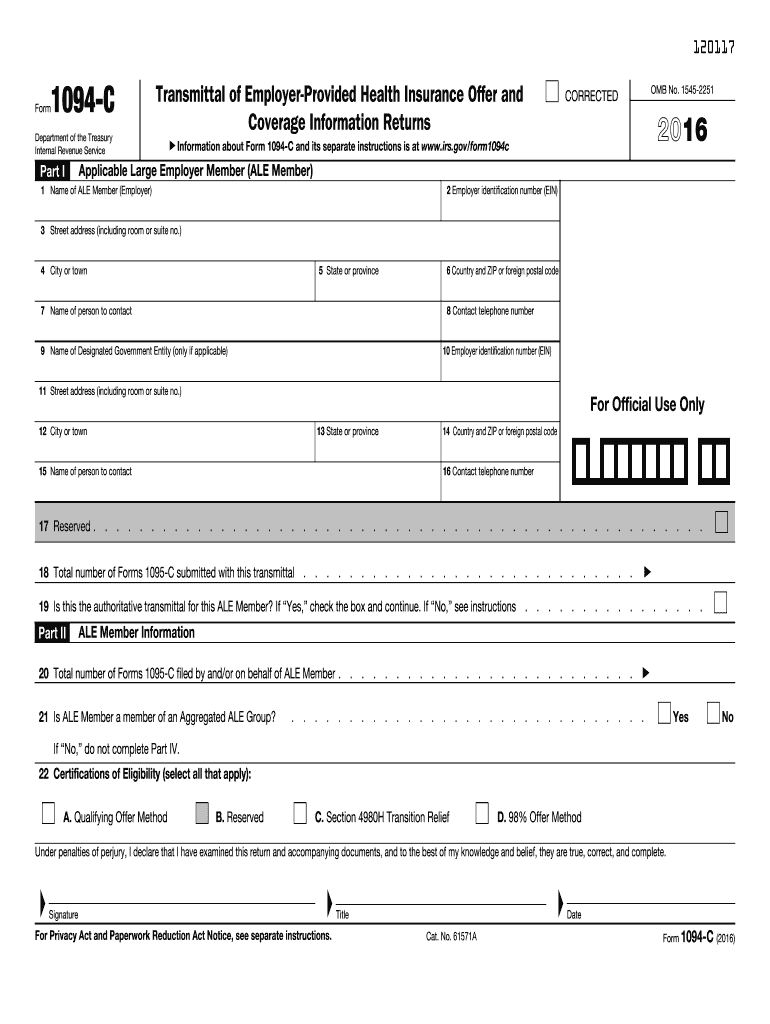

The Form 1094 C is a crucial document used by applicable large employers (ALEs) in the United States to report information about health insurance coverage offered to their employees. This form is part of the Affordable Care Act (ACA) reporting requirements and provides the Internal Revenue Service (IRS) with details on the health coverage provided, including the number of full-time employees and the months during which coverage was available. Completing this form accurately is essential for compliance with federal regulations and to avoid potential penalties.

How to use the Form 1094 C

Using the Form 1094 C involves several steps to ensure accurate reporting. Employers must first determine if they qualify as an applicable large employer, which generally means having fifty or more full-time employees, including full-time equivalent employees. Once eligibility is established, employers can gather necessary data regarding health insurance offerings and employee counts. The form must be completed with precise information, including the employer's details, the number of employees, and the type of health coverage provided. After completion, the form is submitted to the IRS as part of the ACA reporting process.

Steps to complete the Form 1094 C

Completing the Form 1094 C requires a systematic approach. Begin by collecting all relevant employee data, including full-time status and health coverage details. Next, fill out the form by entering the employer's information in the designated sections. Ensure that you accurately report the total number of full-time employees and any offers of health coverage. Review the form for any errors or omissions, as inaccuracies can lead to compliance issues. Finally, submit the completed form to the IRS, either electronically or by mail, depending on the number of forms being filed.

Legal use of the Form 1094 C

The legal use of the Form 1094 C is governed by the IRS regulations under the Affordable Care Act. Employers are required to file this form to demonstrate compliance with health coverage mandates. Failure to file the form or providing incorrect information can result in penalties. It is important for employers to understand the legal implications of the form and ensure that all information reported is accurate and complete. Utilizing a reliable electronic signature solution can enhance the legal validity of the form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1094 C are critical for compliance. Generally, the form must be filed annually, with the deadline typically falling on February twenty-eighth for paper submissions and March thirty-first for electronic submissions. Employers should keep track of these dates to avoid penalties. It is advisable to start preparing the form well in advance of the deadline to ensure all necessary information is gathered and accurately reported.

Penalties for Non-Compliance

Non-compliance with Form 1094 C filing requirements can result in significant penalties. The IRS imposes fines for failing to file the form or for filing incorrect information. These penalties can accumulate quickly, especially for larger employers. Understanding the potential consequences of non-compliance emphasizes the importance of accurate and timely filing. Employers should regularly review their reporting practices to ensure they meet all legal obligations associated with the Form 1094 C.

Quick guide on how to complete 2016 form 1094 c

Effortlessly Manage Form 1094 C on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it on the web. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Handle Form 1094 C on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and eSign Form 1094 C with Ease

- Locate Form 1094 C and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Formulate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to deliver your form, be it via email, text message (SMS), or link invitation, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1094 C while ensuring outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1094 c

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1094 c

How to generate an eSignature for your 2016 Form 1094 C in the online mode

How to make an eSignature for the 2016 Form 1094 C in Chrome

How to make an eSignature for signing the 2016 Form 1094 C in Gmail

How to make an eSignature for the 2016 Form 1094 C straight from your smart phone

How to make an eSignature for the 2016 Form 1094 C on iOS

How to generate an eSignature for the 2016 Form 1094 C on Android OS

People also ask

-

What is Form 1094 C and why is it important?

Form 1094 C is a crucial document used by applicable large employers to report their health coverage offerings to the IRS. Understanding the details of Form 1094 C is essential for compliance with the Affordable Care Act (ACA) and helps businesses avoid penalties. Using a reliable eSignature solution like airSlate SignNow can streamline the data collection and submission process for Form 1094 C.

-

How can airSlate SignNow assist with completing Form 1094 C?

airSlate SignNow provides an intuitive platform that allows businesses to easily fill out and eSign Form 1094 C digitally. With customizable templates and automated workflows, users can ensure that all necessary information is included and accurately reported. This not only saves time but also reduces the risk of errors in your Form 1094 C submissions.

-

Is there a cost associated with using airSlate SignNow for Form 1094 C?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including those specifically for managing documents like Form 1094 C. Our affordable pricing ensures that businesses of all sizes can access the tools necessary for efficient document management and compliance. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer to simplify Form 1094 C management?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage to manage Form 1094 C effectively. These tools help streamline the process of gathering signatures and storing completed forms securely. Additionally, the platform ensures that your data is kept safe and compliant with industry standards.

-

Can I integrate airSlate SignNow with other software for Form 1094 C processing?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing the efficiency of your Form 1094 C processing. Whether you're using HR software, accounting tools, or other document management systems, our integrations allow for smooth data transfer and improved workflow management.

-

What benefits can businesses expect from using airSlate SignNow for Form 1094 C?

By utilizing airSlate SignNow for Form 1094 C, businesses can expect increased efficiency and accuracy in their reporting processes. The platform's eSignature capabilities eliminate the need for physical paperwork, saving both time and resources. Additionally, the user-friendly interface ensures that all team members can easily navigate the platform.

-

How does airSlate SignNow ensure the security of Form 1094 C data?

airSlate SignNow prioritizes the security of your data, employing advanced encryption and security protocols to protect sensitive information related to Form 1094 C. Our platform is compliant with various regulations, ensuring that your data is safe from unauthorized access. You can trust airSlate SignNow to handle your documentation securely.

Get more for Form 1094 C

Find out other Form 1094 C

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast