Www Irs Govforms Pubsabout Schedule a Form 1040About Schedule a Form 1040, Itemized Deductions IRS Tax Forms 2020

Understanding Schedule A Form 1040

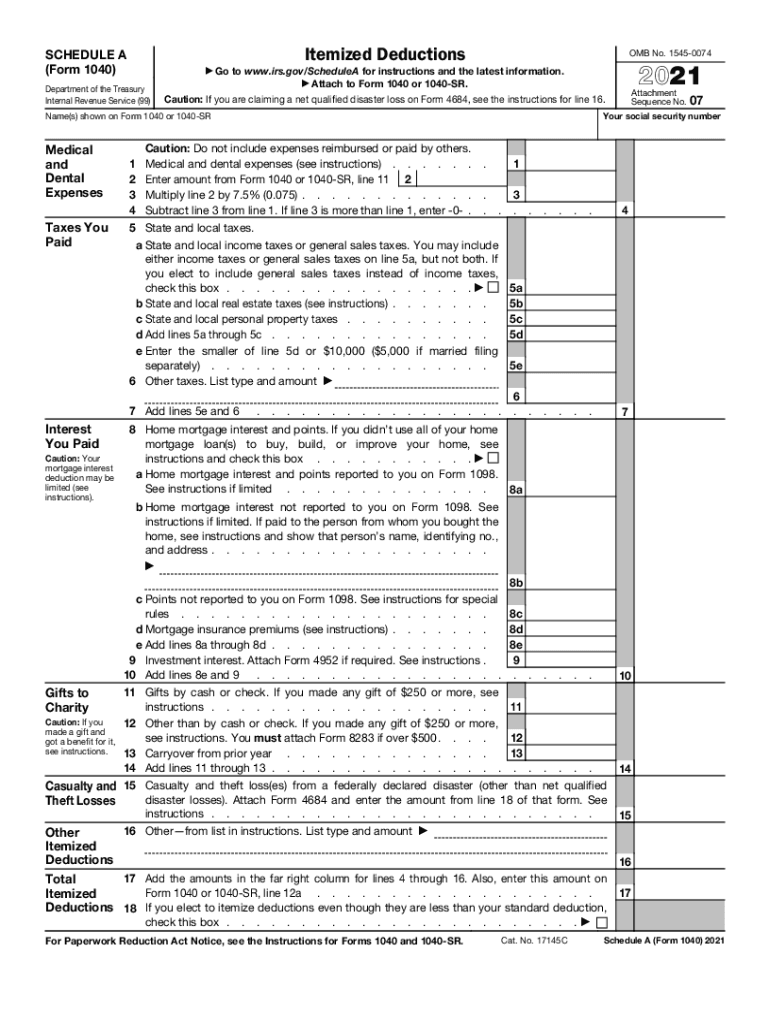

The Schedule A Form 1040 is a crucial component for taxpayers who choose to itemize their deductions instead of taking the standard deduction. This form allows individuals to report various deductible expenses, which can significantly lower their taxable income. Common deductions reported on Schedule A include medical expenses, state and local taxes, mortgage interest, and charitable contributions. By accurately filling out this form, taxpayers can maximize their potential tax savings.

Steps to Complete Schedule A Form 1040

Completing the Schedule A Form 1040 involves several key steps:

- Gather Documentation: Collect all relevant receipts and documents that support your deductions, such as medical bills, mortgage statements, and charitable donation receipts.

- Fill Out Personal Information: Enter your name, Social Security number, and other identifying information at the top of the form.

- Report Deductions: Carefully fill in each section of the form, detailing your itemized deductions. Be sure to follow the instructions for each category.

- Calculate Total Deductions: Sum up all your deductions to find your total itemized deductions, which will be transferred to your Form 1040.

- Review for Accuracy: Double-check your entries for any errors or omissions before submitting the form.

Key Elements of Schedule A Form 1040

Schedule A includes several important sections that taxpayers must complete:

- Medical and Dental Expenses: This section allows you to report unreimbursed medical expenses that exceed a certain percentage of your adjusted gross income.

- Taxes You Paid: Here, you can list state and local taxes, including real estate taxes and personal property taxes.

- Interest You Paid: This section is for reporting mortgage interest and points paid on a mortgage.

- Gifts to Charity: You can report cash and non-cash contributions to qualified charitable organizations.

- Other Itemized Deductions: This includes miscellaneous deductions such as unreimbursed employee expenses and tax preparation fees.

Legal Use of Schedule A Form 1040

Filing Schedule A Form 1040 is legally binding when completed accurately and submitted according to IRS guidelines. It is essential to ensure that all reported deductions comply with current tax laws and regulations. Inaccurate or fraudulent reporting can lead to penalties, including fines and interest on unpaid taxes. Therefore, maintaining thorough records and understanding the legal implications of the deductions claimed is vital.

Filing Deadlines for Schedule A Form 1040

The deadline for filing Schedule A Form 1040 coincides with the standard tax return deadline, which is typically April 15 of each year. If you require additional time to prepare your return, you may file for an extension, which grants an additional six months. However, it is important to note that any taxes owed are still due by the original deadline to avoid penalties and interest.

Eligibility Criteria for Using Schedule A Form 1040

To use Schedule A Form 1040, taxpayers must meet certain eligibility criteria. Primarily, you must choose to itemize your deductions rather than take the standard deduction. This option is typically more beneficial for individuals with significant deductible expenses. Additionally, certain taxpayers, such as those married filing separately, may face limitations on specific deductions. Understanding your financial situation will help determine whether itemizing is advantageous.

Quick guide on how to complete wwwirsgovforms pubsabout schedule a form 1040about schedule a form 1040 itemized deductions irs tax forms

Accomplish Www irs govforms pubsabout schedule a form 1040About Schedule A Form 1040, Itemized Deductions IRS Tax Forms effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the right form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Www irs govforms pubsabout schedule a form 1040About Schedule A Form 1040, Itemized Deductions IRS Tax Forms on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to modify and eSign Www irs govforms pubsabout schedule a form 1040About Schedule A Form 1040, Itemized Deductions IRS Tax Forms with ease

- Obtain Www irs govforms pubsabout schedule a form 1040About Schedule A Form 1040, Itemized Deductions IRS Tax Forms and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Formulate your signature through the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious searching for forms, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Revise and eSign Www irs govforms pubsabout schedule a form 1040About Schedule A Form 1040, Itemized Deductions IRS Tax Forms to ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovforms pubsabout schedule a form 1040about schedule a form 1040 itemized deductions irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovforms pubsabout schedule a form 1040about schedule a form 1040 itemized deductions irs tax forms

The way to create an e-signature for your PDF in the online mode

The way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to the 2012 schedule a?

airSlate SignNow is an electronic signature solution that enables businesses to send and eSign documents efficiently. With features designed for ease of use, it streamlines the process to 2012 schedule a, ensuring quick turnaround times for important documents.

-

What are the pricing plans for airSlate SignNow for users looking to 2012 schedule a?

airSlate SignNow offers competitive pricing plans tailored for various business needs. Whether you’re an individual or part of a larger organization, you can find a plan that accommodates your requirements for 2012 schedule a, helping you manage document workflows effectively.

-

How does airSlate SignNow improve the efficiency of 2012 schedule a?

By implementing airSlate SignNow for your document processes, you can signNowly enhance efficiency when it comes to 2012 schedule a. The platform allows for real-time collaboration and quick access to necessary documents, resulting in faster approvals and reduced turnaround times.

-

What features does airSlate SignNow provide that support 2012 schedule a?

airSlate SignNow includes features such as customizable templates, workflow automation, and secure cloud storage, all of which facilitate easy management of 2012 schedule a. These features ensure that your documents are easily accessible and can be signed quickly, saving valuable time.

-

Can airSlate SignNow integrate with other software tools for managing 2012 schedule a?

Yes, airSlate SignNow offers integrations with various software tools, making it easy to manage 2012 schedule a alongside your existing systems. This flexibility allows businesses to streamline their workflows and ensure cohesive handling of document-related tasks.

-

What security measures are in place for the 2012 schedule a processes through airSlate SignNow?

airSlate SignNow prioritizes security with features like encryption, secure access controls, and compliance with regulatory standards. Your documents involved in the 2012 schedule a process are protected, ensuring that sensitive information remains confidential during the entire signing process.

-

How can I get started with a free trial to explore 2012 schedule a features in airSlate SignNow?

You can easily sign up for a free trial on the airSlate SignNow website to explore features related to 2012 schedule a. This trial provides you with hands-on experience in sending and managing documents, allowing you to see how the platform can benefit your organization.

Get more for Www irs govforms pubsabout schedule a form 1040About Schedule A Form 1040, Itemized Deductions IRS Tax Forms

Find out other Www irs govforms pubsabout schedule a form 1040About Schedule A Form 1040, Itemized Deductions IRS Tax Forms

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document