Form 1099 a Acquisition or Abandonment of Secured Property 2021

What is the Form 1099 A Acquisition Or Abandonment Of Secured Property

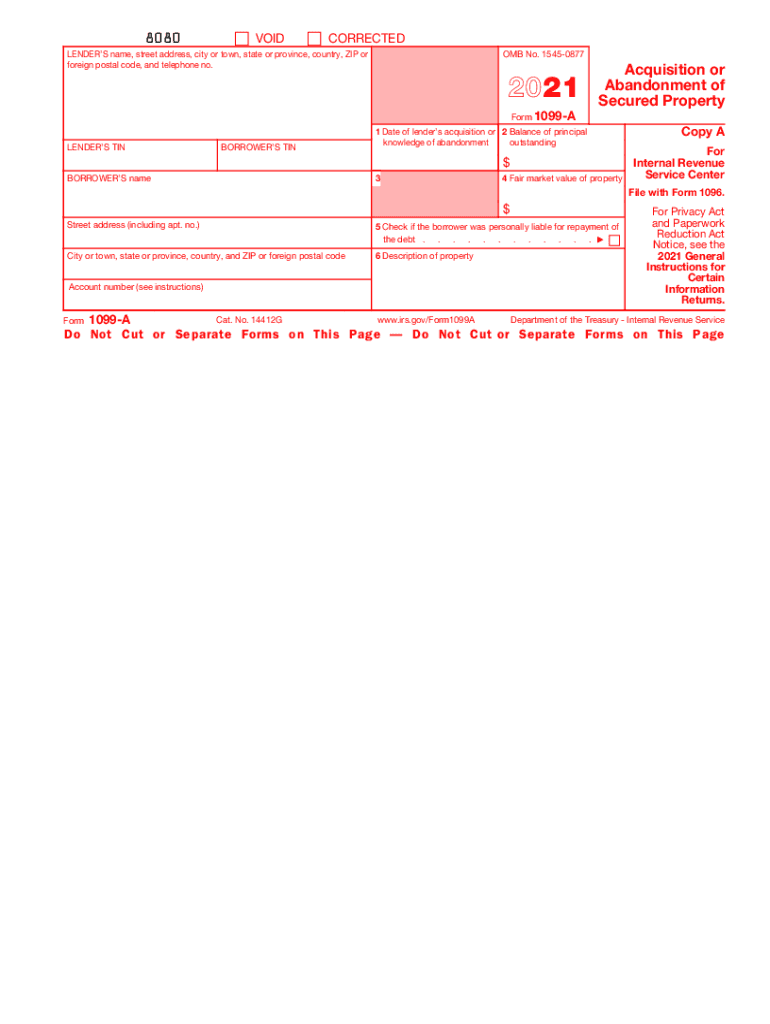

The Form 1099 A, officially known as the Acquisition or Abandonment of Secured Property, is a tax document used in the United States to report the acquisition or abandonment of property that is secured by a loan. This form is primarily utilized by lenders when a borrower defaults on a loan and the lender takes possession of the property. The information reported on this form is essential for both the lender and the borrower, as it helps determine potential tax implications related to the property.

Key elements of the Form 1099 A Acquisition Or Abandonment Of Secured Property

The Form 1099 A includes several important elements that must be accurately completed. Key components include:

- Borrower's Information: This section captures the name, address, and taxpayer identification number of the borrower.

- Lender's Information: Similar to the borrower's section, this captures the lender's details, including their name and taxpayer identification number.

- Property Description: This includes the address of the property and a description of the secured property.

- Date of Acquisition or Abandonment: The date on which the lender acquired the property or the date it was abandoned.

- Balance of Principal Outstanding: The remaining balance on the loan at the time of acquisition or abandonment.

How to use the Form 1099 A Acquisition Or Abandonment Of Secured Property

Using the Form 1099 A involves several steps. Lenders must complete the form when they take possession of the secured property. The completed form is then sent to the IRS and a copy is provided to the borrower. This allows the borrower to report any potential gain or loss on their tax return. It is crucial for both parties to retain copies of the form for their records, as it may be needed for future tax filings or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 A are typically aligned with other 1099 forms. Lenders must submit the form to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. Additionally, borrowers should receive their copies by January 31 of the following tax year to ensure timely reporting on their tax returns. Keeping track of these dates is essential for compliance and to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 1099 A or providing incorrect information can lead to penalties imposed by the IRS. These penalties can vary based on how late the form is filed and whether the failure to file was intentional. Lenders should ensure that they accurately complete and submit the form to avoid any potential fines or legal issues. Understanding the implications of non-compliance is critical for both lenders and borrowers.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 1099 A. Lenders must adhere to these guidelines to ensure proper reporting and compliance. This includes understanding the circumstances under which the form is required, how to accurately report the information, and the importance of timely submission. Familiarity with these guidelines can help prevent errors and ensure that all parties meet their tax obligations.

Quick guide on how to complete 2021 form 1099 a acquisition or abandonment of secured property

Complete Form 1099 A Acquisition Or Abandonment Of Secured Property seamlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without interruptions. Manage Form 1099 A Acquisition Or Abandonment Of Secured Property on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 1099 A Acquisition Or Abandonment Of Secured Property effortlessly

- Find Form 1099 A Acquisition Or Abandonment Of Secured Property and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to secure your updates.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new versions. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 1099 A Acquisition Or Abandonment Of Secured Property to guarantee superior communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1099 a acquisition or abandonment of secured property

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1099 a acquisition or abandonment of secured property

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an e-signature for a PDF on Android OS

People also ask

-

What is a 1099 form and who needs it?

A 1099 form is a tax document used to report income other than wages, salaries, or tips. Independent contractors, freelancers, or anyone who receives payments for services or interest must typically receive a 1099 form from the payer. Understanding what a 1099 form is can help ensure that all income is properly reported to the IRS.

-

How do I know if I should send a 1099 form?

You should send a 1099 form if you have paid someone $600 or more for services in a given tax year. This includes various payments such as rents, prizes, and awards. Clarifying what a 1099 form is will help you meet tax obligations and avoid penalties.

-

What features does airSlate SignNow offer for managing 1099 forms?

airSlate SignNow streamlines the process of sending and signing 1099 forms with features like eSignature, document templates, and real-time tracking. Our platform ensures that your forms are legally binding and compliant. By using airSlate SignNow, you can manage what a 1099 form efficiently and increase productivity.

-

Is there a cost associated with using airSlate SignNow for 1099 forms?

Yes, airSlate SignNow does have subscription plans that vary based on your business needs and the number of users. However, the platform offers exceptional value by saving you time and ensuring that your 1099 forms are processed smoothly. Understanding what a 1099 form entails can help you gauge the importance of investing in our solution.

-

Can I integrate airSlate SignNow with other accounting software for 1099 forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy for you to manage what a 1099 form is within your financial ecosystem. This integration ensures that all your financial documents, including 1099 forms, are unified for easier access and management.

-

What benefits does airSlate SignNow provide for digital 1099 forms?

By using airSlate SignNow for digital 1099 forms, you benefit from reduced turnaround times, enhanced security, and the convenience of online access. This means you can send, sign, and store your forms all in one place. Learning what a 1099 form is through airSlate SignNow enhances your workflow and compliance efforts.

-

What steps can I take to fill out a 1099 form using airSlate SignNow?

To fill out a 1099 form using airSlate SignNow, you start by selecting a template or uploading your document. Then, simply input the necessary information, sign, and send it directly from the platform. Knowing what a 1099 form is will guide you through each step to ensure accurate completion and submission.

Get more for Form 1099 A Acquisition Or Abandonment Of Secured Property

- Renovation contractor package georgia form

- Concrete mason contractor package georgia form

- Demolition contractor package georgia form

- Security contractor package georgia form

- Insulation contractor package georgia form

- Paving contractor package georgia form

- Site work contractor package georgia form

- Siding contractor package georgia form

Find out other Form 1099 A Acquisition Or Abandonment Of Secured Property

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word