1099 a Form 2015

What is the 1099 A Form

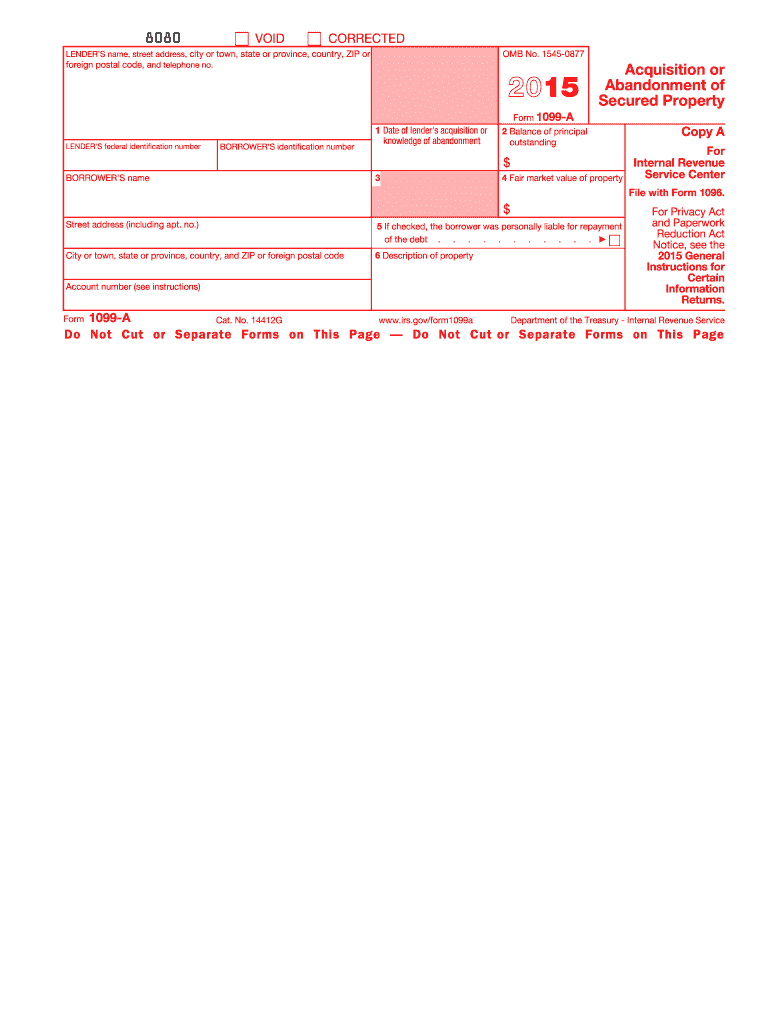

The 1099 A Form, officially known as the Acquisition or Abandonment of Secured Property, is a tax document used in the United States. It is primarily utilized by lenders to report the acquisition or abandonment of property that secures a loan. This form is essential for both borrowers and lenders, as it provides critical information regarding the status of secured property, which can impact tax liabilities and financial reporting.

How to use the 1099 A Form

The 1099 A Form is used to report specific financial transactions related to secured property. Borrowers should receive this form from their lender if they have abandoned property or if the lender has acquired it. The form includes important details such as the date of acquisition, the fair market value of the property, and any outstanding debt. Borrowers must use this information when filing their taxes, as it may affect their capital gains or losses.

Steps to complete the 1099 A Form

Completing the 1099 A Form involves several steps. First, ensure that you have the correct form, which can be obtained from the IRS website or your lender. Next, fill in the required fields, including your name, address, and taxpayer identification number. Provide details about the property, including its description, acquisition date, and fair market value. Finally, review the form for accuracy before submitting it to the IRS.

Key elements of the 1099 A Form

The 1099 A Form contains several key elements that are crucial for accurate reporting. These include:

- Borrower Information: Name, address, and taxpayer identification number.

- Property Description: Details about the secured property.

- Acquisition Date: The date when the property was acquired or abandoned.

- Fair Market Value: The value of the property at the time of acquisition.

- Outstanding Debt: Any remaining debt associated with the property.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 1099 A Form. It is important to follow these guidelines to ensure compliance and avoid penalties. The form must be submitted to the IRS by the deadline, which is typically January 31 of the year following the transaction. Additionally, copies of the form should be provided to the borrower for their records.

Penalties for Non-Compliance

Failure to file the 1099 A Form or inaccuracies in reporting can result in penalties imposed by the IRS. These penalties can vary based on the severity of the non-compliance, including fines for late filing or failure to provide accurate information. It is crucial for lenders and borrowers to understand their responsibilities regarding this form to avoid potential financial repercussions.

Quick guide on how to complete 1099 a 2015 form

Effortlessly Prepare 1099 A Form on Any Gadget

Managing documents online has gained traction among enterprises and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed paperwork, allowing you to obtain the required form and store it securely online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle 1099 A Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to modify and eSign 1099 A Form with ease

- Locate 1099 A Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that task.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced files, the hassle of searching for forms, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 1099 A Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 a 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 a 2015 form

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is a 1099 A Form and when do I need it?

The 1099 A Form is a tax document used to report the acquisition or abandonment of secured property. You typically need this form when you have sold or forfeited property that was secured by a loan. Understanding when to use the 1099 A Form can help ensure you comply with IRS requirements.

-

How can airSlate SignNow help with the 1099 A Form?

airSlate SignNow offers an efficient way to create, send, and eSign your 1099 A Form. With our user-friendly interface, you can streamline the process of preparing tax documents, ensuring that everything is completed accurately and on time. Our platform makes it simple to manage all your eSignatures and document workflows.

-

Is airSlate SignNow a cost-effective solution for managing the 1099 A Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible and competitive, allowing you to efficiently manage your document needs, including the 1099 A Form, without breaking the bank. You can easily scale your usage as your business grows.

-

What features does airSlate SignNow include for handling the 1099 A Form?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and real-time tracking for the 1099 A Form. These features help ensure that your documents are not only legally binding but also tracked and managed efficiently throughout the signing process. You can also integrate with other tools to enhance your workflow.

-

Can I integrate airSlate SignNow with my accounting software for 1099 A Form management?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software platforms, making it easy to manage your 1099 A Form alongside your financial records. This integration helps streamline your workflow and ensures that all your documentation is synced and up-to-date.

-

What are the benefits of using airSlate SignNow for 1099 A Form eSigning?

Using airSlate SignNow for 1099 A Form eSigning provides numerous benefits, including increased efficiency and reduced turnaround times. With our secure eSignature technology, you can ensure that your forms are signed quickly and legally, while also reducing the need for paper documents, which is better for the environment.

-

How does airSlate SignNow ensure the security of my 1099 A Form?

airSlate SignNow prioritizes the security of your documents, including the 1099 A Form, by implementing advanced encryption and authentication protocols. Our platform is compliant with industry standards, ensuring that your sensitive information is protected throughout the document signing process. You can trust us with your important tax documents.

Get more for 1099 A Form

- Blue cross blue shield of michigan southfield member application for payment consideration form

- Oakland county medical control authority table of contents form

- Disabled dependent application for state health plan bcbsm and blue care network members disabled dependent application for form

- Win by losing meal plan checklist flier form

- State health plan incapacitated dependent application guideleines and instructions state health plan incapacitated dependent form

- Dhs 3876 form

- Respiratory and asbestos questionnaire for occupational health form

- Consent respiratory asbestos questionnaire for occupational medicine form

Find out other 1099 A Form

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document