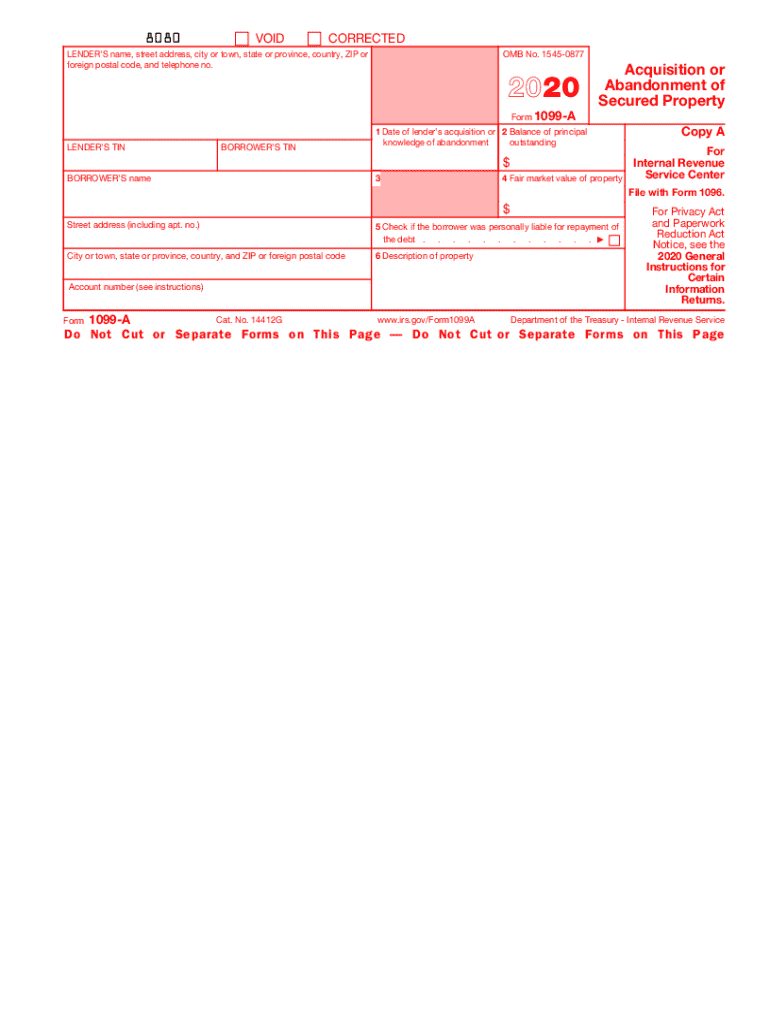

Form 1099 a Acquisition or Abandonment of Secured Property 2020

What is the Form 1099 A Acquisition Or Abandonment Of Secured Property

The Form 1099 A, officially known as the Acquisition or Abandonment of Secured Property, is a tax document used in the United States. It is primarily issued by lenders when a borrower has either acquired or abandoned property that is secured by a loan. This form provides essential information regarding the property in question, including the date of acquisition or abandonment, the fair market value of the property, and the outstanding balance on the loan at the time of the event. Understanding this form is crucial for accurately reporting any potential tax implications related to the acquisition or abandonment of secured property.

How to Use the Form 1099 A Acquisition Or Abandonment Of Secured Property

Using the Form 1099 A involves several steps to ensure accurate reporting on your tax return. First, you should receive the form from your lender if applicable. Review the details carefully, noting the fair market value and any outstanding loan balances. If you abandoned the property, this form will assist in reporting any potential losses on your tax return. When filing your taxes, include the information from the 1099 A in the appropriate sections to reflect any gain or loss from the property in question. It is advisable to consult a tax professional if you have questions about how this form affects your tax situation.

Steps to Complete the Form 1099 A Acquisition Or Abandonment Of Secured Property

Completing the Form 1099 A requires careful attention to detail. Here are the steps to follow:

- Obtain the form from your lender or download it from the IRS website.

- Fill in the borrower's information, including name, address, and taxpayer identification number.

- Provide details about the property, including the date of acquisition or abandonment.

- Enter the fair market value of the property at the time of the event.

- List the outstanding balance of the loan at the time of acquisition or abandonment.

- Review the completed form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 1099 A. It is essential to follow these guidelines to ensure compliance with tax regulations. The form must be filed by the lender, and copies should be provided to both the borrower and the IRS. The IRS requires that this form be filed for any property that has been acquired or abandoned during the tax year. Additionally, the information reported on the form must be consistent with the borrower’s tax return to avoid discrepancies that could lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 1099 A align with the general deadlines for tax documents. The lender must file the form with the IRS by January 31 of the year following the tax year in which the acquisition or abandonment occurred. Borrowers should receive their copy of the form by the same date, allowing them to incorporate the information into their tax returns. It is crucial to be aware of these deadlines to ensure timely compliance and avoid potential penalties.

Penalties for Non-Compliance

Failure to file Form 1099 A or inaccuracies in the information provided can result in penalties imposed by the IRS. Lenders may face fines for not submitting the form by the deadline or for providing incorrect information. The penalties can vary based on the severity and duration of the non-compliance. Borrowers should also be cautious, as failing to report information from the 1099 A on their tax returns could lead to audits or additional tax liabilities. It is advisable to keep accurate records and consult a tax professional if there are uncertainties regarding compliance.

Quick guide on how to complete 2020 form 1099 a acquisition or abandonment of secured property

Effortlessly Prepare Form 1099 A Acquisition Or Abandonment Of Secured Property on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without any holdups. Manage Form 1099 A Acquisition Or Abandonment Of Secured Property on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

Simplest way to edit and electronically sign Form 1099 A Acquisition Or Abandonment Of Secured Property effortlessly

- Find Form 1099 A Acquisition Or Abandonment Of Secured Property and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1099 A Acquisition Or Abandonment Of Secured Property and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1099 a acquisition or abandonment of secured property

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1099 a acquisition or abandonment of secured property

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form 1099A 2018 and why do I need it?

Form 1099A 2018 is used to report the acquisition or abandonment of secured property. It's essential for individuals and businesses involved in real estate transactions to accurately document the details for tax purposes.

-

How can airSlate SignNow help with Form 1099A 2018?

airSlate SignNow streamlines the process of preparing and eSigning Form 1099A 2018. With our easy-to-use interface, you can quickly fill out the form and send it for signature, ensuring compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for Form 1099A 2018?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business needs. Our cost-effective solution allows you to handle Form 1099A 2018 without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 1099A 2018?

With airSlate SignNow, you get robust features including eSigning, document management, and team collaboration to simplify the handling of Form 1099A 2018. These tools help you keep everything organized and accessible.

-

Can I integrate airSlate SignNow with other software for Form 1099A 2018?

Absolutely! airSlate SignNow integrates with a variety of software solutions, enabling you to seamlessly manage Form 1099A 2018 alongside other business applications. This functionality enhances your workflow and efficiency.

-

How secure is my data when using airSlate SignNow for Form 1099A 2018?

Your data security is our top priority. airSlate SignNow employs advanced encryption and security protocols to ensure that all information related to Form 1099A 2018 is protected against unauthorized access.

-

Do I need any training to use airSlate SignNow for Form 1099A 2018?

Not at all! airSlate SignNow is designed to be user-friendly, allowing you to get started quickly with Form 1099A 2018 without any extensive training. Our intuitive interface makes it easy for anyone to navigate.

Get more for Form 1099 A Acquisition Or Abandonment Of Secured Property

Find out other Form 1099 A Acquisition Or Abandonment Of Secured Property

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online