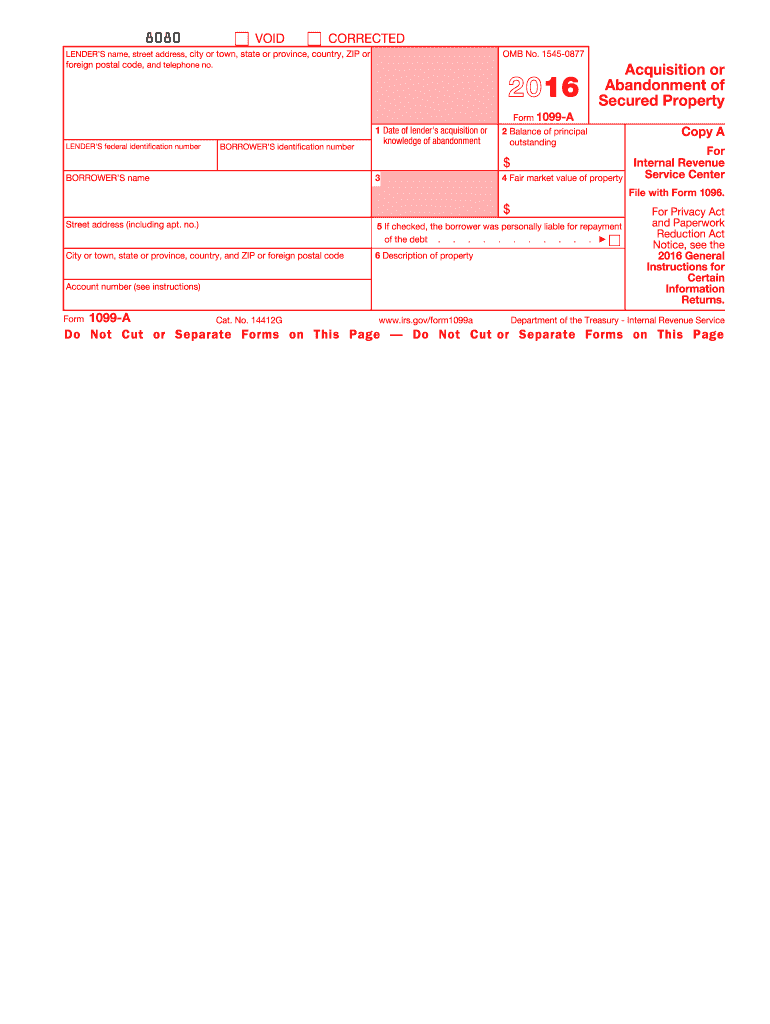

1099a Form 2016

What is the 1099A Form

The 1099A Form, officially known as the Acquisition or Abandonment of Secured Property, is a tax document used in the United States. It is primarily utilized by lenders to report the acquisition of property through foreclosure or abandonment. This form provides essential information regarding the property, including its fair market value and any outstanding debt at the time of acquisition. Understanding the 1099A Form is crucial for both lenders and borrowers, as it can impact tax obligations and financial reporting.

How to Use the 1099A Form

Using the 1099A Form involves several key steps. First, lenders must accurately fill out the form with details such as the borrower’s information, property description, and the amounts involved. Once completed, the lender must provide a copy to the borrower and submit it to the IRS. Borrowers may need this form when filing their taxes, as it can affect their tax liabilities. It is important for both parties to keep a copy for their records, as it serves as a formal record of the transaction.

Steps to Complete the 1099A Form

Completing the 1099A Form requires attention to detail to ensure accuracy. Here are the steps to follow:

- Gather necessary information, including the borrower's name, address, and taxpayer identification number.

- Provide details about the property, including its address and description.

- Enter the fair market value of the property at the time of acquisition.

- List any outstanding debt associated with the property.

- Review all entries for accuracy before submitting the form.

Legal Use of the 1099A Form

The legal use of the 1099A Form is governed by IRS regulations. It is essential for lenders to issue this form accurately to comply with tax laws. Failure to provide the 1099A Form when required can result in penalties for the lender. Additionally, borrowers should retain the form for their tax records, as it may be necessary for reporting income or losses related to the property. Understanding the legal implications of this form can help both parties navigate their tax responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines for the 1099A Form are crucial for compliance. Generally, lenders must provide the completed form to borrowers by January 31 of the year following the property acquisition. The form must also be submitted to the IRS by the same date. Missing these deadlines can lead to penalties, so it is important for lenders to stay organized and ensure timely submission. Keeping track of these dates can help avoid unnecessary complications during tax season.

Key Elements of the 1099A Form

The 1099A Form includes several key elements that are important for both lenders and borrowers. These elements include:

- The borrower's name and taxpayer identification number.

- The property address and description.

- The fair market value of the property at the time of acquisition.

- The outstanding debt amount associated with the property.

Each of these elements plays a significant role in accurately reporting the transaction and ensuring compliance with tax regulations.

Quick guide on how to complete 1099a 2016 form

Prepare 1099a Form effortlessly on any device

Digital document management has gained prominence among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, adjust, and eSign your documents quickly without hindrances. Handle 1099a Form on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The simplest way to modify and eSign 1099a Form seamlessly

- Find 1099a Form and click on Get Form to initiate.

- Utilize the features we offer to complete your document.

- Highlight essential parts of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate worries about missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your choice. Edit and eSign 1099a Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099a 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1099a 2016 form

How to make an electronic signature for the 1099a 2016 Form in the online mode

How to create an electronic signature for the 1099a 2016 Form in Google Chrome

How to generate an eSignature for signing the 1099a 2016 Form in Gmail

How to create an electronic signature for the 1099a 2016 Form straight from your smartphone

How to create an electronic signature for the 1099a 2016 Form on iOS devices

How to make an electronic signature for the 1099a 2016 Form on Android OS

People also ask

-

What is a 1099a Form and its purpose?

The 1099a Form is an important document used by the IRS to report the acquisition of property by a lender, specifically regarding mortgage loans. It serves to inform the taxpayer and the IRS about the details of the loan situation, ensuring proper reporting of income and potential tax implications.

-

How can airSlate SignNow help with the 1099a Form?

AirSlate SignNow offers an easy-to-use platform that allows users to create, send, and eSign the 1099a Form efficiently. With features like document templates and cloud storage, businesses can streamline their document management processes related to the 1099a Form.

-

Is there a cost associated with using airSlate SignNow for the 1099a Form?

AirSlate SignNow provides a cost-effective solution for managing documents, including the 1099a Form. Pricing plans are flexible and cater to different business sizes, ensuring you choose the right package that meets your needs without breaking the budget.

-

What features does airSlate SignNow offer for handling the 1099a Form?

With airSlate SignNow, you can enjoy features like customizable templates, electronic signatures, and secure document storage specifically tailored for the 1099a Form. These features simplify the signing process, making it faster and more efficient for all parties involved.

-

Can I integrate airSlate SignNow with other software for the 1099a Form?

Yes, airSlate SignNow seamlessly integrates with various software solutions, allowing you to manage your 1099a Form alongside your other tools. These integrations enhance workflow efficiency and ensure that all your document management needs are addressed.

-

What are the benefits of using airSlate SignNow for the 1099a Form?

Using airSlate SignNow for the 1099a Form provides several benefits, including time-saving automation, higher accuracy, and enhanced security. This user-friendly platform allows businesses to focus on their core operations while ensuring compliance and proper documentation of important forms.

-

How secure is airSlate SignNow when handling the 1099a Form?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance measures to safeguard your sensitive information, especially when handling the 1099a Form. Businesses can trust that their data is protected throughout the signing and storage processes.

Get more for 1099a Form

- Where can i get a pamd 22a form

- Certificate of plumbing compliance form 33

- Financial hardship assistance application vodafone form

- N10 declaration form

- Vp form application

- Reiq contract houses amp land reiq 3rd edition save on form

- Form 1257 2015 2019

- Human services profit and loss statement 2014 2019 form

Find out other 1099a Form

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT