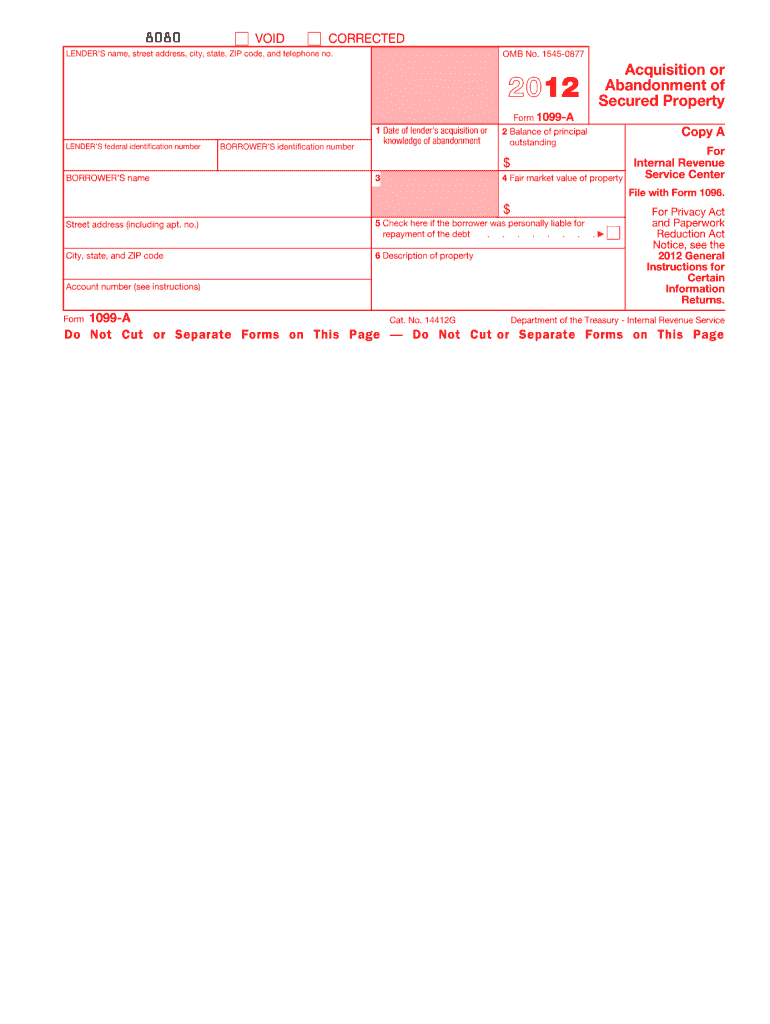

1099 a Form 2012

What is the 1099 A Form

The 1099 A Form, officially known as the Acquisition or Abandonment of Secured Property, is a tax form used in the United States. It is typically issued by lenders to report the acquisition or abandonment of property that is secured by a loan. This form is essential for taxpayers who have experienced a foreclosure or have abandoned a property that was financed through a secured loan. The information reported on this form helps the IRS determine the tax implications of such transactions.

How to use the 1099 A Form

Using the 1099 A Form involves several key steps. First, ensure that you receive the form from your lender if you have either acquired or abandoned secured property. Next, review the information provided on the form, which includes details about the property, the outstanding loan amount, and the fair market value of the property at the time of acquisition or abandonment. This information is crucial for accurately reporting your financial situation on your tax return. Finally, include the relevant details from the 1099 A Form when filing your taxes, as it may affect your taxable income and potential deductions.

Steps to complete the 1099 A Form

Completing the 1099 A Form requires attention to detail. Start by entering the lender's information, including their name, address, and taxpayer identification number. Next, fill in the borrower's details, ensuring accuracy in the name and Social Security number. The form will also require information about the property, such as its address and the date of acquisition or abandonment. Additionally, report the outstanding loan balance and the fair market value of the property at the time of the event. Double-check all entries for accuracy before submission, as errors can lead to complications with the IRS.

Legal use of the 1099 A Form

The legal use of the 1099 A Form is primarily to report property transactions to the IRS. It is important for taxpayers to understand that this form serves as an official record of the acquisition or abandonment of secured property. Proper use of the form ensures compliance with tax regulations and helps avoid potential penalties. Taxpayers should retain a copy of the 1099 A Form for their records and consult with a tax professional if they have questions regarding its implications on their tax situation.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 A Form align with the annual tax filing schedule. Lenders are required to send the form to the IRS by the end of January following the tax year in which the acquisition or abandonment occurred. Taxpayers should ensure they receive their copy in a timely manner to accurately report the information on their tax returns. It is advisable to keep track of any changes in IRS regulations regarding deadlines to avoid late filing penalties.

Who Issues the Form

The 1099 A Form is typically issued by lenders, including banks and financial institutions, that hold a secured interest in a property. If a borrower has experienced foreclosure or abandoned a property, the lender is responsible for completing and sending this form to both the borrower and the IRS. It is crucial for borrowers to maintain communication with their lenders to ensure they receive the necessary documentation for tax reporting purposes.

Quick guide on how to complete 1099 a 2012 form

Facilitate 1099 A Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious option to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage 1099 A Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign 1099 A Form with ease

- Obtain 1099 A Form and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to store your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management within a few clicks from any gadget of your choosing. Modify and electronically sign 1099 A Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 a 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 a 2012 form

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is a 1099 A Form and why do I need it?

The 1099 A Form is a tax document used to report the acquisition or abandonment of secured property. Businesses and individuals may need it during tax season to ensure accurate reporting of income and assets. Using airSlate SignNow, you can easily eSign and manage your 1099 A Form, streamlining your tax preparation process.

-

How does airSlate SignNow simplify the process of signing a 1099 A Form?

airSlate SignNow offers a user-friendly platform that allows you to electronically sign and send your 1099 A Form with just a few clicks. This eliminates the hassle of printing, signing, and scanning documents, saving you time and reducing errors. With our intuitive interface, eSigning your 1099 A Form has never been easier.

-

Can I store my 1099 A Form securely using airSlate SignNow?

Yes, airSlate SignNow provides secure storage for all your documents, including the 1099 A Form. Our platform ensures that your sensitive information is protected with top-grade encryption and secure servers. You can access your 1099 A Form anytime, anywhere, knowing that it is safe and confidential.

-

Is there a free trial available for airSlate SignNow when signing a 1099 A Form?

Absolutely! airSlate SignNow offers a free trial that allows you to explore our features, including signing documents like the 1099 A Form, without any commitment. This is a great opportunity to experience the benefits of our eSignature solution and see how it can simplify your document management.

-

What features does airSlate SignNow offer for managing a 1099 A Form?

airSlate SignNow includes a variety of features for managing your 1099 A Form, such as customizable templates, automated workflows, and real-time tracking of document status. These tools help you stay organized and ensure that your forms are completed accurately and on time. Plus, our platform integrates seamlessly with other applications you may already be using.

-

How does airSlate SignNow integrate with accounting software for the 1099 A Form?

airSlate SignNow can easily integrate with popular accounting software, allowing you to manage your 1099 A Form efficiently. This integration facilitates automatic updates and ensures that your financial records are synchronized, reducing the risk of errors. Streamlining your workflow with airSlate SignNow means you can focus more on your business and less on paperwork.

-

What are the benefits of using airSlate SignNow for my 1099 A Form compared to traditional methods?

Using airSlate SignNow for your 1099 A Form offers numerous benefits over traditional methods. It reduces the time spent on document handling, minimizes paper use, and enhances collaboration by allowing multiple parties to eSign in one place. The convenience and efficiency of our platform can signNowly improve your overall document management process.

Get more for 1099 A Form

- Solved the final tax return period for c corp form

- Contact us by maildepartment of revenue taxation form

- Form st 100 new york state and local quarterly sales and use tax return revised 920

- 2020 form 590 withholding exemption certificate city of

- Form tp 215 application for registration as a distributor of alcoholic beverages revised 520

- Pdf form dtf 505320authorization for release of photocopies of tax

- Fillable online form cms 1 mn315request for conciliation

- Form mt 40 form mt 40 return of tax on wines liquors alcohol and distilled or rectified spirits revised 520

Find out other 1099 A Form

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later