Form 1099 a Rev January Acquisition or Abandonment of Secured Property 2022

What is the Form 1099-A?

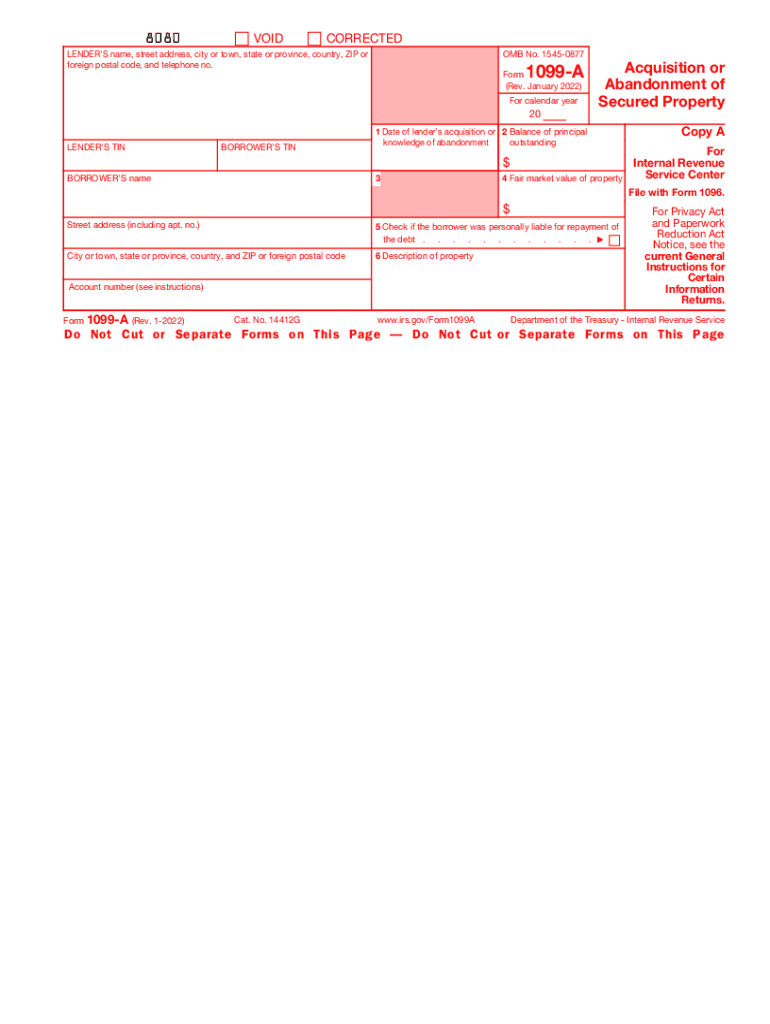

The Form 1099-A, titled "Acquisition or Abandonment of Secured Property," is used to report the acquisition of property that is secured by a loan. This form is crucial for both taxpayers and the IRS, as it provides information regarding the status of a property that has been foreclosed or abandoned. It includes details such as the date of acquisition, the fair market value of the property, and any outstanding debt at the time of acquisition. Understanding this form is essential for accurately reporting any gains or losses related to the property on your tax return.

Steps to Complete the Form 1099-A

Completing the Form 1099-A involves several key steps:

- Gather necessary information: Collect details about the property, including its fair market value and any outstanding loans.

- Fill out the form: Enter the required information in the appropriate fields, ensuring accuracy to avoid issues with the IRS.

- Distribute copies: Provide copies of the completed form to the IRS and the borrower, if applicable.

- Retain records: Keep a copy of the form and any supporting documents for your records, as they may be needed for future reference or audits.

IRS Guidelines for Form 1099-A

The IRS provides specific guidelines regarding the use and submission of Form 1099-A. It is important to follow these guidelines to ensure compliance and avoid penalties. Taxpayers must file this form when they acquire property through foreclosure or abandonment. Additionally, the form must be submitted to the IRS by the deadline set for information returns, typically by the end of January following the tax year in which the acquisition occurred. Familiarizing yourself with these guidelines can help ensure that you meet all necessary requirements.

Filing Deadlines for Form 1099-A

Filing deadlines are critical for compliance with IRS regulations. For Form 1099-A, the deadline for filing with the IRS is typically January thirty-first of the year following the tax year in which the property was acquired. If you are filing electronically, the deadline may extend to March thirty-first. It is essential to adhere to these deadlines to avoid potential penalties and ensure that all required parties receive their copies in a timely manner.

Who Issues the Form 1099-A?

The Form 1099-A is generally issued by lenders or financial institutions that have foreclosed on a property or have been involved in the abandonment process. These entities are responsible for reporting the acquisition of the secured property to the IRS and the borrower. Understanding who issues this form can help taxpayers identify the correct source of their tax documents and ensure they have all necessary information for their tax filings.

Penalties for Non-Compliance with Form 1099-A

Failing to file Form 1099-A or filing it incorrectly can result in penalties imposed by the IRS. These penalties can vary based on the severity of the non-compliance, including late filing or incorrect information. Taxpayers may face fines for each form that is not filed or filed incorrectly, which can accumulate quickly. Being aware of these potential penalties emphasizes the importance of accurate and timely filing of this form.

Quick guide on how to complete form 1099 a rev january 2022 acquisition or abandonment of secured property

Effortlessly Prepare Form 1099 A Rev January Acquisition Or Abandonment Of Secured Property on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1099 A Rev January Acquisition Or Abandonment Of Secured Property on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to Modify and Electronically Sign Form 1099 A Rev January Acquisition Or Abandonment Of Secured Property with Ease

- Obtain Form 1099 A Rev January Acquisition Or Abandonment Of Secured Property and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 1099 A Rev January Acquisition Or Abandonment Of Secured Property to ensure clear communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 a rev january 2022 acquisition or abandonment of secured property

Create this form in 5 minutes!

People also ask

-

What is a 1099 form and why do I need it?

A 1099 form is an IRS tax document used to report income earned by non-employees, such as freelancers or independent contractors. Understanding what a 1099 is essential for ensuring accurate tax reporting and compliance. It helps businesses track payments made to non-employees, making it easier to fulfill tax obligations.

-

How does airSlate SignNow simplify the 1099 filing process?

airSlate SignNow makes it easy to manage and eSign 1099 forms with its intuitive interface. Users can quickly prepare, send, and secure digital signatures on these documents, streamlining the entire process. This ultimately saves time and reduces the hassle involved in filing tax documents.

-

What features does airSlate SignNow offer for managing 1099 forms?

airSlate SignNow provides features like template creation, automated workflows, and secure cloud storage for 1099 forms. These tools help users efficiently manage their documentation and ensure compliance. The platform's electronic signature capability allows for quick approvals, enhancing collaboration with stakeholders.

-

Can I integrate airSlate SignNow with accounting software for 1099 management?

Yes, airSlate SignNow offers integrations with various accounting software to facilitate 1099 management. By connecting your accounting tools, you can automatically sync payment data and streamline the reporting process. This integration helps reduce errors and ensures that your financial records are accurate.

-

What are the pricing options for using airSlate SignNow for 1099 processing?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including features necessary for 1099 processing. Customers can choose from individual, team, or enterprise plans based on their requirements. Investing in an affordable plan allows businesses to efficiently manage their 1099 forms without breaking the bank.

-

How secure is the information in my 1099 documents with airSlate SignNow?

airSlate SignNow prioritizes the security of your 1099 documents by employing robust encryption and compliance measures. Your information is stored safely, and access is restricted to authorized users only. This commitment to security ensures that sensitive data related to your 1099 forms remains protected.

-

Can I track the status of my 1099 forms sent through airSlate SignNow?

With airSlate SignNow, you can easily track the status of your sent 1099 forms in real-time. The platform provides notifications for document views and signatures, allowing you to monitor progress efficiently. This feature ensures you stay informed and can follow up as necessary.

Get more for Form 1099 A Rev January Acquisition Or Abandonment Of Secured Property

- Oh fiduciary deed form

- Warranty deed from limited partnership or llc is the grantor or grantee ohio form

- General corporation form

- Warranty deed for husband and wife to three individuals as joint tenants ohio form

- Limited warranty deed for husband and wife to an individual ohio form

- Warranty deed for husband and wife to husband and wife ohio form

- Ohio workers form

- Ohio workers compensation 497322673 form

Find out other Form 1099 A Rev January Acquisition Or Abandonment Of Secured Property

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile