Irs Form 990 Ez 2016

What is the Irs Form 990 Ez

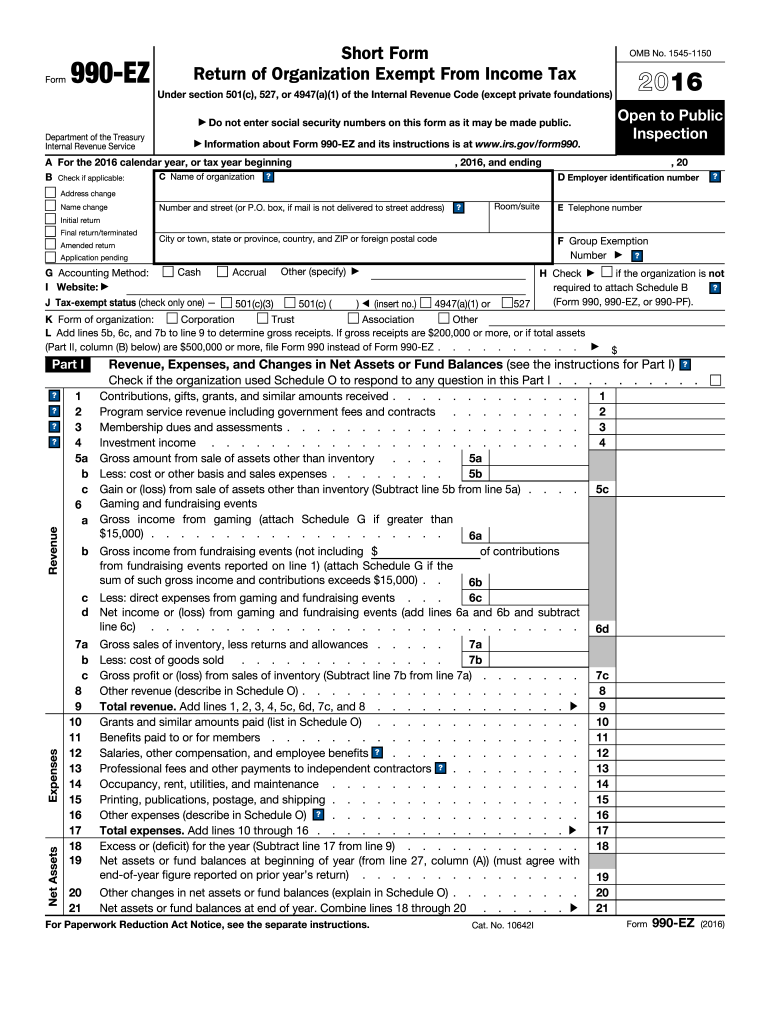

The Irs Form 990 Ez is a simplified version of the standard Form 990, designed for small tax-exempt organizations. This form provides the IRS with essential information about the organization’s financial activities, governance, and compliance with tax regulations. It is specifically intended for organizations that have gross receipts of less than two hundred fifty thousand dollars and total assets of less than five hundred thousand dollars. By using Form 990 Ez, eligible organizations can fulfill their annual reporting requirements while streamlining the process of providing necessary financial information.

How to use the Irs Form 990 Ez

Using the Irs Form 990 Ez involves several straightforward steps. First, organizations must gather relevant financial information, including income, expenses, and assets. Next, they should download the form from the IRS website or obtain it through authorized sources. After filling out the required sections, organizations need to review the information for accuracy. It is also important to ensure that all necessary schedules and attachments are included. Finally, the completed form should be submitted to the IRS by the specified deadline, either electronically or by mail.

Steps to complete the Irs Form 990 Ez

Completing the Irs Form 990 Ez requires careful attention to detail. Here are the steps to follow:

- Gather financial records: Collect all relevant documents, including income statements and balance sheets.

- Fill out basic information: Enter the organization’s name, address, and Employer Identification Number (EIN).

- Report financial data: Complete the sections detailing revenue, expenses, and net assets.

- Disclose governance details: Provide information about the organization’s board members and key personnel.

- Review and verify: Double-check all entries for accuracy and completeness.

- Submit the form: File the completed form with the IRS by the deadline.

Legal use of the Irs Form 990 Ez

The Irs Form 990 Ez serves a vital legal function for tax-exempt organizations. By filing this form, organizations demonstrate compliance with federal regulations governing tax-exempt status. It is essential for maintaining transparency and accountability, as the information provided is accessible to the public. Additionally, accurate completion of the form helps avoid potential penalties or loss of tax-exempt status. Organizations must ensure that they adhere to all legal requirements when using this form to safeguard their standing with the IRS.

Filing Deadlines / Important Dates

Organizations must be aware of specific deadlines related to the Irs Form 990 Ez to ensure timely filing. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is typically due on May fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can also file for an automatic six-month extension, but they must submit Form 8868 to request this extension.

Penalties for Non-Compliance

Failure to file the Irs Form 990 Ez by the deadline can result in significant penalties. The IRS imposes a fine for each month the form is late, with a maximum penalty that can accumulate over time. Additionally, organizations that consistently fail to file may risk losing their tax-exempt status. It is crucial for organizations to understand these penalties and prioritize timely filing to maintain compliance and avoid financial repercussions.

Quick guide on how to complete irs form 2016 990 ez

Effortlessly Prepare Irs Form 990 Ez on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the necessary resources to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 990 Ez on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and eSign Irs Form 990 Ez Effortlessly

- Locate Irs Form 990 Ez and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 990 Ez and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 2016 990 ez

Create this form in 5 minutes!

How to create an eSignature for the irs form 2016 990 ez

How to make an electronic signature for the Irs Form 2016 990 Ez online

How to make an eSignature for the Irs Form 2016 990 Ez in Chrome

How to make an electronic signature for signing the Irs Form 2016 990 Ez in Gmail

How to make an eSignature for the Irs Form 2016 990 Ez straight from your mobile device

How to generate an eSignature for the Irs Form 2016 990 Ez on iOS devices

How to generate an electronic signature for the Irs Form 2016 990 Ez on Android

People also ask

-

What is IRS Form 990 EZ, and how can airSlate SignNow help with it?

IRS Form 990 EZ is a streamlined version of the standard Form 990 that nonprofit organizations use to report their financial information. With airSlate SignNow, organizations can easily create, send, and eSign Form 990 EZ efficiently, ensuring compliance and simplifying the filing process.

-

What are the pricing options for using airSlate SignNow for IRS Form 990 EZ?

airSlate SignNow offers flexible pricing plans tailored to fit the needs of businesses and nonprofits alike. Whether you're a small organization or a large nonprofit, you can find a cost-effective solution that allows you to efficiently manage IRS Form 990 EZ signing and submission.

-

What features does airSlate SignNow provide for eSigning IRS Form 990 EZ?

airSlate SignNow includes powerful features such as real-time tracking, secure storage, and multiple signing options, making it easy to eSign IRS Form 990 EZ. The platform also integrates with various business tools to streamline your workflow and ensure that your documents are handled efficiently.

-

Can airSlate SignNow integrate with accounting software to simplify IRS Form 990 EZ filing?

Yes, airSlate SignNow integrates seamlessly with popular accounting software solutions, enhancing your workflow for IRS Form 990 EZ preparation and filing. This integration allows for easy data management, ensuring that your financial information is accurate and readily available when needed.

-

What are the benefits of using airSlate SignNow for IRS Form 990 EZ over traditional paper methods?

Using airSlate SignNow for IRS Form 990 EZ provides numerous benefits compared to traditional paper methods, such as faster processing times, reduced costs, and improved accuracy. The platform allows for instant eSigning and immediate document access, minimizing the chance of delays and errors in your filing.

-

Is airSlate SignNow secure for handling sensitive information on IRS Form 990 EZ?

Absolutely, airSlate SignNow prioritizes security by utilizing end-to-end encryption and stringent data protection measures. This ensures that your sensitive information on IRS Form 990 EZ remains secure throughout the signing process, giving you peace of mind.

-

How user-friendly is airSlate SignNow for newcomers unfamiliar with IRS Form 990 EZ?

airSlate SignNow is designed for ease of use, even for those new to IRS Form 990 EZ. With its intuitive interface and clear instructions, users can navigate the platform effortlessly, making it simple to complete and eSign their forms without any prior experience.

Get more for Irs Form 990 Ez

Find out other Irs Form 990 Ez

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free