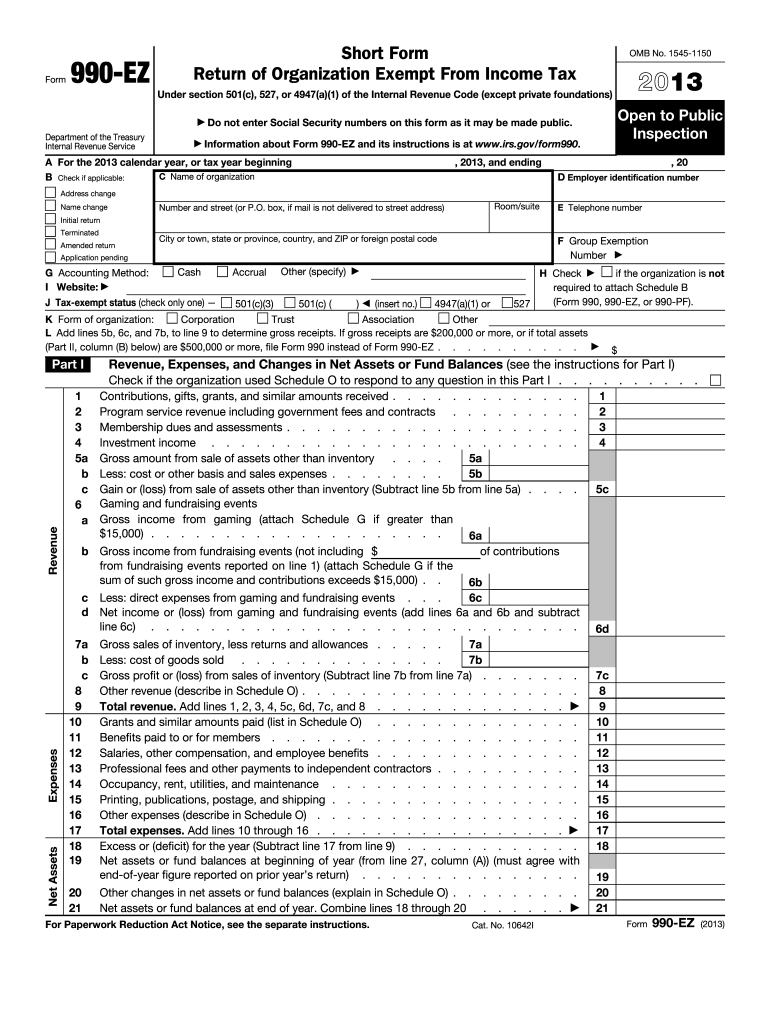

Ez Irs Form 2013

What is the Ez Irs Form

The Ez Irs Form is a simplified tax form used by eligible taxpayers in the United States to report their income and calculate their tax liability. This form is designed to streamline the filing process for individuals who meet specific criteria, making it easier to comply with federal tax regulations. It typically includes sections for reporting wages, interest, dividends, and other income, as well as deductions and credits that may apply.

How to use the Ez Irs Form

Using the Ez Irs Form involves a few straightforward steps. First, gather all necessary financial documents, such as W-2 forms, 1099 forms, and any other relevant income statements. Next, carefully read the instructions provided with the form to understand the requirements and ensure accurate completion. Fill out the form by entering your income and any applicable deductions or credits. Finally, review your entries for accuracy before submitting the form to the IRS.

Steps to complete the Ez Irs Form

Completing the Ez Irs Form can be broken down into several key steps:

- Collect all relevant tax documents, including income statements and previous year’s tax returns.

- Read the instructions carefully to understand eligibility and filing requirements.

- Fill out the form, ensuring that all income sources and deductions are accurately reported.

- Double-check all entries for accuracy and completeness.

- Submit the completed form either electronically or by mail, following the guidelines provided.

Legal use of the Ez Irs Form

The Ez Irs Form is legally recognized by the IRS as a valid method for filing taxes, provided that it is completed accurately and submitted on time. To ensure legal compliance, taxpayers must adhere to the guidelines set forth by the IRS, including eligibility requirements and deadlines. Using the form correctly helps avoid penalties and ensures that taxpayers fulfill their legal obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Ez Irs Form typically align with the annual tax filing season in the United States. Generally, taxpayers must submit their forms by April fifteenth of each year. However, it is essential to check for any changes or extensions that may apply, as well as specific deadlines for state tax filings. Staying informed about these important dates helps ensure timely compliance and avoids potential penalties.

Required Documents

To complete the Ez Irs Form, certain documents are necessary. These include:

- W-2 forms from employers, detailing annual wages and tax withheld.

- 1099 forms for any freelance or contract work, reporting additional income.

- Records of any deductible expenses, such as medical costs or charitable contributions.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The Ez Irs Form can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system, which is secure and efficient.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, though this option may require an appointment.

Quick guide on how to complete ez 2013 irs form

Effortlessly manage Ez Irs Form on any device

Web-based document administration has gained traction among businesses and individuals. It offers an excellent sustainable alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without hassles. Manage Ez Irs Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Ez Irs Form effortlessly

- Locate Ez Irs Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your digital signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to store your changes.

- Decide how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign Ez Irs Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ez 2013 irs form

Create this form in 5 minutes!

How to create an eSignature for the ez 2013 irs form

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Ez Irs Form and how can airSlate SignNow help?

The Ez Irs Form is a simplified tax form designed for easy filing of tax returns. With airSlate SignNow, you can effortlessly complete and eSign your Ez Irs Form, streamlining the process and ensuring compliance with IRS regulations. Our platform makes it easy to manage and send your documents securely.

-

How does airSlate SignNow ensure the security of my Ez Irs Form?

At airSlate SignNow, we prioritize the security of your documents, including your Ez Irs Form. Our platform utilizes advanced encryption methods and complies with industry standards to protect sensitive information. You can trust that your data is safe while you eSign your forms.

-

Is there a cost associated with using airSlate SignNow for my Ez Irs Form?

Yes, airSlate SignNow offers several pricing plans to cater to different needs, including those who need to manage their Ez Irs Form. Our plans are cost-effective and provide you with the tools necessary for efficient document management and eSigning. Check our pricing page for detailed options.

-

Can I integrate airSlate SignNow with other applications for my Ez Irs Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easy to manage your Ez Irs Form alongside your existing workflows. Whether you use CRM systems or cloud storage solutions, our integrations enhance functionality and streamline your document processes.

-

What features does airSlate SignNow offer for completing an Ez Irs Form?

airSlate SignNow provides a variety of features to assist you with your Ez Irs Form, including customizable templates, electronic signatures, and real-time tracking. These tools simplify the completion process and help ensure that your forms are submitted accurately and on time.

-

How can airSlate SignNow benefit my business when dealing with Ez Irs Forms?

By using airSlate SignNow for your Ez Irs Form, your business can save time and reduce the hassle of managing paperwork. Our easy-to-use solution allows for quick eSigning and document sharing, enhancing productivity while ensuring compliance with tax requirements.

-

Is it easy to eSign an Ez Irs Form with airSlate SignNow?

Yes, eSigning your Ez Irs Form with airSlate SignNow is incredibly straightforward. Our user-friendly interface allows you to complete the form and add your electronic signature in just a few clicks. You can do this from any device, making it convenient and efficient.

Get more for Ez Irs Form

Find out other Ez Irs Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF