Form 990 EZ Short Form Return of Organization Exempt from Income Tax 2023

Understanding the Form 990 EZ

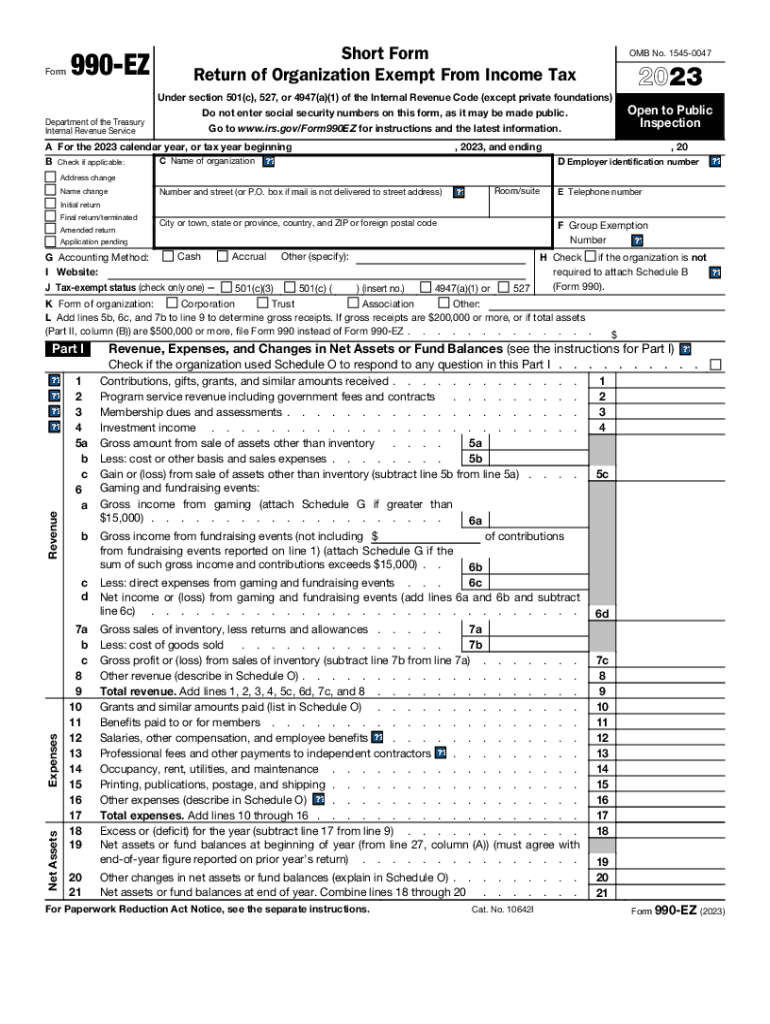

The Form 990 EZ is a short form return designed for organizations that are exempt from income tax under the Internal Revenue Code. This form is specifically tailored for smaller tax-exempt organizations, allowing them to report their financial information to the IRS in a simplified manner. It is essential for maintaining compliance with federal regulations and providing transparency about the organization's financial activities.

How to Complete the Form 990 EZ

Completing the Form 990 EZ involves several key steps. Organizations must gather necessary financial data, including revenue, expenses, and net assets. The form requires information about the organization’s mission, activities, and governance. Each section must be filled out accurately to ensure compliance and avoid potential penalties. It is advisable to consult IRS guidelines or seek assistance from a tax professional if needed.

Eligibility Criteria for Using the Form 990 EZ

To qualify for using the Form 990 EZ, organizations must meet specific criteria. Typically, this form is intended for organizations with gross receipts of less than $200,000 and total assets of less than $500,000 at the end of the year. Organizations must also be recognized as tax-exempt under section 501(c)(3) or other applicable sections of the Internal Revenue Code. Meeting these criteria allows organizations to file this simplified form rather than the more complex Form 990.

Filing Deadlines for the Form 990 EZ

The filing deadline for the Form 990 EZ is the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due by May 15. Organizations can apply for an automatic extension, which allows an additional six months to file, but it is crucial to submit the extension request before the original deadline to avoid penalties.

Submission Methods for the Form 990 EZ

Organizations can submit the Form 990 EZ through various methods. The IRS allows for electronic filing, which is often the preferred method due to its convenience and speed. Alternatively, organizations may choose to mail a paper version of the form. It is important to ensure that the form is sent to the correct IRS address based on the organization’s location and whether it includes a payment.

Key Elements of the Form 990 EZ

The Form 990 EZ includes several critical sections that organizations must complete. These sections cover basic organizational information, financial data, and a summary of the organization’s activities. Key elements include total revenue, expenses, and changes in net assets. Additionally, organizations must provide details about their governance, including the number of board members and any related party transactions. Accurate completion of these sections is vital for compliance and transparency.

Quick guide on how to complete form 990 ez short form return of organization exempt from income tax

Complete Form 990 EZ Short Form Return Of Organization Exempt From Income Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 990 EZ Short Form Return Of Organization Exempt From Income Tax on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form 990 EZ Short Form Return Of Organization Exempt From Income Tax without hassle

- Locate Form 990 EZ Short Form Return Of Organization Exempt From Income Tax and click on Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or by downloading it to your PC.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 990 EZ Short Form Return Of Organization Exempt From Income Tax and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 ez short form return of organization exempt from income tax

Create this form in 5 minutes!

How to create an eSignature for the form 990 ez short form return of organization exempt from income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2021 990 form and why is it important?

The 2021 990 form is a crucial tax document used by tax-exempt organizations to provide the IRS with annual financial information. It's important because it allows organizations to maintain transparency and accountability, ensuring compliance with federal regulations.

-

How does airSlate SignNow simplify the process of signing the 2021 990 form?

airSlate SignNow streamlines the signing process for the 2021 990 form by providing an easy-to-use platform where multiple stakeholders can eSign documents securely. This eliminates the need for printing, scanning, or mailing, saving time and reducing errors.

-

What features of airSlate SignNow help with the preparation of the 2021 990?

airSlate SignNow offers features like document templates, custom workflows, and automated reminders that help users prepare and organize their 2021 990 forms efficiently. These features ensure that all necessary documents are completed accurately and on time.

-

Is airSlate SignNow affordable for small organizations filing the 2021 990?

Yes, airSlate SignNow is designed to be cost-effective, making it an excellent choice for small organizations needing to file the 2021 990 form. With various pricing plans, businesses can choose a solution that fits their budget while still benefiting from comprehensive eSignature functionalities.

-

Can I integrate airSlate SignNow with other accounting software for filing the 2021 990?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing users to manage and file the 2021 990 form more efficiently. This integration facilitates a smoother data transfer process, reducing duplication of efforts.

-

What documents can I eSign with airSlate SignNow in relation to the 2021 990?

With airSlate SignNow, you can eSign various documents related to the 2021 990, including organizational bylaws, financial statements, and the actual 990 form itself. This versatility ensures that all necessary documentation can be managed in one platform.

-

How secure is airSlate SignNow when signing the 2021 990?

Security is a top priority for airSlate SignNow. The platform employs state-of-the-art encryption and complies with industry standards to ensure that all signatures and sensitive data related to the 2021 990 form remain protected.

Get more for Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

- Mutual wills package with last wills and testaments for married couple with adult and minor children maine form

- Legal last will and testament form for a widow or widower with adult children maine

- Legal last will and testament form for widow or widower with minor children maine

- Legal last will form for a widow or widower with no children maine

- Legal last will and testament form for a widow or widower with adult and minor children maine

- Legal last will and testament form for divorced and remarried person with mine yours and ours children maine

- Legal last will and testament form with all property to trust called a pour over will maine

- Written revocation of will maine form

Find out other Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement