Form 990 EZ Short Form Return of Organization Exempt from Income Tax 2020

What is the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

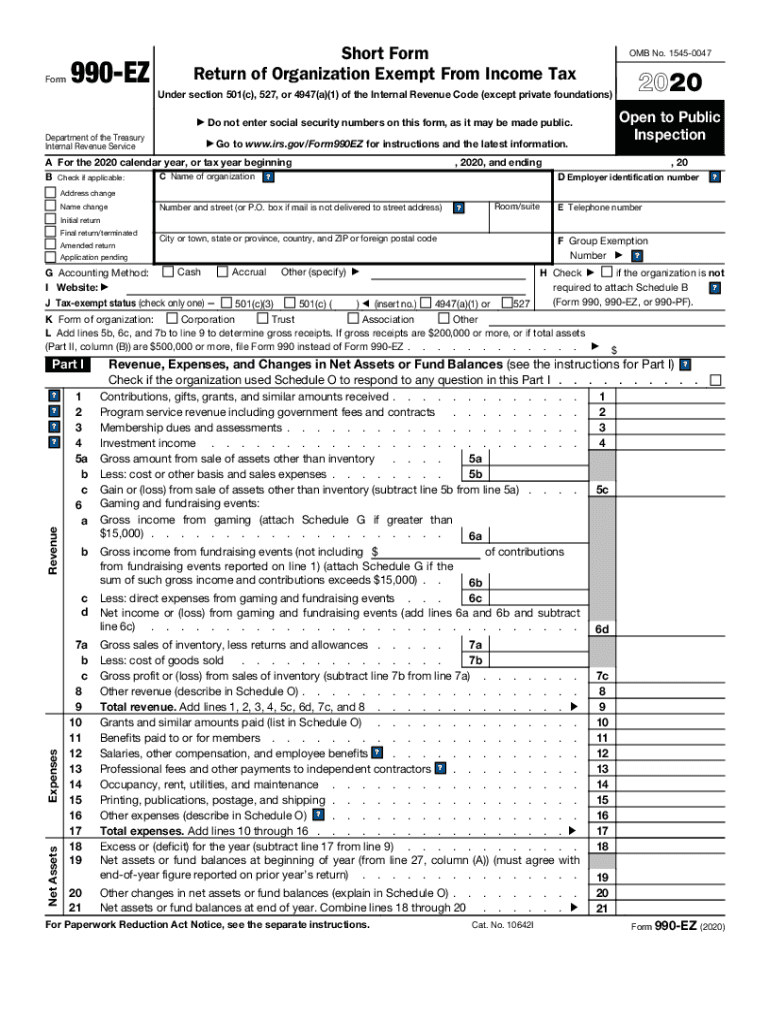

The Form 990 EZ is a simplified version of the standard Form 990, designed for small tax-exempt organizations that meet specific criteria. This form allows eligible organizations to report their financial information to the IRS, ensuring compliance with federal tax regulations. It is particularly beneficial for organizations with gross receipts under two hundred fifty thousand dollars and total assets under five hundred thousand dollars. By using the 990 EZ, organizations can provide essential financial data while minimizing the complexity of the reporting process.

How to use the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

Using the Form 990 EZ involves several steps to ensure accurate completion and compliance. Organizations must first determine their eligibility based on revenue and asset thresholds. Once eligibility is confirmed, they can download the form from the IRS website or obtain it through other means. The form requires detailed financial information, including revenue, expenses, and net assets. After completing the form, organizations must file it with the IRS by the applicable deadline, ensuring they retain copies for their records.

Steps to complete the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

Completing the Form 990 EZ involves a series of systematic steps:

- Gather financial records, including income statements and balance sheets.

- Determine eligibility based on gross receipts and total assets.

- Download the Form 990 EZ from the IRS website.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- File the completed form with the IRS by the due date.

Key elements of the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

The Form 990 EZ includes several key elements that organizations must complete:

- Part I: Basic information about the organization, including name, address, and EIN.

- Part II: Financial information detailing revenue, expenses, and changes in net assets.

- Part III: Statement of program service accomplishments, outlining the organization’s mission and activities.

- Part IV: Governance, management, and disclosure practices.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 EZ to maintain compliance. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due by May fifteenth. It is essential to file on time to avoid penalties and maintain tax-exempt status.

Penalties for Non-Compliance

Failure to file the Form 990 EZ on time can result in significant penalties. The IRS imposes a penalty for each month the form is late, with a maximum penalty amount that can accumulate quickly. Additionally, organizations that fail to file for three consecutive years risk losing their tax-exempt status. It is crucial for organizations to adhere to filing requirements to avoid these potential consequences.

Quick guide on how to complete 2020 form 990 ez short form return of organization exempt from income tax

Complete Form 990 EZ Short Form Return Of Organization Exempt From Income Tax effortlessly on any device

Online document handling has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 990 EZ Short Form Return Of Organization Exempt From Income Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 990 EZ Short Form Return Of Organization Exempt From Income Tax without any hassle

- Obtain Form 990 EZ Short Form Return Of Organization Exempt From Income Tax and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Form 990 EZ Short Form Return Of Organization Exempt From Income Tax and ensure superior communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 990 ez short form return of organization exempt from income tax

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 990 ez short form return of organization exempt from income tax

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the 990 ez form 2020?

The 990 ez form 2020 is a simplified version of the IRS Form 990 that smaller tax-exempt organizations must file. It helps these organizations report their financial information efficiently and stay compliant with IRS regulations. Understanding this form is essential for non-profits to avoid penalties and maintain their tax-exempt status.

-

How can airSlate SignNow help with the 990 ez form 2020?

airSlate SignNow allows users to easily eSign and send important documents like the 990 ez form 2020. With its user-friendly interface, organizations can obtain signatures swiftly, ensuring faster submission of forms and improved compliance with deadlines. This feature streamlines the filing process for non-profits and eases documentation management.

-

Is there a cost associated with using airSlate SignNow for the 990 ez form 2020?

Yes, airSlate SignNow offers various pricing plans that accommodate the needs of different organizations. While the cost depends on the chosen plan, it remains a cost-effective solution for businesses looking to manage their documentation, including the 990 ez form 2020. Prospective users can sign up for a free trial to explore features before committing.

-

What features does airSlate SignNow offer for managing the 990 ez form 2020?

airSlate SignNow provides features such as customizable templates, bulk sending of documents, and secure eSigning capabilities for forms like the 990 ez form 2020. These tools not only enhance efficiency but also ensure that the necessary documents are completed correctly and securely. This makes it easier for organizations to focus on their mission rather than tedious paperwork.

-

How secure is the eSigning process for the 990 ez form 2020 with airSlate SignNow?

The eSigning process for the 990 ez form 2020 on airSlate SignNow is highly secure, utilizing advanced encryption and compliance with eSignature laws. This ensures that all signed documents remain confidential and tamper-proof, providing organizations peace of mind when handling sensitive financial information. Additionally, audit trails are available to track who signed when.

-

Can I integrate airSlate SignNow with other software for the 990 ez form 2020?

Yes, airSlate SignNow offers integrations with various software solutions, making it easy to handle the 990 ez form 2020 alongside other business tools. This includes CRM systems, document management systems, and more, enabling a seamless workflow. Integrating these tools helps streamline the entire document processing journey.

-

What are the benefits of using airSlate SignNow for the 990 ez form 2020?

Using airSlate SignNow for the 990 ez form 2020 provides a range of benefits, including increased efficiency, enhanced security, and ease of use. Organizations can complete and file their forms faster, which is crucial for compliance. Moreover, the ability to eSign documents reduces the need for physical paperwork, helping save both time and resources.

Get more for Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

- Form rp 6704 a1 joint statement of school tax levy for the 2022 2023 fiscal year revised 722

- Wwwirsgovforms pubsabout form 1094 cabout form 1094 c transmittal of employer provided health

- 2022 form 945 annual return of withheld federal income tax

- E 1r form fillable st louis

- Form mo 5090 net operating loss addition modification sheet missouri

- Attach one or more forms 8283 to your tax irs tax formsabout form 8283 noncash charitable contributionsattach one or more forms

- Form 637 rev april 2022 application for registration for certain excise tax activities

- 39256 38063 form e 6 nov 2021

Find out other Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template