990 Ez Form 2014

What is the 990 Ez Form

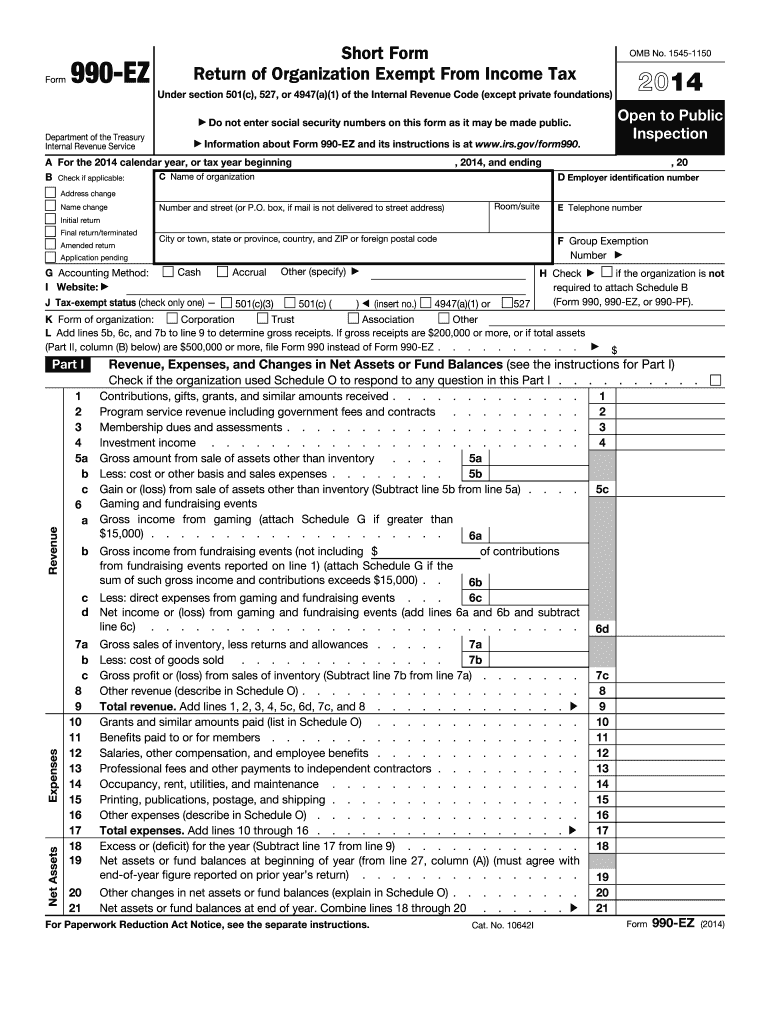

The 990 Ez Form is a simplified version of the IRS Form 990, designed for small tax-exempt organizations. It allows these organizations to report their financial activities, including income, expenses, and operational details, to the IRS. This form is typically used by organizations with gross receipts of less than two hundred fifty thousand dollars and total assets of less than five hundred thousand dollars at the end of the year. The 990 Ez Form helps ensure transparency and accountability in the nonprofit sector while providing essential information to the IRS and the public.

How to use the 990 Ez Form

Using the 990 Ez Form involves several steps to ensure accurate and complete reporting. First, gather all necessary financial records, including income statements, balance sheets, and any relevant documentation. Next, carefully fill out the form, providing detailed information about the organization’s revenue, expenses, and activities. It is important to follow the instructions provided by the IRS to ensure compliance with all regulations. After completing the form, review it for accuracy and completeness before submission. Finally, file the form by the designated deadline to avoid penalties.

Steps to complete the 990 Ez Form

Completing the 990 Ez Form requires a systematic approach. Begin by identifying the reporting period for the organization. Next, collect financial data, including total revenue and expenses, and prepare a balance sheet. Fill out the form sections methodically, ensuring that all figures are accurate and correspond with supporting documents. Pay special attention to the summary section, which provides an overview of the organization’s financial health. Once the form is filled out, conduct a thorough review to catch any errors or omissions. Finally, submit the form electronically or by mail, depending on the organization’s preference.

Legal use of the 990 Ez Form

The legal use of the 990 Ez Form is governed by IRS regulations, which require tax-exempt organizations to file this form annually. Compliance with these regulations is crucial for maintaining tax-exempt status. The information provided in the form must be truthful and complete, as inaccuracies can lead to legal repercussions, including penalties or loss of tax-exempt status. Organizations must also ensure that they meet the eligibility criteria for using the 990 Ez Form, as failure to do so may result in the need to file the more complex Form 990.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Ez Form are critical for compliance. Generally, organizations must file the form by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this typically means a May fifteenth deadline. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can request a six-month extension if needed, but they must file the extension request before the original deadline. Awareness of these dates is essential to avoid late fees and penalties.

Examples of using the 990 Ez Form

Examples of organizations that typically use the 990 Ez Form include small charities, religious organizations, and educational institutions with limited financial activity. For instance, a local charity that raises funds through community events and has minimal operational expenses may qualify to use the 990 Ez Form. Similarly, a small church that receives donations and has a modest budget would also find this form appropriate. These examples illustrate how the 990 Ez Form serves as a practical tool for small organizations to fulfill their reporting obligations while maintaining transparency.

Quick guide on how to complete 990 ez 2014 form 6962123

Complete 990 Ez Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage 990 Ez Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign 990 Ez Form without hassle

- Locate 990 Ez Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your revisions.

- Select how you wish to send your document, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from your chosen device. Modify and electronically sign 990 Ez Form and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990 ez 2014 form 6962123

Create this form in 5 minutes!

How to create an eSignature for the 990 ez 2014 form 6962123

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the 990 Ez Form?

The 990 Ez Form is a simplified version of the IRS Form 990 that nonprofit organizations can use to report their financial information. This form is specifically designed for smaller charities with less complex finances, making it easier to comply with federal regulations. Understanding the 990 Ez Form is crucial for maintaining transparency and fulfilling your organization's tax obligations.

-

How can airSlate SignNow help in filling out the 990 Ez Form?

airSlate SignNow provides an efficient platform for organizations to eSign and manage their 990 Ez Forms digitally. With features like document templates and secure cloud storage, you can easily fill out and submit the form without the hassle of paper. Our solution streamlines the process, ensuring you meet deadlines effortlessly.

-

What are the pricing options for using airSlate SignNow with the 990 Ez Form?

AirSlate SignNow offers competitive pricing plans to fit different organizational sizes and needs while using the 990 Ez Form. Our plans include a free trial, followed by monthly or annual subscriptions that provide cost-effective solutions for document management. Check our website for the latest pricing information and find the plan that suits your nonprofit.

-

What are the key features of airSlate SignNow that support the 990 Ez Form?

Key features of airSlate SignNow include customizable templates, automated workflows, and real-time tracking. These functionalities make it simple to prepare, send, and sign the 990 Ez Form with ease. Our eSignature capabilities ensure that your documents are legally binding and securely stored.

-

Can I integrate airSlate SignNow with other tools to manage the 990 Ez Form?

Yes, airSlate SignNow offers seamless integration with various business applications that can enhance your workflow while handling the 990 Ez Form. Popular integrations include CRM systems, cloud storage providers, and accounting software. This flexibility allows for a more efficient process and better data management.

-

What are the benefits of using airSlate SignNow for the 990 Ez Form?

Using airSlate SignNow for the 990 Ez Form provides numerous benefits, including increased efficiency, cost savings, and improved compliance. By digitizing the form-filling process, you reduce the risk of errors and ensure timely submissions. Additionally, our platform enhances collaboration among team members for a smoother experience.

-

Is airSlate SignNow secure for submitting the 990 Ez Form?

Absolutely! AirSlate SignNow employs rigorous security measures such as encryption and compliance with industry standards to protect your sensitive information when working with the 990 Ez Form. Our platform ensures that your data is safe from unauthorized access, giving users peace of mind.

Get more for 990 Ez Form

- Appointment time agreement form appointment time agreement

- Broker sheet form

- Wwwbalexandriadermbbcomb form

- For internal promotional use only form

- Northwest spokane pediatrics pllc better business bureau form

- Illumina laboratory form

- Appointment cover sheet templatexlsx form

- Mc 600 application for emergency commitment form

Find out other 990 Ez Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors