Www Irs Govpubirs Pdf2021 Form 4797 Internal Revenue Service 2021

What is form 4797?

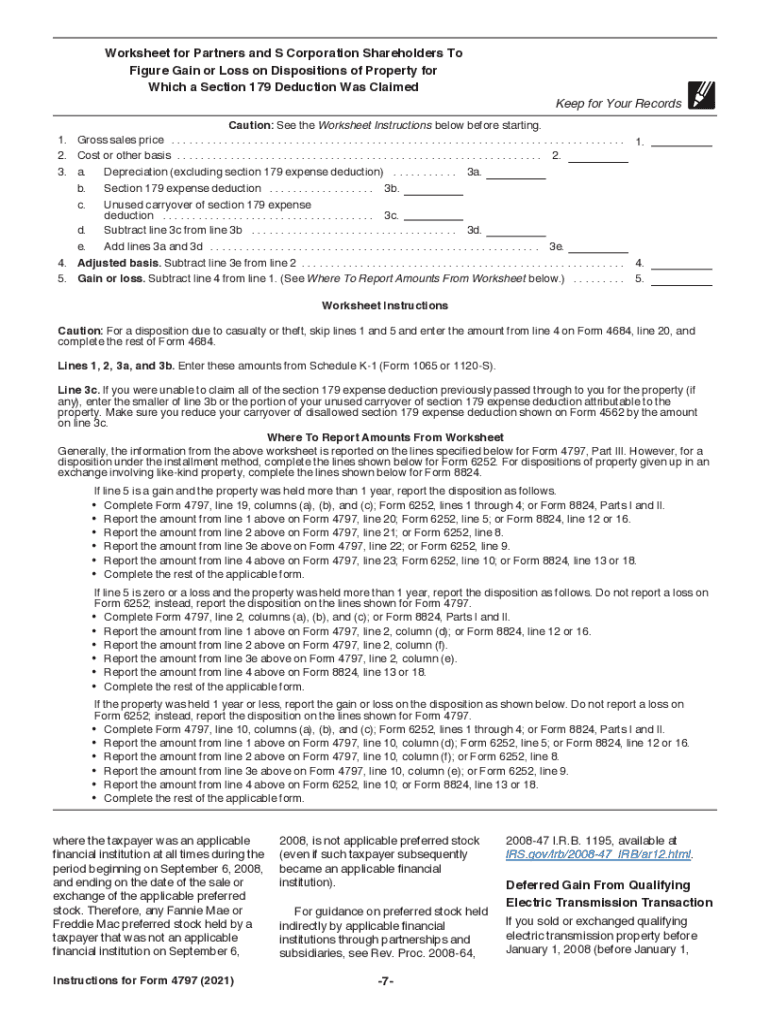

The form 4797, officially known as the Sales of Business Property, is a tax form used by the Internal Revenue Service (IRS) in the United States. It is primarily utilized to report the sale, exchange, or involuntary conversion of property used in a trade or business. This form helps taxpayers calculate the gain or loss from these transactions, ensuring compliance with federal tax regulations. Understanding the purpose of form 4797 is essential for individuals and businesses engaged in the sale of business assets.

Key elements of form 4797

Form 4797 includes several important sections that taxpayers must complete accurately. These sections consist of:

- Part I: Sales or exchanges of property used in a trade or business.

- Part II: Ordinary gains and losses from the sale of property.

- Part III: Gain from the disposition of section 1250 property.

- Part IV: Like-kind exchanges.

Each part requires specific information regarding the property sold, the date of sale, and the proceeds received. Properly filling out these sections is crucial for accurate tax reporting.

Steps to complete form 4797

Completing form 4797 involves several steps to ensure accuracy and compliance. Here’s a brief overview of the process:

- Gather necessary documentation, including records of the property sold and any related expenses.

- Identify the appropriate sections of the form based on the nature of the transaction.

- Input details such as the description of the property, date acquired, date sold, and sales price.

- Calculate any gains or losses based on the information provided.

- Review the completed form for accuracy before submission.

Following these steps can help ensure that form 4797 is filled out correctly, minimizing the risk of errors that may lead to penalties.

IRS guidelines for form 4797

The IRS provides specific guidelines for completing form 4797, which are crucial for compliance. These guidelines include:

- Understanding the definitions of terms such as "business property" and "involuntary conversion."

- Familiarizing oneself with the tax implications of gains and losses reported on the form.

- Ensuring that all calculations are based on accurate and complete records.

Referencing these guidelines can aid taxpayers in navigating the complexities of reporting business property transactions.

Filing deadlines for form 4797

Timely filing of form 4797 is essential to avoid penalties. Generally, the deadline for submitting this form aligns with the taxpayer's income tax return due date. For most individuals, this is April 15. However, if additional time is needed, taxpayers may file for an extension. It is important to stay informed about any changes to deadlines that the IRS may implement.

Legal use of form 4797

Form 4797 must be used in accordance with IRS regulations to ensure its legal validity. This includes:

- Filing the form accurately and on time to avoid penalties.

- Maintaining proper documentation to support the information reported.

- Understanding the implications of gains and losses on overall tax liability.

Adhering to these legal requirements is crucial for taxpayers to protect themselves from potential audits or disputes with the IRS.

Quick guide on how to complete wwwirsgovpubirs pdf2021 form 4797 internal revenue service

Prepare Www irs govpubirs pdf2021 Form 4797 Internal Revenue Service easily on any device

Digital document management has become popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Www irs govpubirs pdf2021 Form 4797 Internal Revenue Service on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Www irs govpubirs pdf2021 Form 4797 Internal Revenue Service effortlessly

- Locate Www irs govpubirs pdf2021 Form 4797 Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Www irs govpubirs pdf2021 Form 4797 Internal Revenue Service and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 form 4797 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 form 4797 internal revenue service

How to generate an e-signature for your PDF online

How to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an e-signature for a PDF document on Android

People also ask

-

What is the purpose of form 4797?

Form 4797 is used to report the sale of business property. This includes sales, exchanges, and between related parties, making it essential for businesses and individuals to accurately report their transactions for tax purposes.

-

How can airSlate SignNow streamline the process of filling out form 4797?

airSlate SignNow simplifies the process of completing form 4797 by allowing users to fill out and eSign the form electronically. With our user-friendly interface, you can easily edit, sign, and send form 4797 to relevant parties without the hassle of printing and scanning.

-

What are the pricing options for using airSlate SignNow to manage form 4797?

airSlate SignNow offers competitive pricing plans to suit businesses of all sizes, ensuring you have access to features necessary for effectively managing form 4797. Visit our pricing page to find a plan that fits your needs and budget.

-

Are there any specific features for handling form 4797 with airSlate SignNow?

Yes, airSlate SignNow includes features such as document templates, automated workflows, and secure cloud storage, all tailored to help you manage form 4797 efficiently. These features reduce errors and streamline the process of completing your tax forms.

-

Can airSlate SignNow be integrated with other software for filing form 4797?

Absolutely! airSlate SignNow integrates smoothly with various accounting and tax software, making it easier to file your form 4797 and manage your tax documents in one central location. Integration options include popular tools like QuickBooks and Salesforce.

-

How does eSigning benefit the processing of form 4797?

eSigning via airSlate SignNow makes the processing of form 4797 faster and more secure. Eliminating the need for physical signatures ensures that your documents are signed promptly, allowing for quicker transactions and compliance with filing deadlines.

-

Is airSlate SignNow secure for handling sensitive documents like form 4797?

Yes, airSlate SignNow prioritizes the security of your documents, including form 4797. Our platform uses advanced encryption methods and compliance with industry standards to ensure that your data remains safe and confidential.

Get more for Www irs govpubirs pdf2021 Form 4797 Internal Revenue Service

- Hawaii installments fixed rate promissory note secured by residential real estate hawaii form

- Hawaii installments fixed rate promissory note secured by personal property hawaii form

- Hawaii installments fixed rate promissory note secured by commercial real estate hawaii form

- Notice of option for recording hawaii form

- Hawaii documents 497304610 form

- Limited power of attorney limited powers specific real estate transaction hawaii form

- Special power attorney hawaii form

- Essential legal life documents for baby boomers hawaii form

Find out other Www irs govpubirs pdf2021 Form 4797 Internal Revenue Service

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now