Irs Instructions Form 4797 2018

What is the IRS Instructions Form 4797?

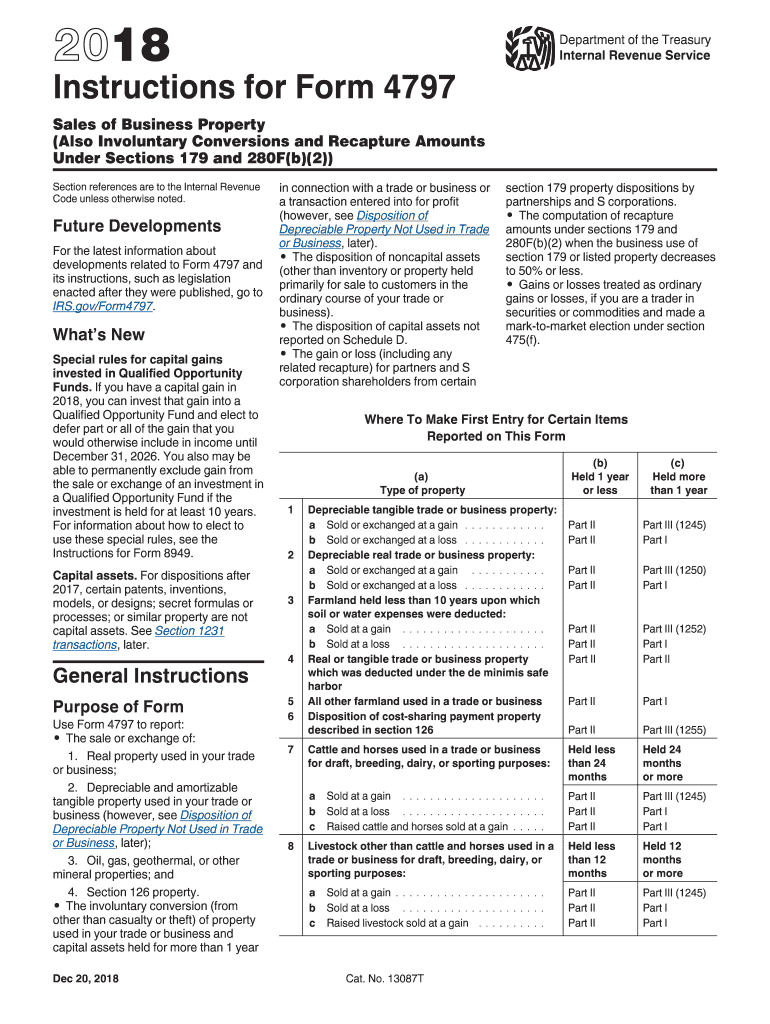

The IRS Instructions Form 4797 is a crucial document for taxpayers who need to report the sale of business property. This form is specifically designed to help individuals and businesses calculate the gain or loss from the sale of assets used in a trade or business. It also addresses the disposition of certain types of property, including real estate and depreciable assets. Understanding the guidelines outlined in the instructions is essential for accurate reporting and compliance with tax regulations.

Steps to Complete the IRS Instructions Form 4797

Completing the IRS Instructions Form 4797 involves several key steps:

- Gather Necessary Information: Collect details about the property sold, including purchase price, selling price, and any depreciation taken.

- Determine the Type of Sale: Identify whether the sale was a direct sale, exchange, or involuntary conversion.

- Fill Out the Form: Enter the required information in the appropriate sections, ensuring accuracy to avoid issues with the IRS.

- Calculate Gains or Losses: Use the provided instructions to compute any gains or losses resulting from the sale.

- Review and Submit: Double-check all entries for accuracy before submitting the form to the IRS.

Legal Use of the IRS Instructions Form 4797

The legal use of the IRS Instructions Form 4797 is defined by its compliance with federal tax laws. To ensure the form is legally binding, it must be filled out accurately and submitted within the designated deadlines. The IRS recognizes e-signatures as valid, provided they meet specific criteria under the ESIGN Act and UETA. Utilizing a reliable electronic signature solution can enhance the legal standing of your completed form.

Key Elements of the IRS Instructions Form 4797

Several key elements are essential for understanding the IRS Instructions Form 4797:

- Property Description: A detailed description of the property sold, including its type and characteristics.

- Sales Price: The total amount received from the sale of the property.

- Adjusted Basis: The original cost of the property, adjusted for improvements and depreciation.

- Gain or Loss Calculation: The difference between the sales price and the adjusted basis determines the taxable gain or deductible loss.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Instructions Form 4797 are typically aligned with the annual tax return deadlines. For most taxpayers, this means the form must be filed by April 15 of the following tax year. If additional time is needed, taxpayers can request an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Form Submission Methods

The IRS Instructions Form 4797 can be submitted through various methods:

- Online Submission: Taxpayers can file electronically using approved tax software that supports Form 4797.

- Mail: Completed forms can be printed and mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Taxpayers may also choose to deliver their forms directly to local IRS offices, although this method is less common.

Quick guide on how to complete 4797 instructions 2018 2019 form

Complete Irs Instructions Form 4797 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Irs Instructions Form 4797 on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest method to modify and electronically sign Irs Instructions Form 4797 without hassle

- Find Irs Instructions Form 4797 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you want to send your form—via email, SMS, or invitation link—or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Irs Instructions Form 4797 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4797 instructions 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the 4797 instructions 2018 2019 form

How to generate an eSignature for the 4797 Instructions 2018 2019 Form in the online mode

How to create an eSignature for your 4797 Instructions 2018 2019 Form in Google Chrome

How to make an electronic signature for signing the 4797 Instructions 2018 2019 Form in Gmail

How to create an electronic signature for the 4797 Instructions 2018 2019 Form from your smartphone

How to create an electronic signature for the 4797 Instructions 2018 2019 Form on iOS

How to create an eSignature for the 4797 Instructions 2018 2019 Form on Android

People also ask

-

What are the Irs Instructions Form 4797 requirements for eSigning documents?

When using airSlate SignNow to eSign documents related to the Irs Instructions Form 4797, ensure that all necessary fields are completed accurately. The eSignature must comply with legal standards set forth by the IRS. airSlate SignNow makes it easy to integrate these requirements into your workflow.

-

How can airSlate SignNow help with filling out the Irs Instructions Form 4797?

airSlate SignNow provides intuitive tools that assist users in accurately completing the Irs Instructions Form 4797. With customizable templates and guided steps, you can ensure that all required information is included. This streamlines the process, making it easier and faster.

-

Is there a cost associated with using airSlate SignNow for the Irs Instructions Form 4797?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for managing documents, including the Irs Instructions Form 4797. Check our pricing page for detailed information and to find a plan that fits your requirements.

-

Can I integrate airSlate SignNow with other software to manage the Irs Instructions Form 4797?

Absolutely! airSlate SignNow supports integrations with popular applications, allowing you to seamlessly manage the Irs Instructions Form 4797 alongside your existing tools. This enhances your workflow efficiency by connecting all your document management needs in one platform.

-

What features does airSlate SignNow offer for managing the Irs Instructions Form 4797?

airSlate SignNow comes equipped with features such as customizable templates, real-time collaboration, and secure storage to help you manage the Irs Instructions Form 4797 effectively. These tools ensure that you can complete and eSign your documents with ease and confidence.

-

How long does it take to eSign the Irs Instructions Form 4797 using airSlate SignNow?

The time it takes to eSign the Irs Instructions Form 4797 with airSlate SignNow can vary based on the number of signers and document complexity. However, our platform is designed for quick turnaround times, allowing you to complete the process in minutes rather than hours.

-

What are the benefits of using airSlate SignNow for the Irs Instructions Form 4797?

Using airSlate SignNow for the Irs Instructions Form 4797 offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. Additionally, the user-friendly interface simplifies the signing process, making it accessible for all users.

Get more for Irs Instructions Form 4797

- Crane checklist form

- Pump alignment form

- Bewijs van garantstelling enof particuliere logiesverstrekking 1310 form

- Confirmation of standing by medical licensing authority form

- 2013 d 400x fillable form

- Visa order form g3 visas amp passports

- Portfolio collection form redleaf press

- Transcript of training nmc form

Find out other Irs Instructions Form 4797

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document