Instructions for Form 4797 Instructions for Form 4797, Sales of Business PropertyAlso Involuntary Conversions and Recapture Amou 2020

Understanding Form 4797

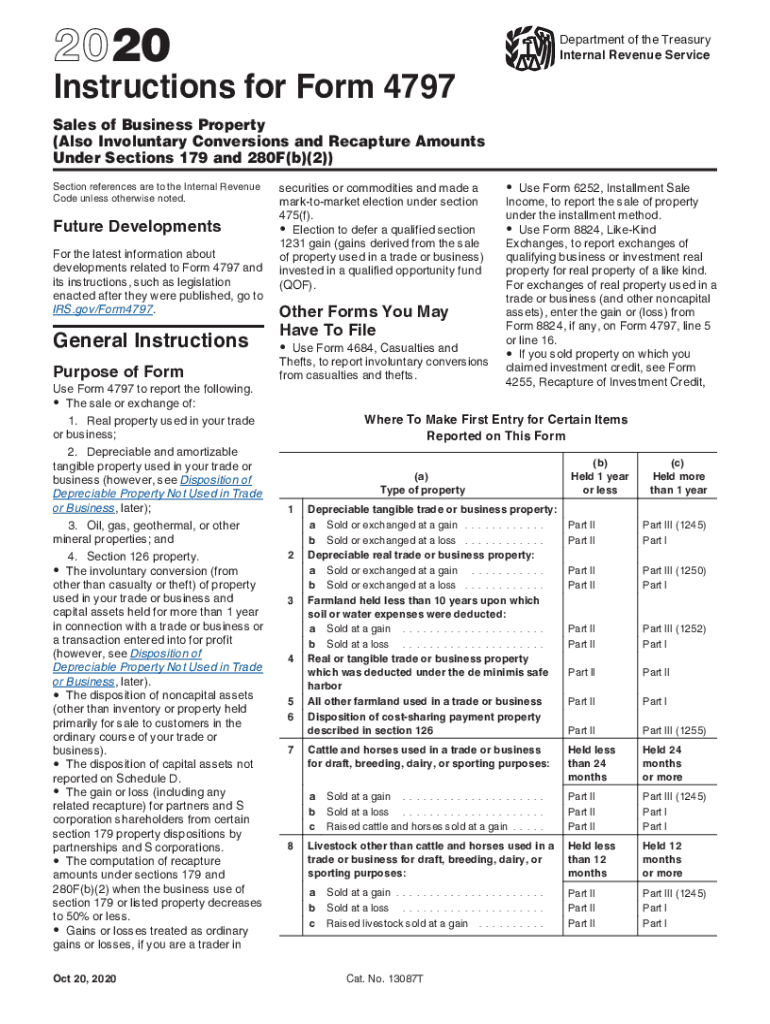

Form 4797, also known as the Sale of Business Property, is used by taxpayers to report the sale, exchange, or involuntary conversion of business property. This form is essential for calculating gain or loss from these transactions and includes specific sections for different types of property, such as real estate and depreciable assets. The form also addresses recapture amounts under Sections 179 and 280F(b)(2), which are crucial for understanding tax implications when business assets are sold or disposed of.

Steps to Complete Form 4797

Completing Form 4797 involves several key steps. First, gather all necessary documentation related to the sale or exchange of the business property. This includes purchase and sale agreements, records of depreciation, and any relevant financial statements. Next, fill out the form by providing details such as the description of the property, the date of sale, and the selling price. It's important to accurately report any gain or loss, as this will affect your overall tax liability. Finally, review the completed form for accuracy before submission.

IRS Guidelines for Form 4797

The IRS provides specific guidelines for completing Form 4797. Taxpayers must follow these instructions carefully to ensure compliance and avoid potential penalties. The form includes sections that require detailed information about the property sold, including its adjusted basis and the amount realized from the sale. It is also important to report any recapture amounts accurately, as failure to do so can lead to incorrect tax calculations.

Filing Deadlines for Form 4797

Filing deadlines for Form 4797 align with the overall tax return deadlines. Typically, this form must be submitted along with your annual tax return, which is due on April fifteenth for most taxpayers. If you are unable to file by this date, you may request an extension; however, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents for Form 4797

To complete Form 4797 accurately, several documents are required. These include records of the property's purchase price, any improvements made, and depreciation schedules. Additionally, documentation related to the sale, such as contracts and closing statements, is essential. Keeping organized records will facilitate the completion of the form and ensure compliance with IRS requirements.

Examples of Using Form 4797

Form 4797 can be used in various scenarios. For instance, if a business sells a piece of equipment that has been depreciated, the owner must report the sale on this form. Another example is when a business property is involuntarily converted due to a natural disaster; the owner would also use Form 4797 to report any gain or loss from the conversion. Understanding these examples can help taxpayers determine when and how to use this important tax form.

Quick guide on how to complete 2020 instructions for form 4797 instructions for form 4797 sales of business propertyalso involuntary conversions and recapture

Complete Instructions For Form 4797 Instructions For Form 4797, Sales Of Business PropertyAlso Involuntary Conversions And Recapture Amou with ease on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Instructions For Form 4797 Instructions For Form 4797, Sales Of Business PropertyAlso Involuntary Conversions And Recapture Amou on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest method to modify and electronically sign Instructions For Form 4797 Instructions For Form 4797, Sales Of Business PropertyAlso Involuntary Conversions And Recapture Amou effortlessly

- Find Instructions For Form 4797 Instructions For Form 4797, Sales Of Business PropertyAlso Involuntary Conversions And Recapture Amou and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or misplaced files, lengthy form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Instructions For Form 4797 Instructions For Form 4797, Sales Of Business PropertyAlso Involuntary Conversions And Recapture Amou and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 4797 instructions for form 4797 sales of business propertyalso involuntary conversions and recapture

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 4797 instructions for form 4797 sales of business propertyalso involuntary conversions and recapture

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a form 4797 and why do I need it?

The form 4797 is used to report the sale of business property and is essential for tax purposes. It helps you correctly report gains or losses from the sale of assets, ensuring compliance with IRS regulations. Utilizing airSlate SignNow can streamline the process of preparing and eSigning your form 4797.

-

How can airSlate SignNow help me with form 4797?

airSlate SignNow simplifies the eSigning process for your form 4797, allowing you to prepare, send, and securely sign your documents from any device. Its user-friendly interface reduces the time spent on paperwork, ensuring you can focus on your business. With integrated templates, you can quickly create and manage your form 4797.

-

Is there a cost associated with using airSlate SignNow for form 4797?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. These plans are cost-effective given the time and resources saved in managing your form 4797. You can choose a subscription that fits your volume of document management and eSigning needs.

-

What features does airSlate SignNow provide for completing form 4797?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking for your form 4797. These features enhance the efficiency of document handling and allow you to maintain complete control over the signing process. Additionally, automatic reminders can help prevent delays in submission.

-

Can I integrate airSlate SignNow with other tools for form 4797?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including popular CRM systems and cloud storage platforms. This allows for a more streamlined process when preparing your form 4797, as you can pull necessary data directly from other tools you’re using.

-

Is airSlate SignNow secure for handling sensitive information in form 4797?

Yes, airSlate SignNow prioritizes your security with advanced encryption and compliance with industry standards. Your form 4797 and other documents are protected during storage and transmission, ensuring that your sensitive data remains confidential. This security is vital for businesses handling tax-related documents.

-

How does airSlate SignNow streamline the eSigning process for form 4797?

AirSlate SignNow allows you to eSign form 4797 easily, eliminating the need for printing and scanning. You can send the form for signatures to multiple parties simultaneously, speeding up the process signNowly. Notifications keep everyone informed, ensuring timely completion of your tax documentation.

Get more for Instructions For Form 4797 Instructions For Form 4797, Sales Of Business PropertyAlso Involuntary Conversions And Recapture Amou

- Mover box form

- Phlebotomy is the practice of drawing blood from patients and taking the blood specimens to the laboratory to prepare form

- Ama university form

- Pdf medvantx pharmacy services po box 5736 sioux falls sd form

- Eye care servicesocli vision form

- Pdf william and mary boookstore college of william and form

- Community based supplier registration form city of cape town

- Electricity and energy business unit form

Find out other Instructions For Form 4797 Instructions For Form 4797, Sales Of Business PropertyAlso Involuntary Conversions And Recapture Amou

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document