4797 Instructions Form 2016

What is the 4797 Instructions Form

The 4797 Instructions Form is a crucial document used for reporting the sale of business property. This form is specifically designed for taxpayers who need to report gains and losses from the disposition of assets, including real estate and personal property. It is essential for individuals and businesses to accurately complete this form to ensure compliance with IRS regulations and to determine the correct tax implications of their transactions.

Steps to complete the 4797 Instructions Form

Completing the 4797 Instructions Form involves several key steps:

- Gather necessary documentation, including details of the property sold, purchase and sale dates, and costs associated with the sale.

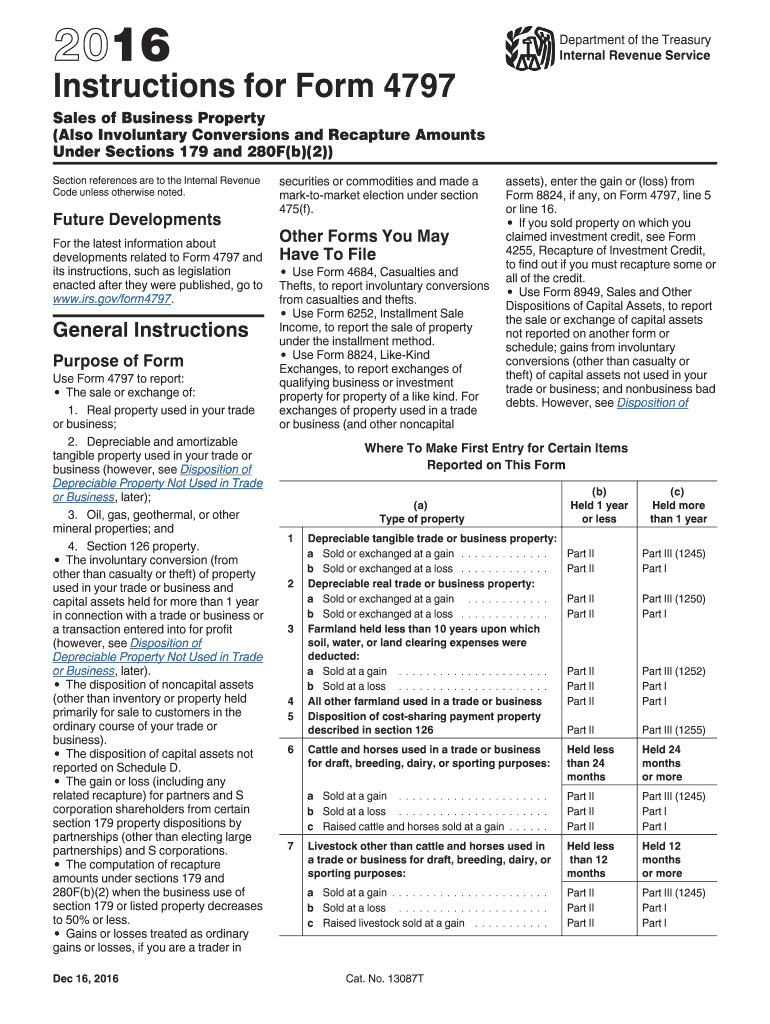

- Determine the type of property being reported, as this will influence the specific sections of the form that need to be filled out.

- Fill out Part I for ordinary gains and losses, if applicable, or Part II for the sale of business property.

- Calculate the gain or loss by subtracting the adjusted basis of the property from the selling price.

- Complete any additional sections relevant to your specific situation, such as depreciation recapture or installment sales.

- Review the form for accuracy before submission, ensuring all calculations and entries are correct.

How to obtain the 4797 Instructions Form

The 4797 Instructions Form can be obtained directly from the IRS website. Taxpayers can download the form in PDF format, which can be printed and filled out manually. Additionally, the form is available through various tax preparation software, which may provide guided assistance in completing the document. It is recommended to ensure you have the most current version of the form to comply with the latest IRS regulations.

Legal use of the 4797 Instructions Form

The legal use of the 4797 Instructions Form is fundamental for taxpayers reporting the sale of business property. To ensure compliance with IRS guidelines, it is important to accurately report all relevant transactions. Failure to do so may result in penalties or audits. The form serves as an official record of the sale and must be submitted with the taxpayer's annual income tax return, providing a clear account of any gains or losses incurred during the tax year.

Filing Deadlines / Important Dates

Filing deadlines for the 4797 Instructions Form align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If additional time is needed, taxpayers can request an extension, but the form must still be submitted by the extended deadline. It is crucial to be aware of these dates to avoid late filing penalties and ensure timely compliance with tax obligations.

Examples of using the 4797 Instructions Form

There are various scenarios in which the 4797 Instructions Form is utilized:

- Reporting the sale of a rental property that has been depreciated over time.

- Documenting the sale of business equipment, such as machinery or vehicles.

- Handling the sale of real estate used in a trade or business, where gains may be subject to different tax treatments.

Each of these examples highlights the importance of accurately reporting transactions to reflect the correct tax implications.

Quick guide on how to complete 4797 instructions 2016 form

Prepare 4797 Instructions Form seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, amend, and electronically sign your documents promptly without any holdups. Handle 4797 Instructions Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign 4797 Instructions Form without breaking a sweat

- Find 4797 Instructions Form and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional copies. airSlate SignNow takes care of all your document management needs in a few clicks from any device of your choosing. Modify and electronically sign 4797 Instructions Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4797 instructions 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 4797 instructions 2016 form

How to create an electronic signature for the 4797 Instructions 2016 Form online

How to make an eSignature for the 4797 Instructions 2016 Form in Google Chrome

How to create an eSignature for putting it on the 4797 Instructions 2016 Form in Gmail

How to create an eSignature for the 4797 Instructions 2016 Form right from your mobile device

How to create an eSignature for the 4797 Instructions 2016 Form on iOS devices

How to make an eSignature for the 4797 Instructions 2016 Form on Android devices

People also ask

-

What is the 4797 Instructions Form?

The 4797 Instructions Form is utilized for reporting the sale of business property, including real estate and depreciable assets. This IRS form provides guidance on how to report gains and losses from these transactions. Understanding the 4797 Instructions Form is essential for accurate tax reporting.

-

How can airSlate SignNow help with the 4797 Instructions Form?

airSlate SignNow provides a user-friendly platform to eSign and send the 4797 Instructions Form efficiently. Our solution streamlines the document workflow, ensuring you can complete your tax filings without hassles. With airSlate SignNow, signing and managing forms becomes a breeze.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you require basic eSigning capabilities or comprehensive document management features, we have a plan that includes access to the 4797 Instructions Form. Visit our pricing page to find the best option for your needs.

-

Can I store my 4797 Instructions Form securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for all your documents, including the 4797 Instructions Form. We prioritize data security and compliance, ensuring your sensitive information is protected. You can easily access and manage your documents anytime, anywhere.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as templates, document sharing, and in-app signing to simplify the process of handling the 4797 Instructions Form. Our platform enhances collaboration by allowing multiple users to work on documents seamlessly. Experience the efficiency of managing all your forms in one place.

-

Does airSlate SignNow integrate with other software for filing the 4797 Instructions Form?

Absolutely! airSlate SignNow integrates with popular software solutions to streamline your tax preparation process, including those needed for filing the 4797 Instructions Form. Explore our integration options to enhance your workflow and ensure a smooth experience when managing your documents.

-

What are the benefits of using airSlate SignNow for eSigning documents like the 4797 Instructions Form?

Using airSlate SignNow offers several benefits, including faster turnaround times and reduced paperwork for documents like the 4797 Instructions Form. Our easy-to-use interface and reliable eSigning technology enhance user experience, making document management efficient. Save time and effort by leveraging our comprehensive eSigning solution.

Get more for 4797 Instructions Form

Find out other 4797 Instructions Form

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT