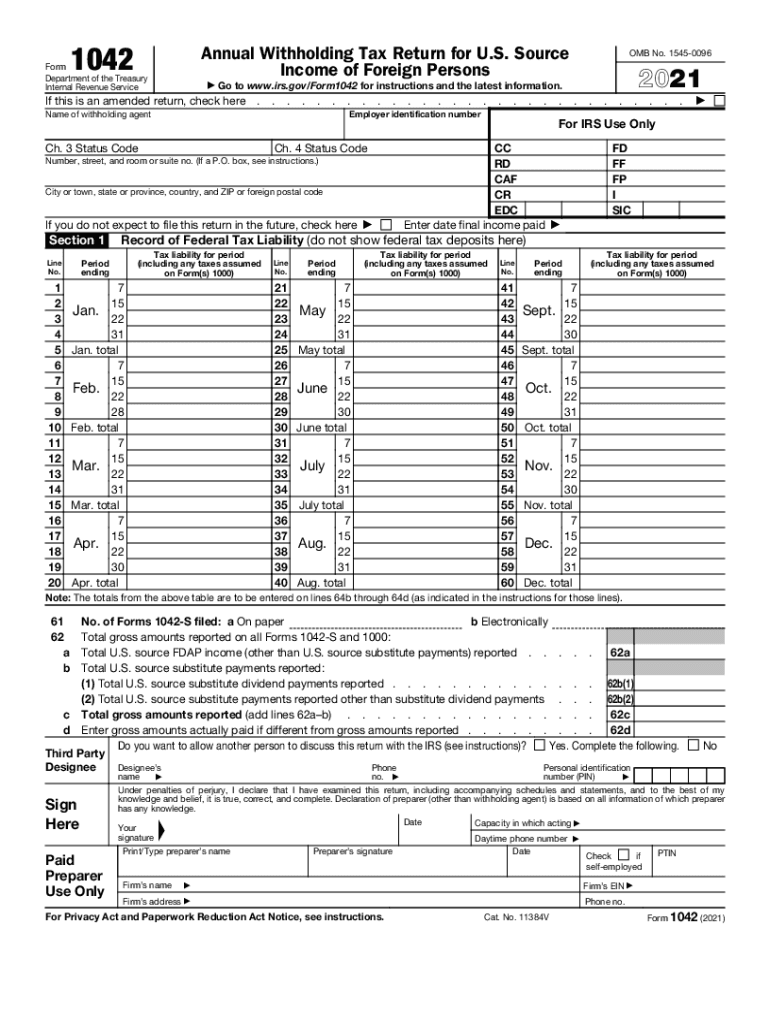

Form 1042 PDF 1042 Annual Withholding Tax Return for U S 2021

What is the Form 1042?

The Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. This form is essential for U.S. withholding agents who make payments to foreign persons, including non-resident aliens and foreign corporations. It is used to report tax withheld on income such as interest, dividends, rents, and royalties. Understanding this form is crucial for compliance with U.S. tax laws, especially for entities that engage in transactions with foreign individuals or businesses.

Steps to Complete the Form 1042

Completing the Form 1042 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding payments made to foreign persons. This includes details about the recipient, the type of income, and the amount paid. Next, determine the appropriate withholding tax rates based on the recipient's country of residence and any applicable tax treaties. Fill out the form by entering the required information in the designated fields, ensuring that all entries are accurate. Finally, review the completed form for any errors before submission.

Filing Deadlines / Important Dates

It is important to adhere to specific deadlines when filing the Form 1042. The form must be filed by March 15 of the year following the calendar year in which the payments were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, any withheld taxes must be deposited according to the IRS deposit schedule, which varies based on the amount of tax withheld.

IRS Guidelines for Form 1042

The IRS provides comprehensive guidelines for completing and submitting the Form 1042. These guidelines outline the requirements for withholding agents, including how to determine the correct withholding rates and the documentation needed to support the claims made on the form. It is crucial to follow these guidelines closely to avoid penalties and ensure compliance with U.S. tax regulations.

Penalties for Non-Compliance

Failure to file the Form 1042 or to withhold the appropriate taxes can result in significant penalties. The IRS may impose fines for late filing, failure to file, or failure to pay the correct amount of tax. These penalties can accumulate quickly, making it essential for withholding agents to stay informed about their obligations and to file the form accurately and on time.

Digital vs. Paper Version of Form 1042

With the increasing shift towards digital solutions, the Form 1042 can be completed and submitted electronically. This digital version offers advantages such as faster processing times and reduced chances of errors compared to paper submissions. However, some entities may still prefer the traditional paper form for various reasons, including record-keeping practices. It is important to understand the benefits of each method to choose the one that best fits your needs.

Required Documents for Form 1042

When completing the Form 1042, certain documents are required to support the information reported. These may include Form W-8BEN or W-8BEN-E, which certify the foreign status of the recipient, as well as any applicable tax treaties. Additionally, records of payments made and taxes withheld must be maintained to substantiate the claims made on the form. Proper documentation is vital for compliance and for any potential audits by the IRS.

Quick guide on how to complete form 1042pdf 1042 annual withholding tax return for us

Accomplish Form 1042 pdf 1042 Annual Withholding Tax Return For U S effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, amend, and electronically sign your documents quickly without delays. Manage Form 1042 pdf 1042 Annual Withholding Tax Return For U S on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to amend and electronically sign Form 1042 pdf 1042 Annual Withholding Tax Return For U S effortlessly

- Locate Form 1042 pdf 1042 Annual Withholding Tax Return For U S and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors requiring new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1042 pdf 1042 Annual Withholding Tax Return For U S and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1042pdf 1042 annual withholding tax return for us

Create this form in 5 minutes!

How to create an eSignature for the form 1042pdf 1042 annual withholding tax return for us

The way to generate an e-signature for a PDF online

The way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

How to generate an e-signature for a PDF on Android

People also ask

-

What are IRS withholding tables and how do they affect my business?

IRS withholding tables are guidelines provided by the IRS that determine how much tax should be withheld from an employee's paycheck. Understanding these tables is crucial for businesses to ensure compliance with tax regulations and to avoid under or over-withholding. By using airSlate SignNow, businesses can streamline the process of integrating payroll systems with the latest IRS withholding tables.

-

How can airSlate SignNow help me manage IRS withholding tables?

airSlate SignNow offers solutions that can help you automate the collection of employee tax information, including their preferences related to IRS withholding tables. This ensures accurate calculations and communications, reducing errors in payroll processing. Our platform allows for secure eSigning of tax-related documents, streamlining your compliance processes.

-

Is there a cost associated with using airSlate SignNow for managing IRS withholding tables?

Yes, airSlate SignNow offers tiered pricing plans to suit businesses of different sizes. Whether you need basic document management or advanced integration for IRS withholding tables, there's a plan that's cost-effective. Our solution can actually save you time and reduce potential tax mistakes, making it a worthwhile investment.

-

What features does airSlate SignNow provide for handling IRS withholding tables?

With airSlate SignNow, you receive features such as customizable templates for tax documents and automated workflows to ensure accurate handling of IRS withholding tables. Our platform also provides real-time reporting and tracking of document statuses, facilitating better management of employee tax forms. This ultimately helps maintain compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other accounting software to manage IRS withholding tables?

Absolutely! airSlate SignNow seamlessly integrates with major accounting software and HR tools. This integration allows for automatic updates regarding IRS withholding tables and helps in keeping your payroll processing efficient. Combined with our eSigning functionality, you can easily manage tax-related documents.

-

How does airSlate SignNow ensure the security of documents related to IRS withholding tables?

At airSlate SignNow, we prioritize the security of your documents, including those related to IRS withholding tables, by employing industry-leading encryption methods. Our platform provides secure storage and access controls to protect sensitive tax information. You can rest assured that your compliance documents are safe with us.

-

What are the benefits of using airSlate SignNow for IRS withholding tables?

Using airSlate SignNow for IRS withholding tables offers numerous benefits, including increased accuracy, reduced processing time, and enhanced compliance. Our user-friendly platform ensures that you can easily manage and eSign tax-related documents. Moreover, this efficiency often leads to cost savings for your business.

Get more for Form 1042 pdf 1042 Annual Withholding Tax Return For U S

- Essential legal life documents for military personnel idaho form

- Essential legal life documents for new parents idaho form

- General power of attorney for care and custody of child or children idaho form

- Small business accounting package idaho form

- Company employment policies and procedures package idaho form

- Idaho child form

- Idaho power attorney form

- Newly divorced individuals package idaho form

Find out other Form 1042 pdf 1042 Annual Withholding Tax Return For U S

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online