1042 Annual Withholding Tax Return Fillable Form 2010

What is the 1042 Annual Withholding Tax Return Fillable Form

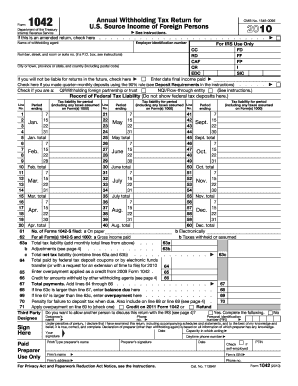

The 1042 Annual Withholding Tax Return Fillable Form is a crucial document used by withholding agents to report income paid to foreign persons, along with the taxes withheld on that income. This form is essential for compliance with U.S. tax laws, ensuring that the correct amount of tax is withheld and reported to the Internal Revenue Service (IRS). It is specifically designed for use by entities that have made payments subject to withholding under Chapter 3 of the Internal Revenue Code.

Steps to complete the 1042 Annual Withholding Tax Return Fillable Form

Completing the 1042 Annual Withholding Tax Return Fillable Form involves several important steps:

- Gather necessary information, including the names and addresses of payees, the amounts paid, and the taxes withheld.

- Access the fillable form, ensuring you have the latest version to avoid any errors.

- Fill in the required fields accurately, paying close attention to details such as tax identification numbers and payment amounts.

- Review the completed form for accuracy, ensuring all necessary signatures are included.

- Submit the form electronically or via mail, depending on your preference and IRS guidelines.

Legal use of the 1042 Annual Withholding Tax Return Fillable Form

The legal use of the 1042 Annual Withholding Tax Return Fillable Form is governed by U.S. tax regulations. To ensure compliance, it is important to understand the requirements for filing, including who is required to file, the types of income that must be reported, and the deadlines for submission. Proper use of this form helps avoid penalties and ensures that withholding agents fulfill their obligations under U.S. tax law.

Filing Deadlines / Important Dates

Filing deadlines for the 1042 Annual Withholding Tax Return Fillable Form are critical to avoid penalties. Generally, the form must be filed by March 15 of the year following the tax year for which the withholding is reported. If this date falls on a weekend or holiday, the deadline may be adjusted. It is advisable to check the IRS website for any updates or changes to these deadlines.

Form Submission Methods (Online / Mail / In-Person)

The 1042 Annual Withholding Tax Return Fillable Form can be submitted through various methods, depending on the preferences of the filer. Options include:

- Online: Electronic filing through the IRS e-file system is available for certain filers, providing a quick and efficient way to submit the form.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring that it is postmarked by the filing deadline.

- In-Person: Some filers may choose to deliver the form in person at designated IRS offices, although this method is less common.

Key elements of the 1042 Annual Withholding Tax Return Fillable Form

Key elements of the 1042 Annual Withholding Tax Return Fillable Form include various sections that require detailed information. These sections typically cover:

- Withholding Agent Information: Name, address, and taxpayer identification number of the withholding agent.

- Payee Information: Details about the foreign persons receiving payments, including their names and addresses.

- Income Types: Categories of income paid, such as interest, dividends, or royalties.

- Tax Withheld: The total amount of tax withheld from each payment made to foreign persons.

Quick guide on how to complete 1042 annual withholding tax return 2010 fillable form

Effortlessly Prepare 1042 Annual Withholding Tax Return Fillable Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, enabling you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents swiftly without interruptions. Manage 1042 Annual Withholding Tax Return Fillable Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign 1042 Annual Withholding Tax Return Fillable Form effortlessly

- Obtain 1042 Annual Withholding Tax Return Fillable Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes a few seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Done button to secure your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1042 Annual Withholding Tax Return Fillable Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1042 annual withholding tax return 2010 fillable form

Create this form in 5 minutes!

How to create an eSignature for the 1042 annual withholding tax return 2010 fillable form

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the 1042 Annual Withholding Tax Return Fillable Form?

The 1042 Annual Withholding Tax Return Fillable Form is a document used by businesses to report income paid to foreign persons and the corresponding tax withheld. This form ensures compliance with U.S. tax regulations and the reporting of income accurately to the IRS. By using the fillable version, users can easily enter and edit their information online.

-

How can airSlate SignNow help with the 1042 Annual Withholding Tax Return Fillable Form?

airSlate SignNow simplifies the process of completing the 1042 Annual Withholding Tax Return Fillable Form by providing easy access to its digital signing features. Users can fill out the form online, securely sign it, and send it directly to the IRS or other recipients. This streamlines compliance and ensures timely submissions, all through a user-friendly platform.

-

Is there a cost associated with using the 1042 Annual Withholding Tax Return Fillable Form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the 1042 Annual Withholding Tax Return Fillable Form. These plans are designed to be cost-effective, ensuring that businesses of all sizes can afford the necessary tools to manage their documentation effectively. A free trial is often available, allowing users to explore features before committing to a plan.

-

What features does airSlate SignNow offer for the 1042 Annual Withholding Tax Return Fillable Form?

airSlate SignNow provides features like customizable templates, electronic signatures, and document tracking for the 1042 Annual Withholding Tax Return Fillable Form. These functionalities enhance user experience by ensuring documents are completed accurately and can be monitored throughout the signing process. This helps maintain efficient workflows in handling tax-related documents.

-

What are the benefits of using airSlate SignNow for tax forms like the 1042 Annual Withholding Tax Return Fillable Form?

Using airSlate SignNow offers numerous benefits such as improved efficiency, reduced paperwork, and faster processing of tax forms like the 1042 Annual Withholding Tax Return Fillable Form. The platform's ease of use and accessibility allow users to complete required forms promptly while ensuring compliance. Additionally, the digital format reduces the risk of errors often associated with paper forms.

-

Can I integrate airSlate SignNow with other platforms while using the 1042 Annual Withholding Tax Return Fillable Form?

Absolutely! airSlate SignNow supports integrations with various productivity tools and applications, making it easy to use the 1042 Annual Withholding Tax Return Fillable Form alongside your existing tools. Integrations streamline data transfer and help maintain organized records, ensuring that your tax documentation process remains efficient and collaborative.

-

Is the 1042 Annual Withholding Tax Return Fillable Form secure on airSlate SignNow?

Yes, the 1042 Annual Withholding Tax Return Fillable Form is secure on airSlate SignNow. The platform employs encryption and secure access protocols to protect your sensitive information. Additionally, airSlate SignNow ensures compliance with legal standards, providing peace of mind that your documents are handled safely.

Get more for 1042 Annual Withholding Tax Return Fillable Form

- Ks deed 497307520 form

- Kansas disclosure 497307521 form

- Notice of dishonored check civil keywords bad check bounced check kansas form

- Mutual wills containing last will and testaments for unmarried persons living together with no children kansas form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children kansas form

- Mutual wills or last will and testaments for unmarried persons living together with minor children kansas form

- Kansas cohabitation 497307526 form

- Paternity law and procedure handbook kansas form

Find out other 1042 Annual Withholding Tax Return Fillable Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document