Form 1042 2014

What is the Form 1042

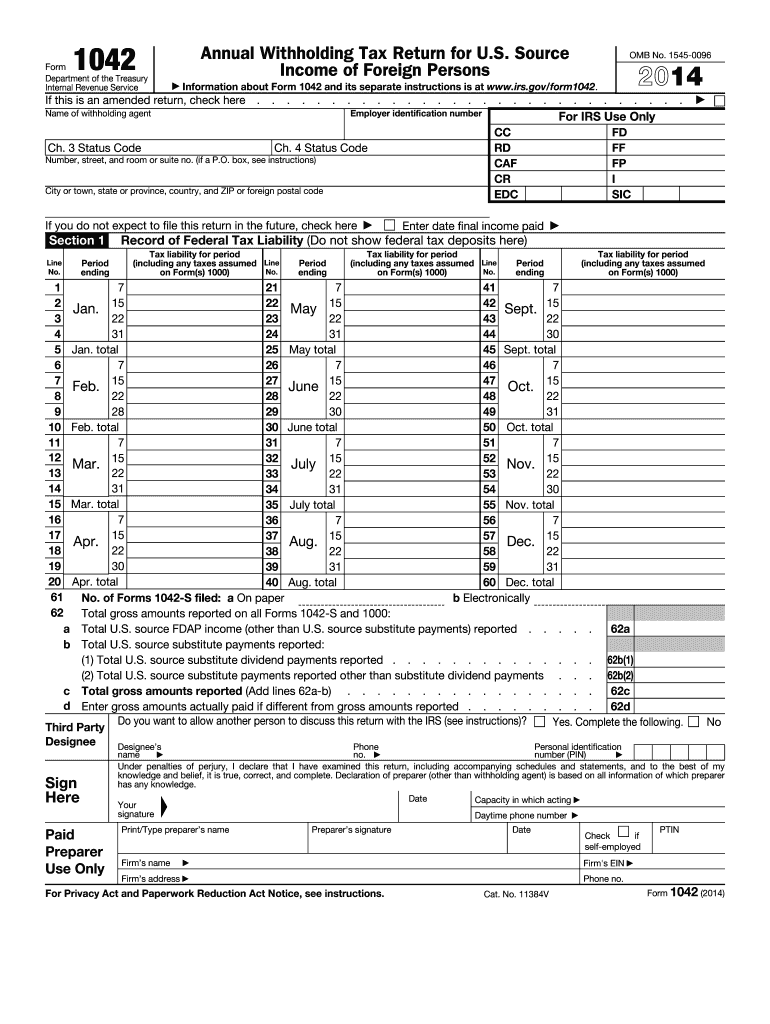

The Form 1042 is a U.S. tax form used by withholding agents to report income paid to foreign persons, including non-resident aliens and foreign entities. This form is essential for compliance with U.S. tax laws, particularly regarding payments that are subject to withholding tax. The income reported can include interest, dividends, rents, and royalties, among others. Understanding the purpose of Form 1042 is crucial for any business or individual involved in international transactions.

How to use the Form 1042

Using Form 1042 involves several steps to ensure accurate reporting and compliance with IRS regulations. First, determine if you are a withholding agent responsible for reporting payments to foreign persons. Next, gather all necessary information about the payments made, including the recipient's details and the nature of the income. Once you have this information, complete the form by accurately filling in the required fields. It is also important to keep records of the payments and any documentation supporting your claims for at least three years.

Steps to complete the Form 1042

Completing Form 1042 requires careful attention to detail. Follow these steps:

- Identify the type of income being reported and the corresponding withholding tax rate.

- Fill in the payer's information, including name, address, and taxpayer identification number.

- List the foreign recipients of the income, providing their names, addresses, and taxpayer identification numbers if available.

- Report the total amount of income paid and the total withholding tax deducted.

- Review the completed form for accuracy before submission.

Legal use of the Form 1042

The legal use of Form 1042 is governed by IRS regulations, which require accurate reporting of payments made to foreign persons. Failure to comply with these regulations can result in penalties and interest on unpaid taxes. It is important to ensure that the form is filed correctly and on time to avoid any legal complications. Additionally, using a reliable e-signature solution can enhance the legitimacy of the form by ensuring secure and compliant electronic submissions.

Filing Deadlines / Important Dates

Form 1042 must be filed annually, with a specific deadline set by the IRS. Generally, the form is due on March 15 of the year following the tax year in which the payments were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial for withholding agents to be aware of these deadlines to ensure timely filing and avoid penalties.

Penalties for Non-Compliance

Non-compliance with Form 1042 filing requirements can lead to significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to withhold the appropriate taxes. Penalties can range from a percentage of the unpaid tax to a fixed amount per form, depending on the severity of the violation. Understanding these penalties emphasizes the importance of accurate and timely submissions.

Quick guide on how to complete 2014 form 1042

Effortlessly Prepare Form 1042 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without holdups. Manage Form 1042 on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and eSign Form 1042 Seamlessly

- Obtain Form 1042 and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from your chosen device. Edit and eSign Form 1042 to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 1042

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1042

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 1042 and who needs to file it?

Form 1042 is an IRS tax form used by withholding agents to report tax withheld on income paid to foreign persons. If your business makes payments to non-U.S. entities, you are required to file Form 1042 annually. Understanding this form is essential for compliance with U.S. tax laws.

-

How can airSlate SignNow help me with Form 1042?

airSlate SignNow offers an efficient way to send, receive, and eSign Form 1042 documents securely. With our platform, you can streamline the collection of necessary signatures and ensure that your document workflow is organized and compliant with tax regulations.

-

Is airSlate SignNow suitable for filing Form 1042?

Yes, airSlate SignNow is designed to facilitate the signing and sending of Form 1042 along with other important documents. Our user-friendly interface allows you to manage documents easily, ensuring that your Form 1042 is completed accurately and submitted on time.

-

What features does airSlate SignNow offer for managing Form 1042?

Our platform provides features like customizable templates, real-time tracking, and automated reminders to ensure that you never miss a deadline when handling Form 1042. Additionally, you can collect electronic signatures securely, maintaining your compliance with IRS regulations.

-

How much does airSlate SignNow cost for handling Form 1042?

airSlate SignNow offers flexible pricing plans, making it a cost-effective solution for businesses needing to manage Form 1042. You can choose from several subscription tiers, allowing you to select the plan that aligns with your document signing and management needs.

-

Can I integrate airSlate SignNow with other tools for Form 1042 management?

Absolutely! airSlate SignNow supports various integrations with other software, enabling you to streamline your workflow when managing Form 1042. Whether you use accounting software or CRM systems, our platform can be connected to meet your specific needs.

-

What are the benefits of using airSlate SignNow for Form 1042?

Using airSlate SignNow for Form 1042 offers numerous advantages, including enhanced security for sensitive data, easy document tracking, and improved workflow efficiency. By simplifying the eSignature process, you’ll save time and reduce errors associated with manual paperwork.

Get more for Form 1042

Find out other Form 1042

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement