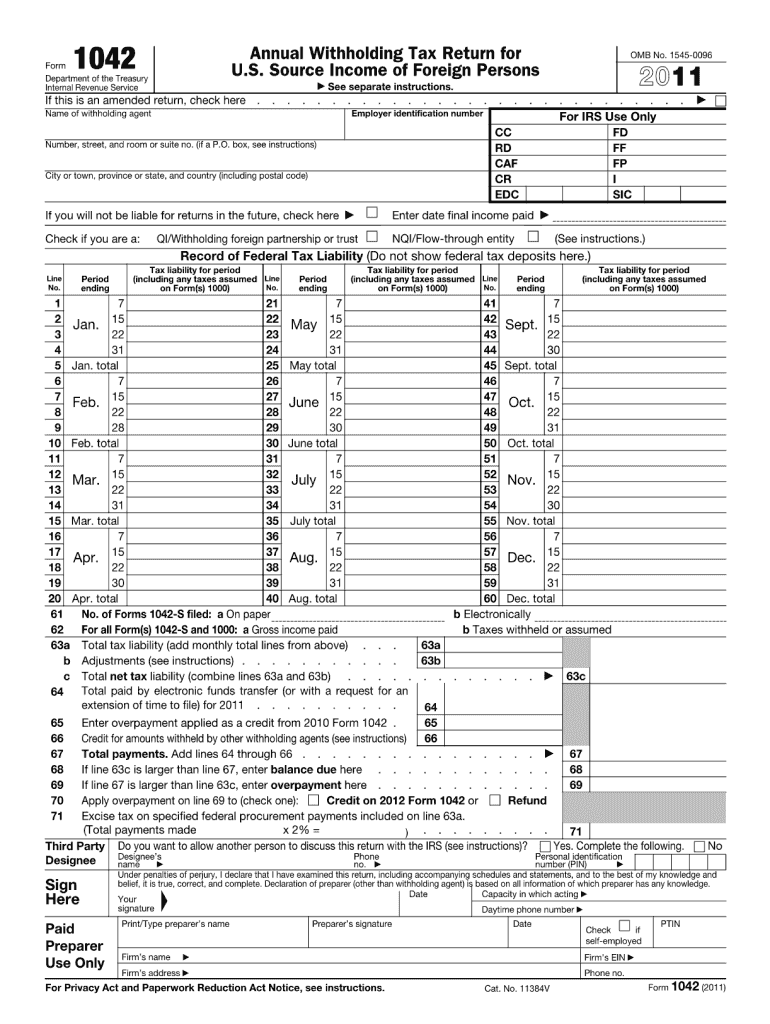

Form 1042 2011

What is the Form 1042

The Form 1042 is a tax document used by withholding agents to report income paid to foreign persons and the associated withholding tax. This form is essential for ensuring compliance with U.S. tax laws when payments are made to non-resident aliens, foreign partnerships, and foreign corporations. It serves as a means for the Internal Revenue Service (IRS) to track income that is subject to withholding tax and ensures that the appropriate taxes are collected from foreign entities receiving U.S. source income.

How to use the Form 1042

To use the Form 1042, withholding agents must accurately report the payments made to foreign recipients. This includes identifying the type of income, the amount paid, and the applicable withholding tax rate. The form must be completed and filed annually, typically by March 15 of the following year. It is important to ensure that all information is correct to avoid penalties and ensure proper tax compliance.

Steps to complete the Form 1042

Completing the Form 1042 involves several key steps:

- Gather necessary information about the foreign payees, including their names, addresses, and taxpayer identification numbers.

- Determine the type of income being reported and the applicable withholding tax rates based on IRS guidelines.

- Fill out the form accurately, ensuring that all amounts and details are correct.

- Review the completed form for any errors or omissions before submission.

- File the form with the IRS by the deadline, along with any required payment of withholding taxes.

Legal use of the Form 1042

The legal use of the Form 1042 is governed by IRS regulations, which outline the requirements for reporting and withholding taxes on payments to foreign persons. Compliance with these regulations is crucial to avoid penalties and ensure that the withholding agent meets their legal obligations. The form must be filed accurately and on time to maintain its legal standing.

Filing Deadlines / Important Dates

The Form 1042 must be filed annually, with the deadline typically set for March 15 of the year following the reporting year. It is essential for withholding agents to be aware of this deadline to avoid late filing penalties. Additionally, any payments of withholding tax must also be submitted by this date to remain compliant with IRS regulations.

Penalties for Non-Compliance

Failure to file the Form 1042 accurately and on time can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to pay the required withholding taxes. These penalties can accumulate quickly, making it crucial for withholding agents to ensure compliance with all filing requirements to avoid financial repercussions.

Quick guide on how to complete 2011 form 1042

Complete Form 1042 effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Form 1042 on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Form 1042 with ease

- Find Form 1042 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes necessitating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1042 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 1042

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 1042

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is Form 1042 and why is it important for businesses?

Form 1042 is a tax document used by U.S. entities to report income paid to foreign persons. It is essential for businesses to understand and comply with Form 1042 to avoid penalties and ensure proper withholding on payments to foreign contractors or vendors. Using airSlate SignNow makes it easier to send and eSign this important document securely.

-

How can airSlate SignNow assist with completing Form 1042?

airSlate SignNow simplifies the process of completing Form 1042 by providing easy-to-use templates. Users can fill out the necessary information online, sign the document electronically, and keep track of submissions. This ensures that the filing of Form 1042 is efficient and compliant with IRS regulations.

-

What are the pricing options for using airSlate SignNow for Form 1042?

airSlate SignNow offers a range of pricing plans that cater to various business needs. The plans include features that support sending, signing, and managing Form 1042 and other documents. You can choose from monthly or annual subscriptions that deliver great value for your business operations.

-

Is it safe to eSign Form 1042 with airSlate SignNow?

Yes, airSlate SignNow implements advanced security measures to ensure that your Form 1042 and other documents are protected. With end-to-end encryption and compliance with legal eSignature laws, you can trust that your sensitive tax information is secure when using our platform.

-

Can I integrate airSlate SignNow with other software for handling Form 1042?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software and document management systems. This enables businesses to streamline their processes when managing Form 1042 and other tax-related documents without disrupting their workflow.

-

What are the key benefits of using airSlate SignNow for tax documents like Form 1042?

Using airSlate SignNow for tax documents, including Form 1042, provides several benefits. These include enhanced efficiency in document handling, reduced turnaround times for approvals, and maintained compliance with legal requirements. The user-friendly interface makes it easy for anyone to manage their forms effectively.

-

How quickly can I send Form 1042 using airSlate SignNow?

Sending Form 1042 through airSlate SignNow is incredibly quick and efficient. Once your document is prepared, you can send it for eSignature in just a few clicks. This ensures that you can meet deadlines and avoid delays in compliance with tax submissions.

Get more for Form 1042

Find out other Form 1042

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP