Form 1042 Annual Withholding Tax Return for U S Source 2024-2026

What is the Form 1042 Annual Withholding Tax Return For U.S. Source

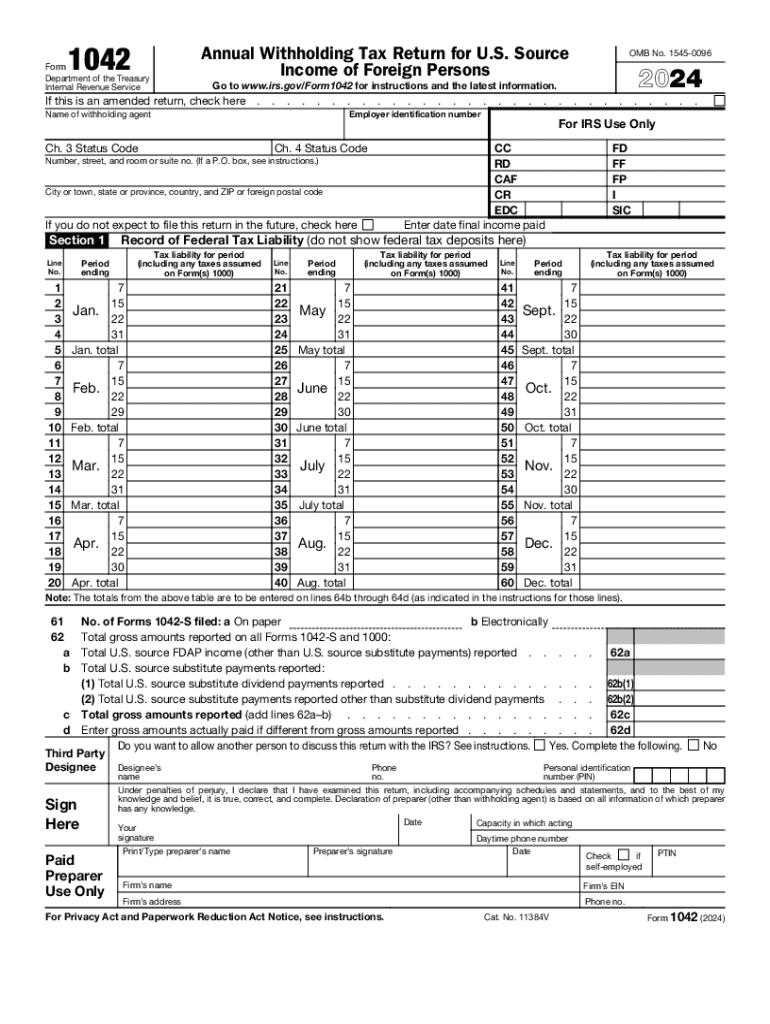

The Form 1042 is an essential document used by withholding agents to report and pay taxes on income paid to foreign persons. This form is specifically designed for U.S. source income, which includes dividends, interest, royalties, and certain types of compensation. It is crucial for entities that make payments to non-resident aliens or foreign entities, ensuring compliance with U.S. tax laws. Understanding the purpose of Form 1042 helps businesses accurately report their tax obligations and avoid potential penalties.

Steps to Complete the Form 1042 Annual Withholding Tax Return For U.S. Source

Completing the Form 1042 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the payments made to foreign persons, including their names, addresses, and taxpayer identification numbers. Next, determine the amount of U.S. source income paid and the applicable withholding tax rates. Fill out the form by entering the required details in the designated fields, ensuring that all information is accurate. Finally, review the completed form for any errors before submitting it to the IRS.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with Form 1042. The form is typically due on March 15 of the year following the calendar year in which the income was paid. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, any taxes withheld must be deposited according to the IRS deposit schedule, which varies based on the amount of tax liability. Keeping track of these important dates helps ensure timely compliance.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and filing Form 1042. These guidelines outline the requirements for withholding agents, including the need to identify the correct tax rates based on the recipient's country of residence and the type of income. The IRS also offers resources to help businesses understand their obligations, including instructions for completing the form and information on how to handle any disputes or corrections. Adhering to these guidelines is crucial for maintaining compliance with U.S. tax laws.

Penalties for Non-Compliance

Failure to comply with the requirements associated with Form 1042 can result in significant penalties. The IRS imposes fines for late filing, failure to file, and inaccuracies on the form. These penalties can accumulate quickly, leading to substantial financial consequences for businesses. It is important for withholding agents to understand these risks and take proactive measures to ensure that all forms are completed accurately and submitted on time.

Required Documents

To complete Form 1042, several documents may be required. These include records of payments made to foreign recipients, documentation supporting the withholding tax rates applied, and any relevant tax treaties that may affect the withholding obligations. Additionally, businesses should maintain copies of the completed forms and any correspondence with the IRS for their records. Having these documents readily available streamlines the filing process and supports compliance efforts.

Create this form in 5 minutes or less

Find and fill out the correct form 1042 annual withholding tax return for u s source

Create this form in 5 minutes!

How to create an eSignature for the form 1042 annual withholding tax return for u s source

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax withholding calculator?

A tax withholding calculator is a tool that helps individuals estimate the amount of federal income tax to withhold from their paychecks. By inputting your income and deductions, the tax withholding calculator provides a clear picture of your tax obligations, ensuring you withhold the right amount throughout the year.

-

How can I use the tax withholding calculator effectively?

To use the tax withholding calculator effectively, gather your financial information, including your income, filing status, and any deductions or credits you may qualify for. Input this data into the calculator to receive an accurate estimate of your withholding needs, helping you avoid underpayment or overpayment of taxes.

-

Is the tax withholding calculator free to use?

Yes, many tax withholding calculators are available for free online, including those provided by reputable financial institutions and tax agencies. Utilizing a free tax withholding calculator can help you make informed decisions about your tax withholdings without incurring any costs.

-

What features should I look for in a tax withholding calculator?

When selecting a tax withholding calculator, look for features such as user-friendly interfaces, the ability to save and compare different scenarios, and up-to-date tax information. A comprehensive tax withholding calculator will also allow you to account for various income sources and deductions.

-

Can the tax withholding calculator help me plan for tax season?

Absolutely! Using a tax withholding calculator can help you plan for tax season by providing insights into your potential tax liability. By adjusting your withholdings based on the calculator's recommendations, you can ensure that you are adequately prepared when tax season arrives.

-

How does the tax withholding calculator integrate with other financial tools?

Many tax withholding calculators can integrate with other financial tools, such as budgeting apps and tax preparation software. This integration allows for a seamless experience, enabling you to manage your finances more effectively and ensuring that your tax planning is aligned with your overall financial goals.

-

What are the benefits of using a tax withholding calculator?

The primary benefits of using a tax withholding calculator include accurate tax planning, avoiding penalties for underpayment, and potentially increasing your tax refund. By understanding your withholding needs, you can make informed decisions that positively impact your financial situation.

Get more for Form 1042 Annual Withholding Tax Return For U S Source

Find out other Form 1042 Annual Withholding Tax Return For U S Source

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast