Form CT 1041 K 1T, Transmittal of Schedule CT 1041 K 1 2021

What is the Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1

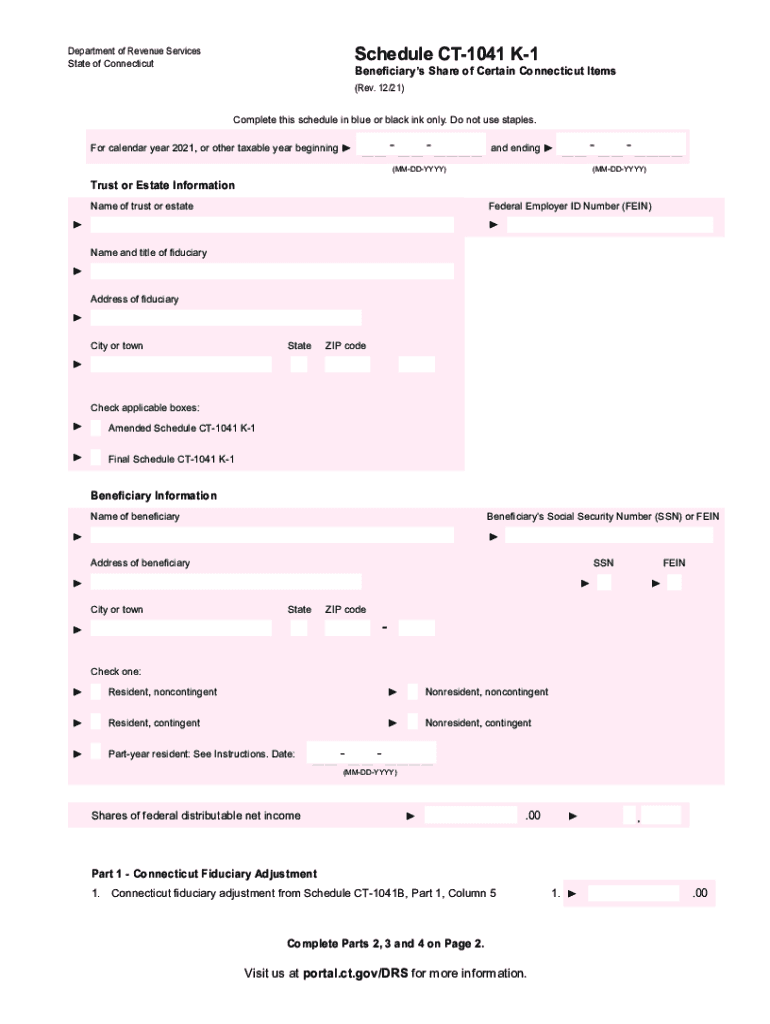

The Form CT 1041 K 1T serves as a transmittal document for the Schedule CT 1041 K 1, which is used in the context of Connecticut income tax for estates and trusts. This form is essential for reporting income, deductions, and credits that are passed through to beneficiaries. The CT 1041 K 1T ensures that the information provided on the Schedule CT 1041 K 1 is submitted correctly to the Connecticut Department of Revenue Services, facilitating accurate tax processing and compliance.

Steps to Complete the Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1

Completing the Form CT 1041 K 1T involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information related to the estate or trust. This includes income, deductions, and any credits applicable to the beneficiaries. Next, accurately fill out the form, ensuring all fields are completed, including the identification of the estate or trust, the tax year, and the details of the beneficiaries. After completing the form, review it for any errors or omissions. Finally, submit the form along with the Schedule CT 1041 K 1 to the appropriate tax authority, either electronically or via mail.

Legal Use of the Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1

The legal use of the Form CT 1041 K 1T is critical for ensuring compliance with Connecticut tax laws. This form must be filed for estates and trusts that have income that is taxable in Connecticut. By submitting this form, taxpayers can properly report income distributions to beneficiaries, which is essential for both the estate's tax obligations and the beneficiaries' individual tax responsibilities. Failure to file this form correctly can result in penalties and complications in tax processing.

Key Elements of the Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1

Key elements of the Form CT 1041 K 1T include the identification of the estate or trust, the tax year for which the form is being filed, and the details of the beneficiaries receiving distributions. Additionally, it requires a summary of the income and deductions reported on the Schedule CT 1041 K 1. Providing accurate information in these sections is crucial for the proper processing of the tax return and for ensuring that beneficiaries receive the correct tax information for their individual filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 1041 K 1T are typically aligned with the tax year of the estate or trust. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes in deadlines or extensions that may be applicable, as these can affect compliance and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 1041 K 1T can be submitted through various methods, providing flexibility for taxpayers. It can be filed online through the Connecticut Department of Revenue Services' electronic filing system, which is often the fastest method. Alternatively, taxpayers may choose to mail the completed form and accompanying Schedule CT 1041 K 1 to the designated address provided by the state. In-person submissions are generally not common for this form, but taxpayers can contact local offices for specific guidance if needed.

Quick guide on how to complete form ct 1041 k 1t transmittal of schedule ct 1041 k 1

Complete Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1 effortlessly on any device

Digital document management has gained increased popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1 on any platform with airSlate SignNow’s Android or iOS applications and simplify your document tasks today.

How to modify and electronically sign Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1 with ease

- Obtain Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1 and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1041 k 1t transmittal of schedule ct 1041 k 1

Create this form in 5 minutes!

How to create an eSignature for the form ct 1041 k 1t transmittal of schedule ct 1041 k 1

The way to create an e-signature for your PDF online

The way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an e-signature for a PDF on Android

People also ask

-

What is the ct 1041 k form?

The ct 1041 k form is a tax document used for reporting income and expenses for trusts and estates in Connecticut. By using the correct information on the ct 1041 k, businesses and individuals can ensure compliance with state tax laws.

-

How can airSlate SignNow help with the ct 1041 k form?

AirSlate SignNow simplifies the process of filling out and eSigning the ct 1041 k form by providing an intuitive, user-friendly platform. Users can easily upload their documents, fill in the necessary fields, and obtain secure signatures in a matter of minutes.

-

What features does airSlate SignNow offer for managing the ct 1041 k form?

AirSlate SignNow offers features like customizable templates, document tracking, and automated reminders, making it easier to handle the ct 1041 k form effectively. These tools help streamline document workflows and ensure timely submissions.

-

Is airSlate SignNow affordable for businesses handling the ct 1041 k form?

Yes, airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes, ensuring that handling the ct 1041 k form remains cost-effective. With various subscription options, you can choose a plan that fits your budget.

-

Can airSlate SignNow be integrated with accounting software for the ct 1041 k form?

Absolutely! AirSlate SignNow can seamlessly integrate with popular accounting software, enabling you to manage the ct 1041 k form alongside your financial data. This integration enhances efficiency and reduces the chances of errors in your tax documentation.

-

What are the benefits of using airSlate SignNow for the ct 1041 k form?

The benefits of using airSlate SignNow for the ct 1041 k form include improved efficiency, enhanced security, and ease of use. By digitizing the signing process, you can reduce paper usage and access your documents from anywhere.

-

How secure is airSlate SignNow when handling the ct 1041 k form?

AirSlate SignNow prioritizes document security with advanced encryption protocols and secure storage options. When dealing with sensitive information such as the ct 1041 k form, users can trust that their data is well-protected.

Get more for Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1

Find out other Form CT 1041 K 1T, Transmittal Of Schedule CT 1041 K 1

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online