Form Ct 1041 K 1 2017

What is the Form CT 1041 K-1?

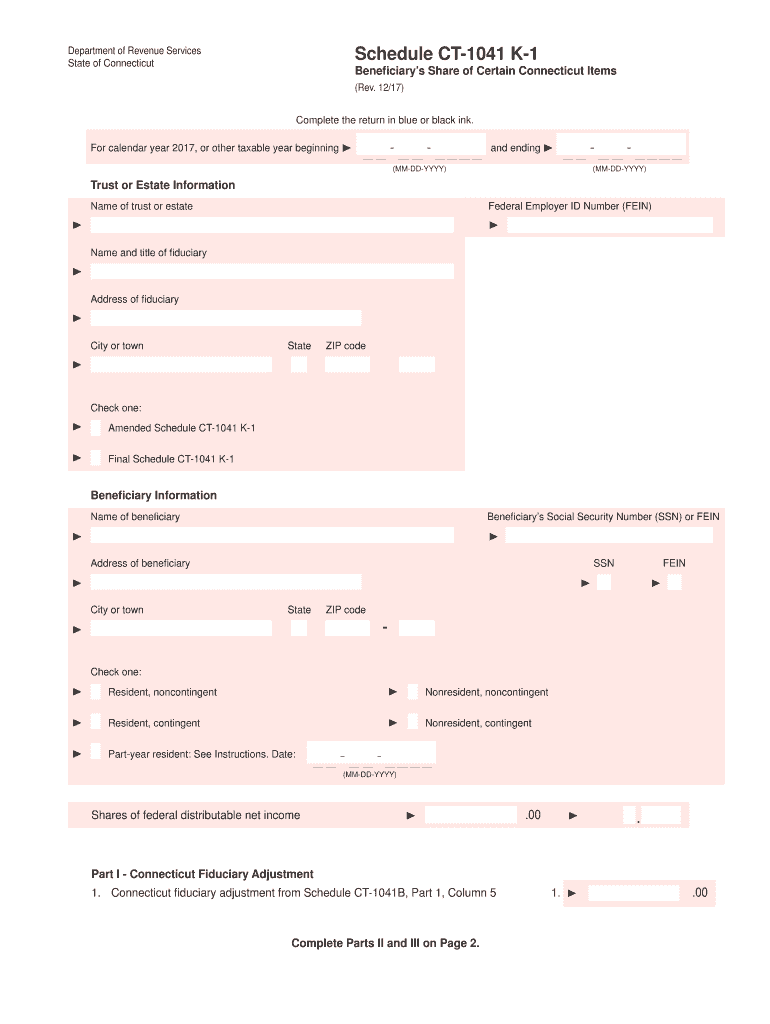

The Form CT 1041 K-1 is a tax document used in the state of Connecticut. It is specifically designed for reporting income, deductions, and credits for beneficiaries of estates and trusts. This form provides essential information that beneficiaries need to accurately report their share of the estate or trust's income on their individual tax returns. The details included in the form help ensure compliance with state tax laws and facilitate proper tax reporting.

How to Use the Form CT 1041 K-1

Using the Form CT 1041 K-1 involves several steps. Beneficiaries receive this form from the fiduciary of the estate or trust, which outlines their share of income and deductions. It is crucial to review the information carefully, as it directly impacts the beneficiary's personal tax return. The income reported on this form must be included on the beneficiary's federal and state tax returns. Accurate reporting ensures compliance and helps avoid potential penalties.

Steps to Complete the Form CT 1041 K-1

Completing the Form CT 1041 K-1 requires attention to detail. Begin by entering the name and address of the estate or trust at the top of the form. Next, provide the beneficiary's information, including their name, address, and taxpayer identification number. Fill in the amounts for income, deductions, and credits as specified. It is essential to ensure that all figures are accurate and correspond to the estate or trust's financial records. Once completed, the form should be signed and dated by the fiduciary before distribution to the beneficiaries.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 1041 K-1 align with the tax deadlines for estates and trusts in Connecticut. Generally, the fiduciary must file the estate or trust tax return by the fifteenth day of the fourth month following the close of the tax year. Beneficiaries should receive their Form CT 1041 K-1 by this deadline to ensure they can report the information on their personal tax returns accurately. It is important to be aware of these dates to avoid late filing penalties.

Legal Use of the Form CT 1041 K-1

The Form CT 1041 K-1 is legally required for beneficiaries receiving income from estates or trusts. It serves as an official record of the income allocated to beneficiaries and is necessary for accurate tax reporting. Failure to provide or accurately report this form can lead to legal issues, including penalties from the state tax authority. Beneficiaries should retain a copy of the form for their records to ensure compliance with tax regulations.

Who Issues the Form CT 1041 K-1

The Form CT 1041 K-1 is issued by the fiduciary of the estate or trust, which may be an individual or an institution responsible for managing the estate's assets. The fiduciary must prepare the form accurately and distribute it to each beneficiary in a timely manner. This ensures that beneficiaries have the necessary information to report their income correctly on their tax returns.

Quick guide on how to complete form ct 1041 k 1t 2017

Your assistance manual on how to prepare your Form Ct 1041 K 1

If you're wondering how to finalize and submit your Form Ct 1041 K 1, here are a few brief instructions on how to simplify tax declaration.

To start, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document management platform that enables you to modify, generate, and complete your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures and return to amend information as necessary. Optimize your tax handling with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finalize your Form Ct 1041 K 1 in no time:

- Create your account and start working on PDFs shortly.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to open your Form Ct 1041 K 1 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any errors.

- Save updates, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can lead to more return errors and delays in refunds. Naturally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1041 k 1t 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the online exam form for the IPCC in November 2017 from Kathmandu?

You can visit http://icaiexams.icai.orgLast date is 25th of August, 2017

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the form ct 1041 k 1t 2017

How to generate an eSignature for your Form Ct 1041 K 1t 2017 in the online mode

How to create an eSignature for your Form Ct 1041 K 1t 2017 in Google Chrome

How to make an eSignature for signing the Form Ct 1041 K 1t 2017 in Gmail

How to create an eSignature for the Form Ct 1041 K 1t 2017 straight from your smart phone

How to generate an electronic signature for the Form Ct 1041 K 1t 2017 on iOS devices

How to generate an electronic signature for the Form Ct 1041 K 1t 2017 on Android OS

People also ask

-

What is Form CT 1041 K 1 and why is it important?

Form CT 1041 K 1 is a tax document used in Connecticut for reporting income from estates and trusts. It is essential for ensuring compliance with state tax laws and accurately reporting beneficiaries' income. By utilizing airSlate SignNow, you can easily manage and eSign your Form CT 1041 K 1, streamlining your tax preparation process.

-

How can airSlate SignNow assist with completing Form CT 1041 K 1?

airSlate SignNow provides an intuitive platform that simplifies the completion of Form CT 1041 K 1. With features like templates and eSigning, you can fill out the form digitally and obtain necessary signatures efficiently. This saves time and reduces the risk of errors in your tax submissions.

-

Is there a cost associated with using airSlate SignNow for Form CT 1041 K 1?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs, including options for handling Form CT 1041 K 1. The plans are designed to be cost-effective, allowing you to choose a solution that fits your budget while providing all the features required for seamless document management.

-

Can I integrate airSlate SignNow with other software for Form CT 1041 K 1?

Absolutely! airSlate SignNow integrates with a variety of popular software applications, making it easy to manage your Form CT 1041 K 1 alongside other tools you use. This integration ensures a smooth workflow, allowing for automatic data transfer and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for Form CT 1041 K 1?

Using airSlate SignNow for Form CT 1041 K 1 offers numerous benefits, including enhanced security for sensitive tax information and improved collaboration among stakeholders. The platform’s user-friendly interface makes it easy to create, send, and sign documents, ensuring that you can focus on your tax strategy rather than paperwork.

-

How secure is my information when using airSlate SignNow for Form CT 1041 K 1?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your information when handling Form CT 1041 K 1. You can trust that your sensitive data remains confidential and secure throughout the signing and submission process.

-

What types of documents can I create besides Form CT 1041 K 1 with airSlate SignNow?

In addition to Form CT 1041 K 1, airSlate SignNow allows you to create and manage a wide variety of documents, including contracts, agreements, and other tax forms. This versatility makes it a comprehensive solution for all your document needs, simplifying your business processes.

Get more for Form Ct 1041 K 1

- Mls policy information ampamp updates utah real estate

- Vp064 form

- Co op equity withdrawal form

- Constructive worry worksheet form

- Choice care card claim form pdf fortitude insurance group

- Quanta lite mpo igg elisa 708700 inova diagnostics form

- Va form 28 1905m 781262240

- Family member loan agreement template form

Find out other Form Ct 1041 K 1

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors