Schedule CT 1041 K 1 CT Gov 2020

What is the Schedule CT 1041 K-1?

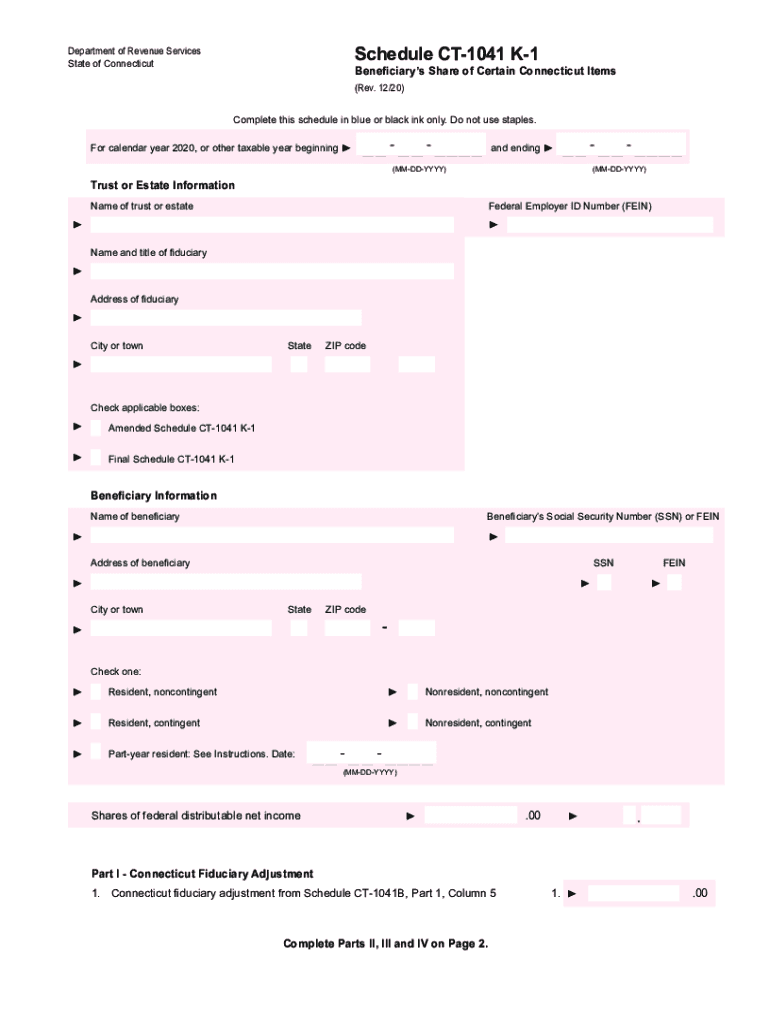

The Schedule CT 1041 K-1 is a tax form used in Connecticut for reporting income, deductions, and credits from pass-through entities, such as partnerships and S corporations. This form provides detailed information about each partner's or shareholder's share of the entity's income, which is essential for accurate tax reporting. The Schedule CT 1041 K-1 is specifically designed for use with the Connecticut Form CT-1041, which is the state's fiduciary income tax return. Understanding this form is crucial for both the entities filing it and the individuals receiving it, as it directly impacts their state tax obligations.

Steps to Complete the Schedule CT 1041 K-1

Completing the Schedule CT 1041 K-1 involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary financial information from the pass-through entity, including income statements and expense reports. Next, accurately report the entity's total income and deductions on the form. Each partner or shareholder's share should be calculated based on their ownership percentage. It's important to double-check all figures for accuracy before submitting the form. Finally, distribute the completed K-1 forms to all partners or shareholders, ensuring they receive their respective copies for their personal tax filings.

Legal Use of the Schedule CT 1041 K-1

The Schedule CT 1041 K-1 is legally binding and must be completed accurately to comply with Connecticut tax laws. It serves as an official record of each partner's or shareholder's share of income, which is necessary for their individual tax returns. Failure to accurately report this information can lead to penalties or audits by the Connecticut Department of Revenue Services. Therefore, it is essential to ensure that all information provided on the K-1 is truthful and complete, reflecting the entity's financial activities for the tax year.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CT 1041 K-1 align with the due dates for the Connecticut Form CT-1041. Typically, this form is due on the fifteenth day of the fourth month following the close of the tax year. For entities operating on a calendar year, this means the form must be filed by April 15. It is important to be aware of any extensions that may apply, as well as any changes to deadlines that may occur due to state regulations or other circumstances. Keeping track of these dates ensures compliance and avoids potential penalties.

Who Issues the Schedule CT 1041 K-1?

The Schedule CT 1041 K-1 is issued by pass-through entities, such as partnerships and S corporations, to their partners or shareholders. These entities are responsible for preparing and distributing the K-1 forms after they have completed their annual tax filings. Each K-1 must be provided to the respective partners or shareholders by the filing deadline, allowing them to accurately report their share of income on their personal tax returns. It is essential for entities to maintain accurate records to ensure timely and correct issuance of these forms.

Examples of Using the Schedule CT 1041 K-1

Using the Schedule CT 1041 K-1 is common among various business structures. For instance, if a partnership generates a profit of one hundred thousand dollars and has three partners, each partner's share will be reported on their individual K-1 forms based on their ownership percentage. If one partner owns fifty percent, they would receive a K-1 reflecting fifty thousand dollars of income. This information is then used by each partner to report their income on their state tax returns. Similarly, S corporations distribute K-1 forms to shareholders, who report their share of the corporation's income accordingly.

Quick guide on how to complete schedule ct 1041 k 1 ctgov

Execute Schedule CT 1041 K 1 CT gov effortlessly on any gadget

Digital document administration has become favored among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct format and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Schedule CT 1041 K 1 CT gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest method to modify and eSign Schedule CT 1041 K 1 CT gov without any hassle

- Find Schedule CT 1041 K 1 CT gov and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate the anxiety of lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule CT 1041 K 1 CT gov while ensuring efficient communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ct 1041 k 1 ctgov

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 1041 k 1 ctgov

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the 'form ct k 1t 2019' and why is it important?

The 'form ct k 1t 2019' is a tax form used in Connecticut to report and pay taxes on income from a partnership or S corporation. It's vital for ensuring compliance with state tax laws and avoiding penalties. Properly submitting the 'form ct k 1t 2019' helps businesses manage their financial obligations efficiently.

-

How can airSlate SignNow help me with the 'form ct k 1t 2019'?

airSlate SignNow simplifies the process of completing and submitting the 'form ct k 1t 2019' by allowing users to fill out, sign, and send the document securely online. This eliminates the need for paper forms and streamlines the filing process. With airSlate SignNow, you can ensure your form submissions are accurate and on time.

-

Is there a cost associated with using airSlate SignNow for the 'form ct k k 1t 2019'?

airSlate SignNow offers various pricing plans to accommodate different business needs, including features for the 'form ct k 1t 2019'. While some basic functionalities may be available for free, more advanced features come with a subscription. It's best to review the pricing page for details on plans that include the 'form ct k 1t 2019' capabilities.

-

What features of airSlate SignNow benefit the completion of 'form ct k k 1t 2019'?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking, which are all beneficial for efficiently handling the 'form ct k 1t 2019'. These features ensure that you can fill out and manage your documents easily while keeping track of submissions and deadlines.

-

Can I integrate the 'form ct k k 1t 2019' with other software using airSlate SignNow?

Yes, airSlate SignNow supports multiple integrations with popular software tools that can help manage your 'form ct k 1t 2019' and other documents. This allows you to connect your workflow seamlessly, ensuring that you can access and use your forms in conjunction with your existing systems. Explore the integration options available to enhance your document management.

-

What are the benefits of using airSlate SignNow for the 'form ct k 1t 2019'?

Using airSlate SignNow for the 'form ct k 1t 2019' offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your sensitive information is protected while streamlining the signing process. This saves time and money, making it a worthwhile investment for businesses.

-

Is it easy to use airSlate SignNow for completing the 'form ct k 1t 2019'?

Absolutely! airSlate SignNow was designed for ease of use. Users can navigate the platform effortlessly to complete the 'form ct k 1t 2019', even if they are not tech-savvy. The intuitive interface guides users through each step, making document management a breeze.

Get more for Schedule CT 1041 K 1 CT gov

- Idnyc application form

- Royal resorts owner loan form

- California brief multicultural competence scale form

- Ds 11 form filler

- Wallet certification card template form

- Equifax disassociation form

- Pet enforcementorder made by another court form

- Form it 2106 estimated income tax payment voucher for fiduciaries tax year 795815982

Find out other Schedule CT 1041 K 1 CT gov

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now